A New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a legally binding contract between a consultant and a company based in New Jersey, that outlines the terms of the consultant's engagement in providing financial services and reporting. This agreement ensures that both parties are clear about the scope of work, compensation, responsibilities, and expectations. The consultant agreement typically includes the following provisions: 1. Services: It specifies the services the consultant will provide, which may include financial analysis, budgeting, forecasting, financial reporting, tax planning, or any other related financial services. 2. Compensation: This section covers the consultant's payment terms, whether it's an hourly rate, fixed fee, or a retainer. It also indicates how and when the payments will be made, and any additional expenses that will be reimbursed. 3. Duration: The agreement outlines the duration of the engagement, which can be a specified number of months, until a particular project is completed, or on an ongoing basis. 4. Confidentiality: Confidentiality provisions are crucial in preserving the company's sensitive financial information. This section ensures that the consultant agrees to keep all financial data, trade secrets, client information, and proprietary knowledge strictly confidential, both during and after the engagement. 5. Ownership and Intellectual Property: If the consultant generates any intellectual property during the engagement, such as financial models or reports, the agreement should specify the ownership rights, ensuring that the company retains full ownership. 6. Non-Competition and Non-Solicitation: Some consultant agreements may include clauses preventing the consultant from competing with the company or soliciting clients, employees, or contractors for a specified period after the termination of the agreement. 7. Termination: This section outlines the circumstances under which either party can terminate the agreement, such as breach of contract, non-performance, or completion of services. It also clarifies the notice period required for termination. Some different types of New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions may include: 1. Project-based Agreement: This type of agreement is used when the consultant is engaged to work on a specific financial project or task, such as a financial audit or tax planning. 2. Retainer Agreement: A retainer agreement establishes an ongoing relationship between the consultant and the company, providing financial services on a regular basis, such as monthly financial reporting or CFO advisory services. 3. Part-time or Temporary Agreement: This type of agreement is suitable when the company requires financial expertise for a fixed duration but does not need a full-time consultant. The consultant may work for a specific number of hours per week or month. 4. Outsourced CFO Agreement: In some cases, small businesses may hire a consultant to act as their Chief Financial Officer (CFO) on an outsourced basis. This agreement establishes the consultant's role as the primary financial advisor, responsible for overseeing financial strategy, reporting, and operations. It's important to consult with a legal professional who specializes in contract law to ensure that all necessary provisions and specific requirements are included in the New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions.

New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out New Jersey Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

US Legal Forms - one of several greatest libraries of legal varieties in the States - provides a wide array of legal document themes you are able to acquire or print. Utilizing the site, you can get a huge number of varieties for enterprise and specific functions, categorized by classes, suggests, or keywords and phrases.You can find the most up-to-date types of varieties like the New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions in seconds.

If you currently have a subscription, log in and acquire New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions in the US Legal Forms catalogue. The Download key can look on each and every develop you view. You have accessibility to all in the past saved varieties inside the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, here are easy directions to obtain began:

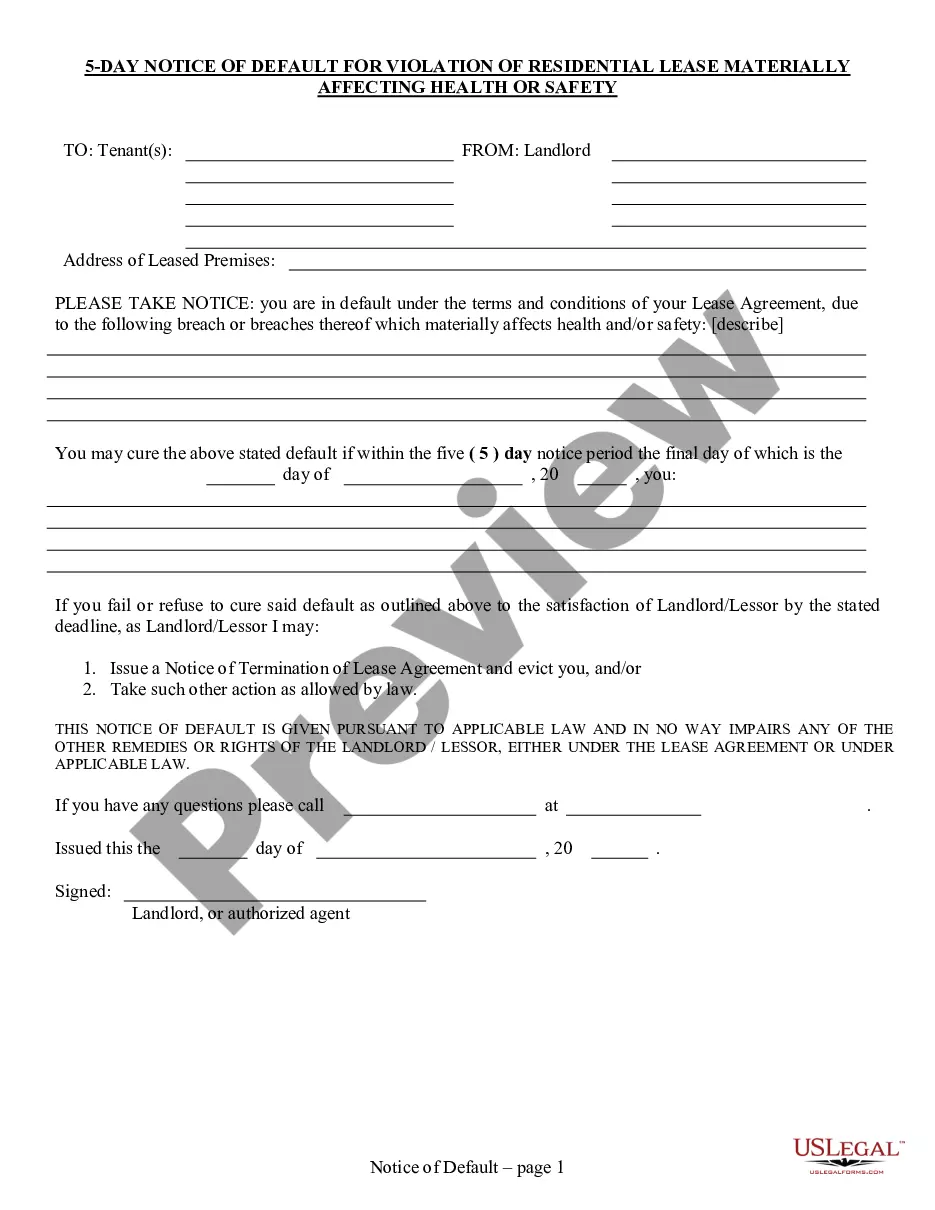

- Be sure you have selected the correct develop for your town/state. Click on the Review key to analyze the form`s content material. See the develop explanation to ensure that you have chosen the right develop.

- If the develop doesn`t match your demands, use the Research industry at the top of the display to get the the one that does.

- When you are pleased with the shape, validate your option by clicking the Purchase now key. Then, pick the costs program you favor and give your references to sign up on an bank account.

- Process the deal. Make use of charge card or PayPal bank account to finish the deal.

- Choose the formatting and acquire the shape on the gadget.

- Make alterations. Load, change and print and signal the saved New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions.

Every single design you put into your bank account does not have an expiry particular date which is your own property forever. So, if you wish to acquire or print yet another duplicate, just check out the My Forms segment and then click about the develop you need.

Obtain access to the New Jersey Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions with US Legal Forms, by far the most extensive catalogue of legal document themes. Use a huge number of skilled and state-certain themes that satisfy your organization or specific needs and demands.

Form popularity

FAQ

Consultancy agreements usually contain clauses covering the following:Duration of contract.Services to be provided.Duties of the consultant.Fees and payment terms.Supply of equipment.Substitution.Tax and NICs.Liability.More items...

Except as specifically required by law, Consultant may disclose Non-Public Information only with Client's prior written consent. Consultant shall have no authority to disclose Non-Public Information except in accordance with this section.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

disclosure agreement is a legally binding contract that establishes a confidential relationship. The party or parties signing the agreement agree that sensitive information they may obtain will not be made available to any others. An NDA may also be referred to as a confidentiality agreement.

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

A consulting services agreement is a contract defining the terms of service between a client and a consultant. The document can also be referred to as a consulting contract, a business consulting agreement, an independent contractor agreement, or a freelance agreement.

State Laws on Confidentiality AgreementsConfidentiality agreements are considered restrictive covenants because they restrict or limit the freedom of an individual. fefffeff In the case of the NDA, the restrictions might hinder someone from going into business, finding work, or making money.

Also known as an NDA or Confidentiality Agreement, this agreement is a legally binding contract where a party agrees to keep confidential information that's received private. For example, if you hire a partner and share a trade secret with him or her; you can ask that your secret remain confidential.

Service Provider's PromisesUnless authorized in writing by Client, Service Provider will keep all Confidential Information and will not copy, reproduce, or make notes of, divulge to anyone or any entity outside Client, or use any of the Confidential Information for Service Provider's or another's benefit or purpose.