New Jersey Balance Sheet Deposits refer to the amount of funds held by financial institutions in the state of New Jersey that can be categorized under various types of deposits. These deposits are an important component of a bank's balance sheet, representing the sum of money entrusted to the bank by its customers. The different types of New Jersey Balance Sheet Deposits include: 1. Checking Deposits: These deposits refer to funds held in a checking account, which customers can access on-demand through various means such as check writing, debit card transactions, or ATM withdrawals. Checking deposits usually offer limited to no interest. 2. Savings Deposits: Savings deposits are held in a savings account and generally offer a modest interest rate compared to checking accounts. These deposits are designed to encourage customers to save money over a longer period. Withdrawals from savings deposits may be subject to certain restrictions or limitations. 3. Time Deposits: Time deposits, commonly known as certificates of deposit (CDs), are a type of deposit that requires customers to deposit a specific amount of money with a bank for a fixed period. These deposits typically offer higher interest rates compared to checking and savings accounts, but customers cannot withdraw the funds before the maturity date without incurring penalties. 4. Money Market Deposits: Money market deposits refer to accounts that combine features of both checking and savings accounts. These deposits often have higher minimum balance requirements and interest rates, but also provide limited check-writing capabilities compared to regular checking accounts. 5. Brokered Deposits: Brokered deposits are obtained by banks through intermediaries such as brokers or financial advisers, who gather deposits on behalf of their clients and place them with different banks. These deposits usually involve higher amounts and can provide banks with a diversified source of funds. 6. Negotiable Order of Withdrawal (NOW) Deposits: NOW deposits are interest-bearing accounts that offer features similar to checking accounts. They are typically targeted at customers who want to earn interest on their checking deposits while maintaining easy access to their funds. 7. Demand Deposits: Demand deposits are essentially checking deposits that are subject to no restrictions or limitations on withdrawals. They can be withdrawn at the depositor's discretion and usually do not accrue interest. 8. Foreign Office Time Deposits: Foreign office time deposits involve deposits made in foreign currencies, held in financial institutions' foreign offices. These deposits enable customers to diversify their currency holdings and potentially benefit from higher interest rates offered abroad. 9. Overnight Deposits: Overnight deposits are short-term deposits that financial institutions hold for a single night or a few days. These deposits usually earn minimal interest but serve as a liquidity management tool for banks. It is important to note that the specific classification and nomenclature of New Jersey Balance Sheet Deposits may vary across different financial institutions and regulatory frameworks. These deposits form a crucial part of a bank's funding structure, enabling them to lend and invest in various financial activities while providing a secure place for customers to store their funds.

New Jersey Balance Sheet Deposits

Description

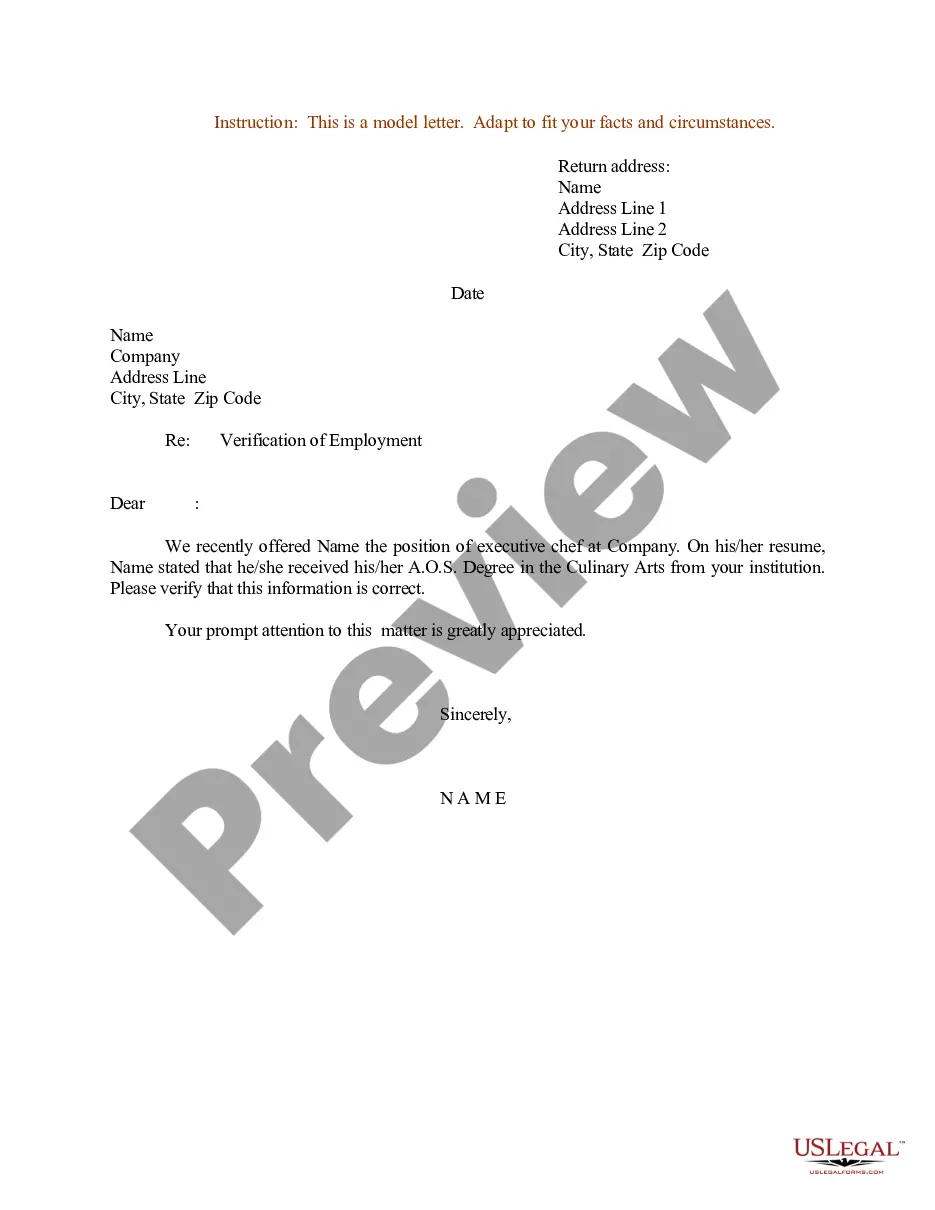

How to fill out New Jersey Balance Sheet Deposits?

US Legal Forms - one of the greatest libraries of legitimate kinds in the United States - offers an array of legitimate record templates you can download or printing. Utilizing the web site, you can get a large number of kinds for organization and specific purposes, categorized by categories, claims, or keywords and phrases.You will find the most recent versions of kinds much like the New Jersey Balance Sheet Deposits within minutes.

If you already have a monthly subscription, log in and download New Jersey Balance Sheet Deposits through the US Legal Forms catalogue. The Obtain button will show up on each kind you perspective. You gain access to all in the past delivered electronically kinds in the My Forms tab of your account.

If you would like use US Legal Forms the first time, allow me to share basic guidelines to get you started:

- Be sure you have picked out the right kind to your area/region. Select the Preview button to review the form`s content material. Look at the kind information to actually have chosen the proper kind.

- In case the kind doesn`t satisfy your specifications, take advantage of the Search area on top of the screen to find the one who does.

- If you are content with the form, affirm your option by clicking the Buy now button. Then, opt for the rates plan you like and supply your references to sign up on an account.

- Method the purchase. Make use of your credit card or PayPal account to accomplish the purchase.

- Choose the structure and download the form in your device.

- Make adjustments. Load, modify and printing and indication the delivered electronically New Jersey Balance Sheet Deposits.

Each template you included in your money lacks an expiration day and is also yours forever. So, if you want to download or printing another copy, just visit the My Forms portion and click on in the kind you require.

Obtain access to the New Jersey Balance Sheet Deposits with US Legal Forms, the most comprehensive catalogue of legitimate record templates. Use a large number of expert and state-specific templates that fulfill your organization or specific requires and specifications.