Title: New Jersey Letter to Creditor Confirming Agreement for Temporary Postponement of Monthly Payments Keywords: New Jersey, letter, creditor, agreement, monthly payments, temporarily postponed Introduction: In New Jersey, when faced with unforeseen financial difficulties, individuals may need to enter into an agreement with their creditor to temporarily postpone their monthly payment obligations. To ensure clarity and legal protection, a well-drafted New Jersey Letter to Creditor Confirming Agreement is essential. This letter serves as a written confirmation between the debtor and creditor, stating the parties' agreement to temporarily postpone monthly payments for a specific period. Types of New Jersey Letters to Creditor Confirming Agreement for Temporary Postponement: 1. Personal Financial Hardship Letter: If an individual is undergoing personal financial hardship due to job loss, medical emergencies, or other legitimate reasons, they may need to provide a New Jersey Letter to their creditor explaining their current situation and requesting temporary postponement of monthly payments. 2. Business Financial Distress Letter: For struggling businesses in New Jersey, a business financial distress letter may be necessary. This letter should outline the company's financial difficulties, such as decreased revenue, increased expenses, or loss of clients, and propose an agreement with the creditor to postpone monthly payments for a specified period. 3. Natural Disaster Relief Letter: In the event of a natural disaster, such as hurricanes, floods, or fires, residents of New Jersey might face severe damages and financial instability. A natural disaster relief letter may be written to creditors to seek temporary postponement of monthly payments due to the impact of the disaster. Components of a New Jersey Letter to Creditor Confirming Agreement for Temporary Postponement: 1. Header: Include the debtor's name, address, and contact information, as well as the creditor's name, address, and contact information. Indicate the date of the letter. 2. Salutation: Address the letter specifically to the creditor by name, using a formal salutation such as "Dear Mr./Ms. [Creditor's Last Name]". 3. Opening paragraph: Briefly state the purpose of the letter, explaining the debtor's request for temporary postponement of monthly payments due to a specific reason, ensuring the creditor understands the debtor's situation. 4. Body paragraphs: — Present a detailed explanation of the debtor's financial circumstance, elaborating on the specific challenges being faced. — Propose a specific timeframe for the temporary postponement, be it a few months or until the financial situation improves. — Suggest any alternative arrangements, such as interest-free payment extensions or revised payment schedules, if applicable. — Highlight the debtor's commitment to resuming regular payment obligations after the agreed-upon postponement period. 5. Closing paragraph: Express gratitude for the creditor's understanding and cooperation. Request a written confirmation from the creditor regarding their acceptance of the temporary postponement agreement. 6. Closing: End the letter with a courteous closing, such as "Sincerely" or "Yours faithfully," followed by the debtor's full name, signature, and printed name. Remember, it is crucial to consult legal professionals or financial advisors while drafting this New Jersey Letter to Creditor Confirming Agreement, as specific legal requirements or regulations might apply.

New Jersey Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

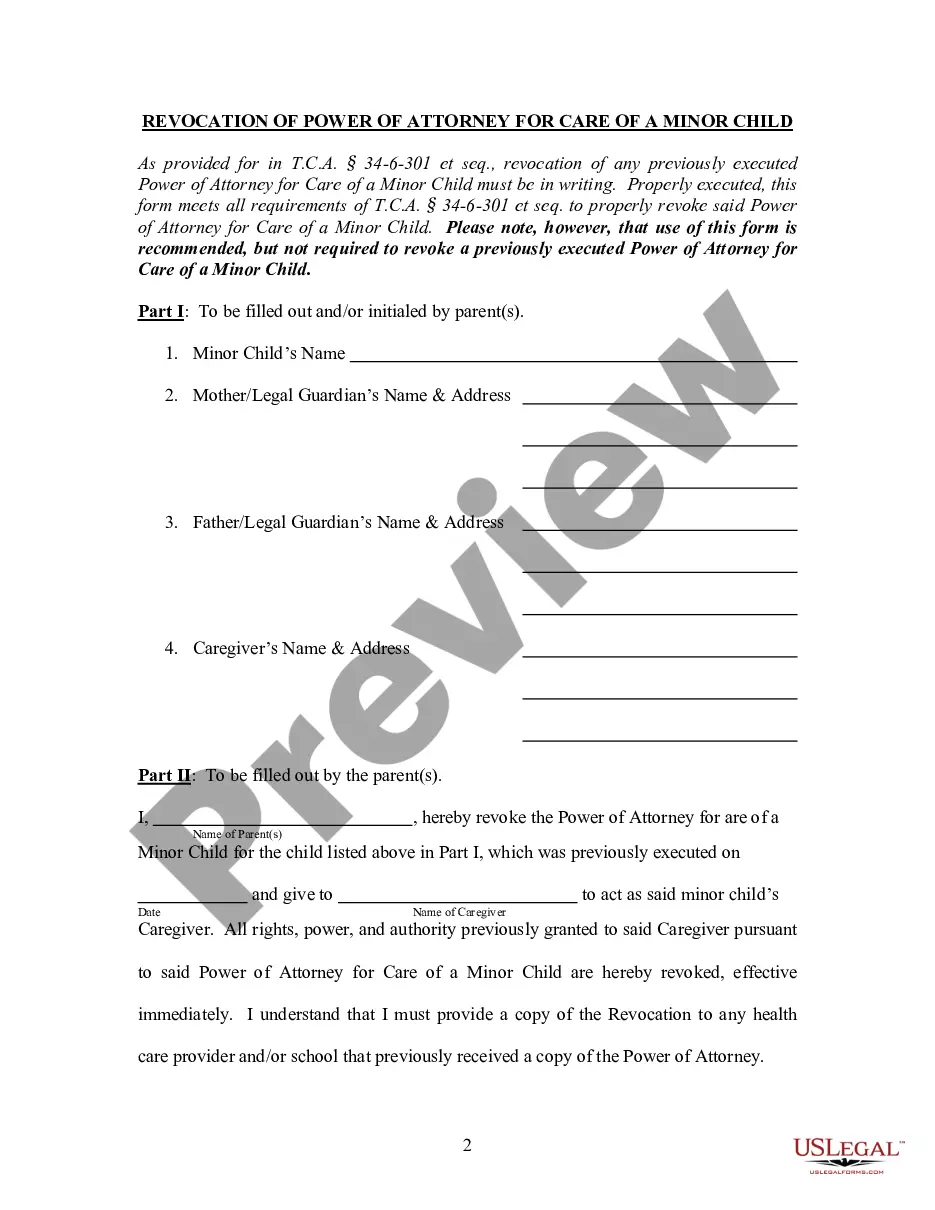

How to fill out New Jersey Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

Choosing the best legal file template might be a struggle. Naturally, there are a lot of themes available on the Internet, but how would you discover the legal type you require? Make use of the US Legal Forms website. The assistance gives thousands of themes, like the New Jersey Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed, which you can use for business and personal demands. Every one of the forms are checked out by pros and meet federal and state requirements.

Should you be previously registered, log in in your bank account and click on the Acquire button to get the New Jersey Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Use your bank account to search from the legal forms you may have purchased earlier. Visit the My Forms tab of your own bank account and obtain another duplicate of the file you require.

Should you be a brand new user of US Legal Forms, here are easy directions that you can adhere to:

- First, make sure you have selected the correct type for your personal area/region. It is possible to look over the form using the Preview button and study the form description to make sure this is the best for you.

- When the type fails to meet your expectations, utilize the Seach field to discover the proper type.

- Once you are certain the form would work, go through the Get now button to get the type.

- Choose the rates program you desire and enter in the needed details. Build your bank account and purchase an order making use of your PayPal bank account or credit card.

- Choose the document format and obtain the legal file template in your product.

- Full, edit and produce and indication the received New Jersey Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

US Legal Forms may be the most significant collection of legal forms for which you can see various file themes. Make use of the service to obtain skillfully-created documents that adhere to status requirements.