A New Jersey Promissory Note for a Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of New Jersey. This type of promissory note specifically pertains to commercial loans that are secured by real property, such as land or buildings. The New Jersey Promissory Note for Commercial Loan Secured by Real Property serves as a written contract that defines the obligations and responsibilities of both the borrower and the lender. It includes details such as the loan amount, interest rate, repayment terms, and any additional provisions or clauses that both parties agree upon. In New Jersey, there are various types of Promissory Notes for Commercial Loans Secured by Real Property, depending on the specific transaction or circumstances involved: 1. Fixed-Rate Commercial Loan Promissory Note: This type of promissory note sets a predetermined interest rate that remains constant throughout the loan term. It provides borrowers with a sense of stability and predictability regarding their monthly payments. 2. Adjustable-Rate Commercial Loan Promissory Note: An adjustable-rate promissory note allows for changes in the interest rate over the course of the loan. These changes typically occur at specified intervals and are often tied to a specific financial index, such as the prime rate. 3. Balloon Payment Commercial Loan Promissory Note: A balloon payment promissory note features regular monthly payments for a predetermined period, followed by a larger lump-sum payment (balloon payment) at the end of the term. This structure may help borrowers with short-term financing needs. 4. Participation Commercial Loan Promissory Note: In some cases, lenders may offer a participation agreement that allows multiple parties to invest in a commercial loan secured by real property. Each participant becomes a co-lender and shares the risks and benefits associated with the loan. This type of promissory note outlines the obligations of each participant. It's essential to consult with legal professionals when drafting or entering into any type of promissory note or loan agreement. They can provide guidance and ensure compliance with specific New Jersey laws and regulations to protect the interests of both the borrower and the lender.

New Jersey Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out New Jersey Promissory Note For Commercial Loan Secured By Real Property?

Are you in a situation the place you require papers for possibly enterprise or person purposes just about every working day? There are tons of lawful file layouts available on the net, but getting versions you can rely isn`t easy. US Legal Forms provides a huge number of kind layouts, such as the New Jersey Promissory Note for Commercial Loan Secured by Real Property, that are composed to fulfill state and federal demands.

In case you are presently acquainted with US Legal Forms site and get your account, basically log in. After that, you can down load the New Jersey Promissory Note for Commercial Loan Secured by Real Property template.

Unless you provide an accounts and need to begin to use US Legal Forms, adopt these measures:

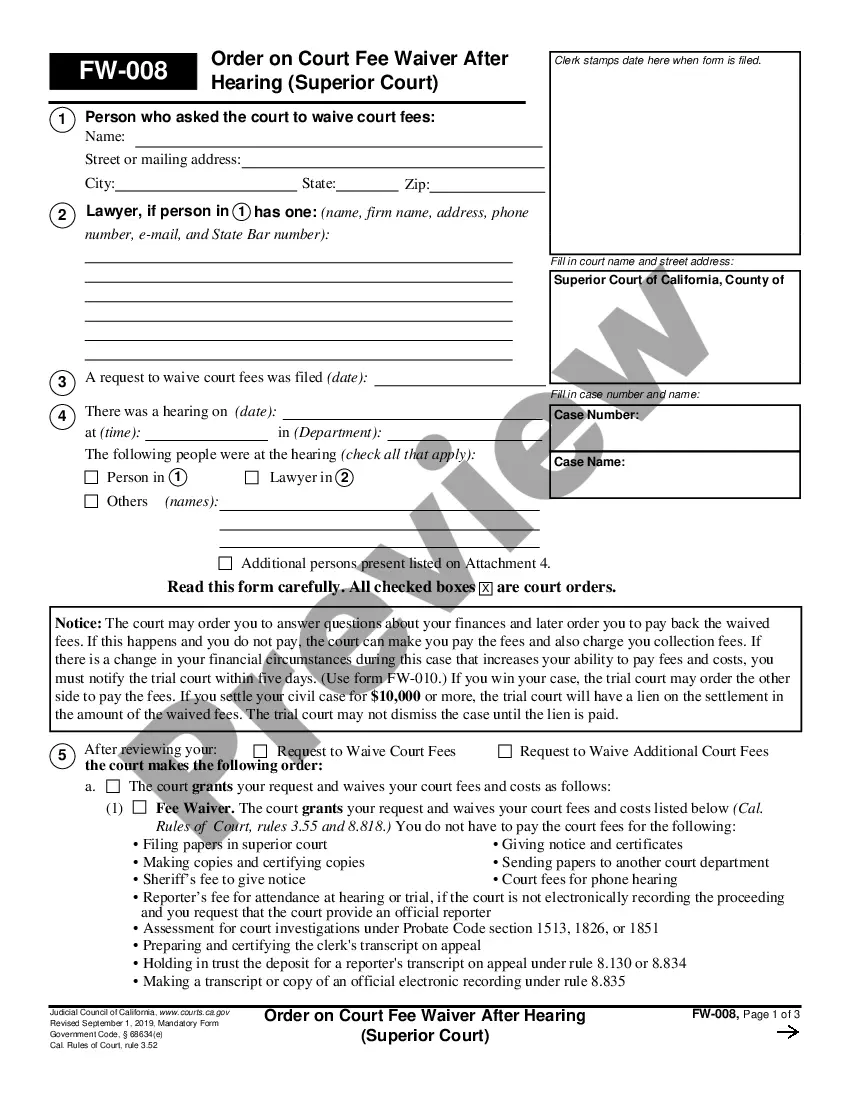

- Find the kind you need and make sure it is to the right city/county.

- Utilize the Review key to check the form.

- See the information to actually have selected the proper kind.

- In case the kind isn`t what you are searching for, utilize the Lookup discipline to find the kind that meets your requirements and demands.

- Whenever you discover the right kind, click on Buy now.

- Pick the prices program you desire, complete the required information to make your money, and purchase your order with your PayPal or bank card.

- Pick a handy paper structure and down load your version.

Discover every one of the file layouts you might have bought in the My Forms menu. You can get a additional version of New Jersey Promissory Note for Commercial Loan Secured by Real Property whenever, if required. Just click on the needed kind to down load or print out the file template.

Use US Legal Forms, the most comprehensive collection of lawful kinds, to conserve some time and prevent errors. The services provides professionally created lawful file layouts which can be used for a range of purposes. Make your account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Q. What are Real Estate Secured loans? A. Often referred to as private money, hard money, or bridge financing, these short-term loans offer greater flexibility than traditional bank financing.

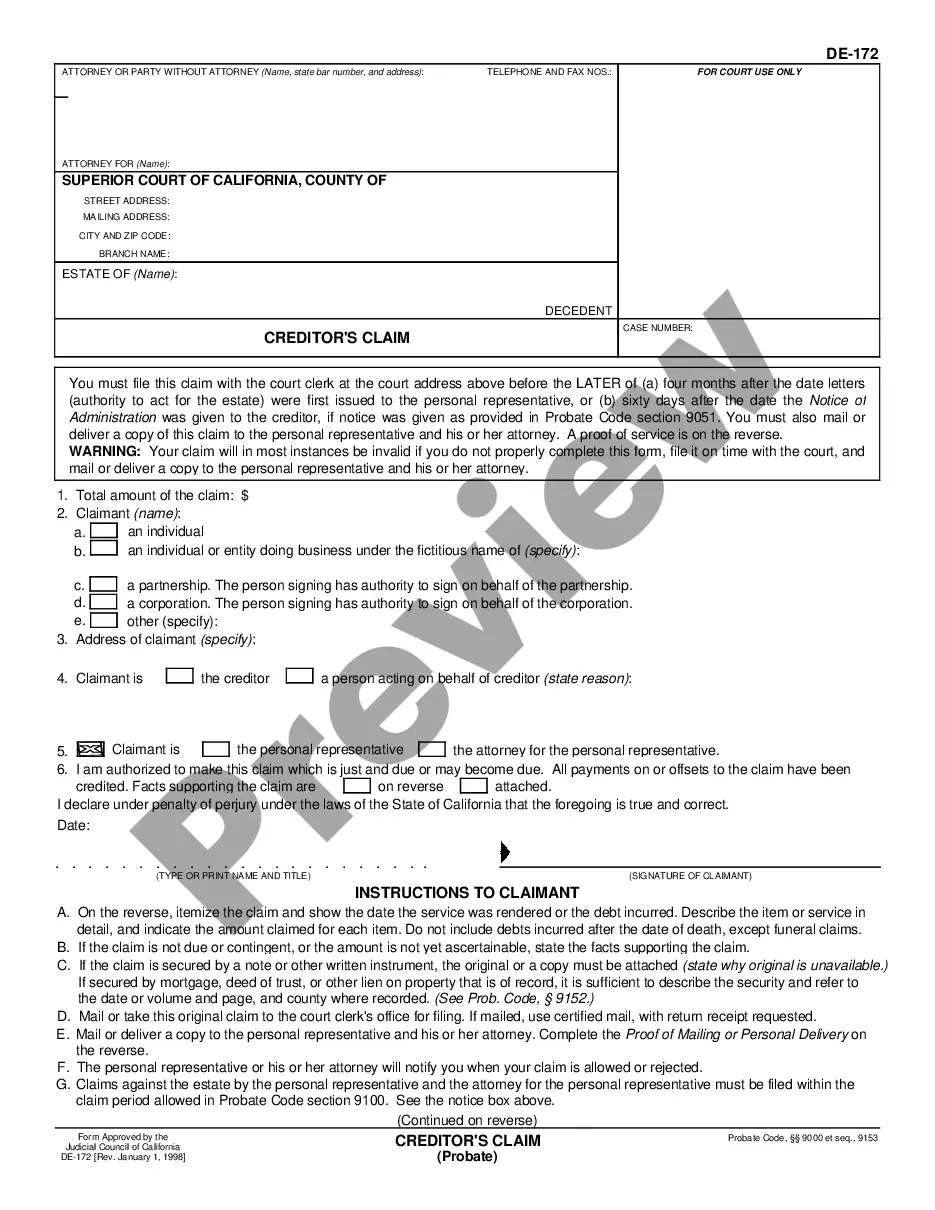

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

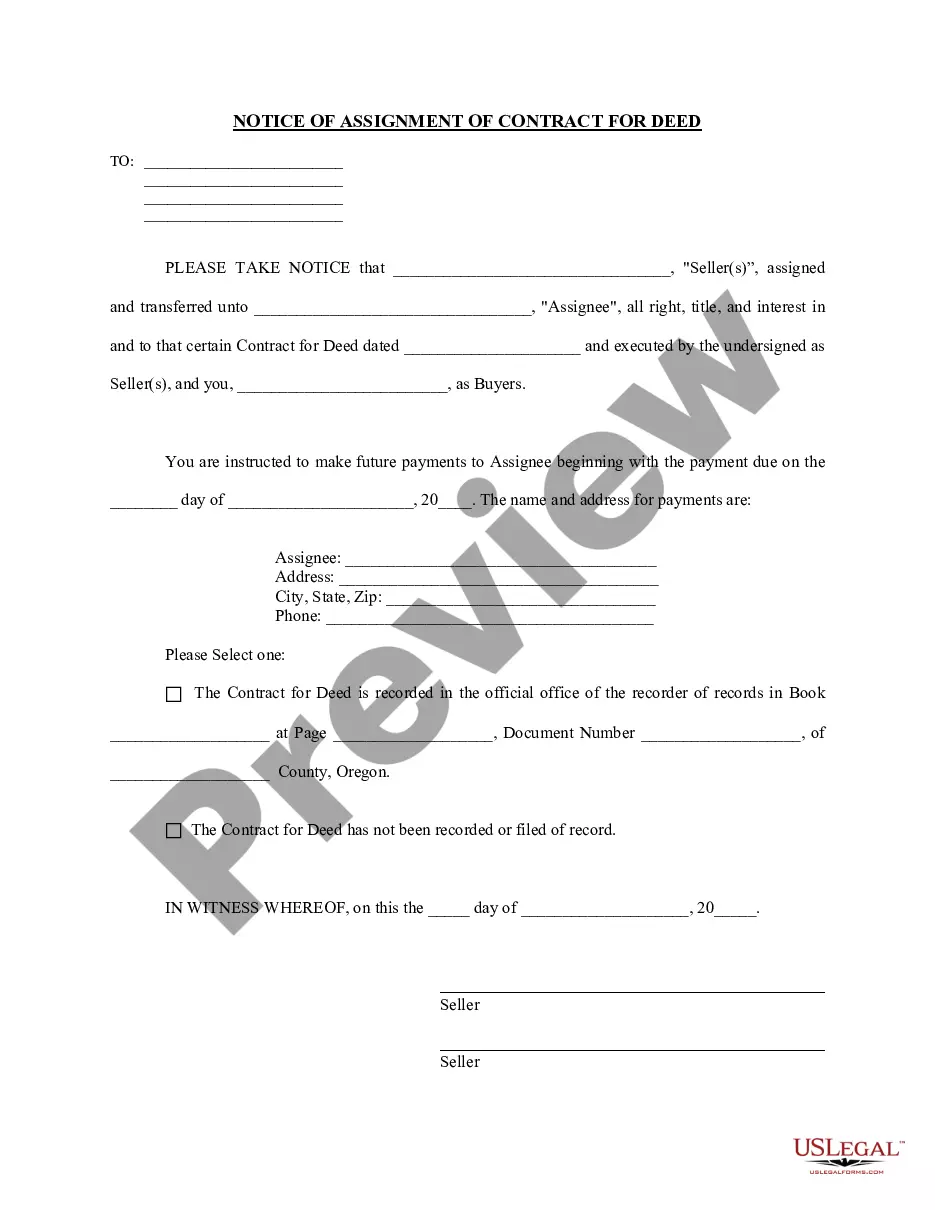

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document.

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.