A New Jersey Granter Retained Annuity Trust (GREAT) is a type of irrevocable trust commonly used for estate planning purposes. It allows a granter to transfer assets into the trust while retaining an annuity payment stream for a specified period of time. The key objective of a GREAT is to minimize estate taxes by transferring appreciation of assets to beneficiaries with limited or no gift tax consequences. The New Jersey Granter Retained Annuity Trust operates similarly to Grants in other states. However, specific regulations and laws in New Jersey may impact the terms and benefits of the trust, making it unique to the state. It is important for individuals considering a GREAT to consult with an experienced estate planning attorney familiar with New Jersey laws to ensure compliance and maximize the benefits. In New Jersey, there are several types of Grants that individuals can utilize, depending on their specific goals and circumstances. These types can include: 1. Standard GREAT: The granter transfers assets into the trust and retains a fixed annuity payment for a predetermined period. At the end of the term, any remaining assets are distributed to the designated beneficiaries, often the granter's family members or loved ones. 2. Zeroed-Out GREAT: This type of GREAT is designed to minimize or eliminate the gift tax associated with the transfer of assets into the trust. The annuity payments are set at a level that reduces the taxable gift to zero, making it an effective tax planning tool. 3. Home Residency GREAT: Specifically applicable to New Jersey residents, this type of GREAT involves transferring a personal residence into the trust while still retaining the right to live in the property for a defined period. This can provide added flexibility and benefits to homeowners looking to transfer their primary residence to their beneficiaries while enjoying continued use during their lifetime. 4. Rolling GREAT: This variant of GREAT allows for the transfer of assets and the creation of multiple Grants in a repeatable and continuous manner. By "rolling over" assets from one GREAT to another, the granter can potentially extend the term and associated tax benefits over several generations. It is worth noting that while Grants offer various advantages, they may not be suitable for everyone. Each individual's financial situation and objectives differ, and it is crucial to consult with professionals, such as estate planning attorneys and financial advisors, to determine the most appropriate trust structure and strategy to meet specific goals. In conclusion, a New Jersey Granter Retained Annuity Trust (GREAT) is an estate planning tool that enables the transfer of assets while retaining an annuity payment stream. Different types of Grants available in New Jersey include the standard GREAT, zeroed-out GREAT, home residency GREAT, and rolling GREAT. However, seeking expert advice from professionals is fundamental to customize the trust structure according to individual objectives and abide by state-specific regulations.

New Jersey Grantor Retained Annuity Trust

Description

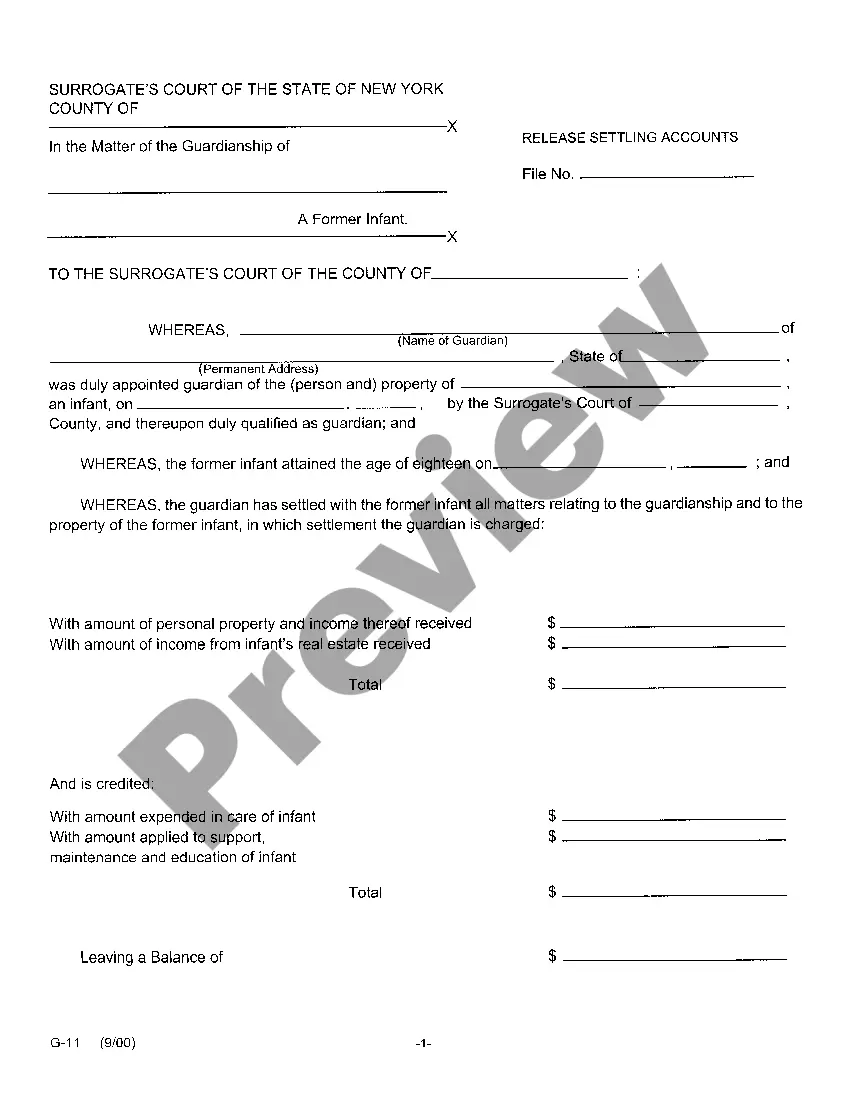

How to fill out New Jersey Grantor Retained Annuity Trust?

If you wish to comprehensive, acquire, or printing legal document themes, use US Legal Forms, the most important variety of legal kinds, that can be found on the web. Utilize the site`s basic and hassle-free search to obtain the paperwork you need. Numerous themes for enterprise and individual uses are categorized by classes and suggests, or key phrases. Use US Legal Forms to obtain the New Jersey Grantor Retained Annuity Trust in just a few mouse clicks.

If you are currently a US Legal Forms buyer, log in to your accounts and click on the Down load button to get the New Jersey Grantor Retained Annuity Trust. You can also entry kinds you formerly downloaded in the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the form for the proper metropolis/land.

- Step 2. Take advantage of the Review solution to look through the form`s content. Don`t forget about to read the information.

- Step 3. If you are unhappy with the develop, use the Lookup field on top of the screen to discover other variations from the legal develop template.

- Step 4. Upon having identified the form you need, go through the Purchase now button. Pick the rates strategy you like and add your qualifications to sign up for an accounts.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the file format from the legal develop and acquire it on your gadget.

- Step 7. Full, edit and printing or indication the New Jersey Grantor Retained Annuity Trust.

Each legal document template you acquire is yours eternally. You may have acces to every single develop you downloaded in your acccount. Click on the My Forms area and decide on a develop to printing or acquire again.

Be competitive and acquire, and printing the New Jersey Grantor Retained Annuity Trust with US Legal Forms. There are millions of specialist and express-certain kinds you can utilize for your enterprise or individual requirements.

Form popularity

FAQ

The Settlor may be the Trustee of the GRAT during the annuity term unless cer- tain voting stock is used to fund the GRAT.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

Grantor Trust.Grantor trusts are required to file a New Jersey Gross Income Tax Fiduciary Return. If the grantor trust income is reportable by or taxable to the grantor for federal income tax purposes, it also is taxable to the grantor for New Jersey Income Tax purposes.

Most states but not all recognize the federal rules of grantor trust status for income tax purposes. Of note, Alabama, Tennessee, Pennsylvania, Louisiana, and the District of Columbia do not follow in all regards federal law with respect to grantor trust taxation.

The Settlor may be the Trustee of the GRAT during the annuity term unless cer- tain voting stock is used to fund the GRAT.

If the grantor dies during the GRAT term, the value of the remainder interest in the trust is included in the grantor's taxable estate under either section 2036 (retained income, possession, or enjoyment of property) or 2039 (retained right to receive annuity in transferred property).

Usually, the beneficiaries of a GRAT are the grantor's children or a trust for their benefit. If a trust is a beneficiary, the terms of the trust will determine when the beneficiaries receive distribution of the trust assets.

California, Georgia, Montana, North Carolina, North Dakota, and Tennessee tax a trust if it has one or more resident beneficiaries. Generally, only income attributable to the resident beneficiary is taxed by the state.

Typically, you'll name yourself as the "trustee" of your trust. This means that while you are alive, you retain control of the trust and its property. In your trust document, you will also name a "successor trustee" to take over and manage the trust (distribute your property) after you die.

Also, the creator of the GRAT can be his or her own trustee.