The New Jersey Investment Management Agreement for Separate Account Clients is a legally binding contract that outlines the relationship between an investment manager and a client in the state of New Jersey. This agreement sets forth the terms and conditions of the investment management services provided by the investment manager to the client. The agreement covers various important aspects, including the scope of the investment services, the investment objectives, risk tolerance, and investment strategies. It also defines the roles and responsibilities of both parties, including the duty of loyalty, fiduciary duty, and the standard of care. Key terms and sections covered in the New Jersey Investment Management Agreement for Separate Account Clients may include: 1. Investment Objectives: This section outlines the specific goals and objectives that the client wishes to achieve through their investment portfolio. These objectives can range from capital preservation to capital appreciation or a combination of both. 2. Investment Strategies: This section details the investment strategies that will be employed by the investment manager to achieve the client's investment objectives. It may cover asset allocation, sector preferences, diversification, and any other relevant investment tactics. 3. Monitoring and Reporting: This section highlights the investment manager's commitment to monitor the client's portfolio, provide regular performance reports, and keep the client informed about the investment progress. 4. Compensation: The agreement will specify the fees and expenses associated with the investment management services provided. This may include a management fee based on a percentage of assets under management, performance fees, and any additional charges for specific services. 5. Duration and Termination: This section describes the initial term of the agreement and the conditions under which either party can terminate the contract. It may also address circumstances such as death, disability, or bankruptcy of either party. Types of New Jersey Investment Management Agreement for Separate Account Clients: 1. Individual Clients: This type of agreement is designed for individual investors who seek professional investment management services customized to their unique investment goals and objectives. 2. Institutional Clients: This type of agreement caters to institutional investors, such as pension funds, endowments, and foundations, who entrust their investment portfolios to professional investment managers. 3. High-net-worth Clients: This type of agreement is tailored for high-net-worth individuals who have substantial investible assets and require more sophisticated investment strategies, tax planning, and estate considerations. In conclusion, the New Jersey Investment Management Agreement for Separate Account Clients is a comprehensive document that governs the relationship between investment managers and their clients. With various types of clients, this agreement ensures that both parties are aligned in their investment objectives, strategies, and responsibilities.

New Jersey Investment Management Agreement for Separate Account Clients

Description

How to fill out New Jersey Investment Management Agreement For Separate Account Clients?

Are you currently inside a position where you require files for either organization or personal purposes almost every working day? There are a variety of legal papers themes available on the Internet, but finding kinds you can rely isn`t easy. US Legal Forms gives thousands of type themes, such as the New Jersey Investment Management Agreement for Separate Account Clients, that are created to meet state and federal requirements.

Should you be presently acquainted with US Legal Forms web site and possess your account, merely log in. Following that, you are able to acquire the New Jersey Investment Management Agreement for Separate Account Clients format.

If you do not have an profile and need to start using US Legal Forms, abide by these steps:

- Discover the type you need and make sure it is to the correct town/state.

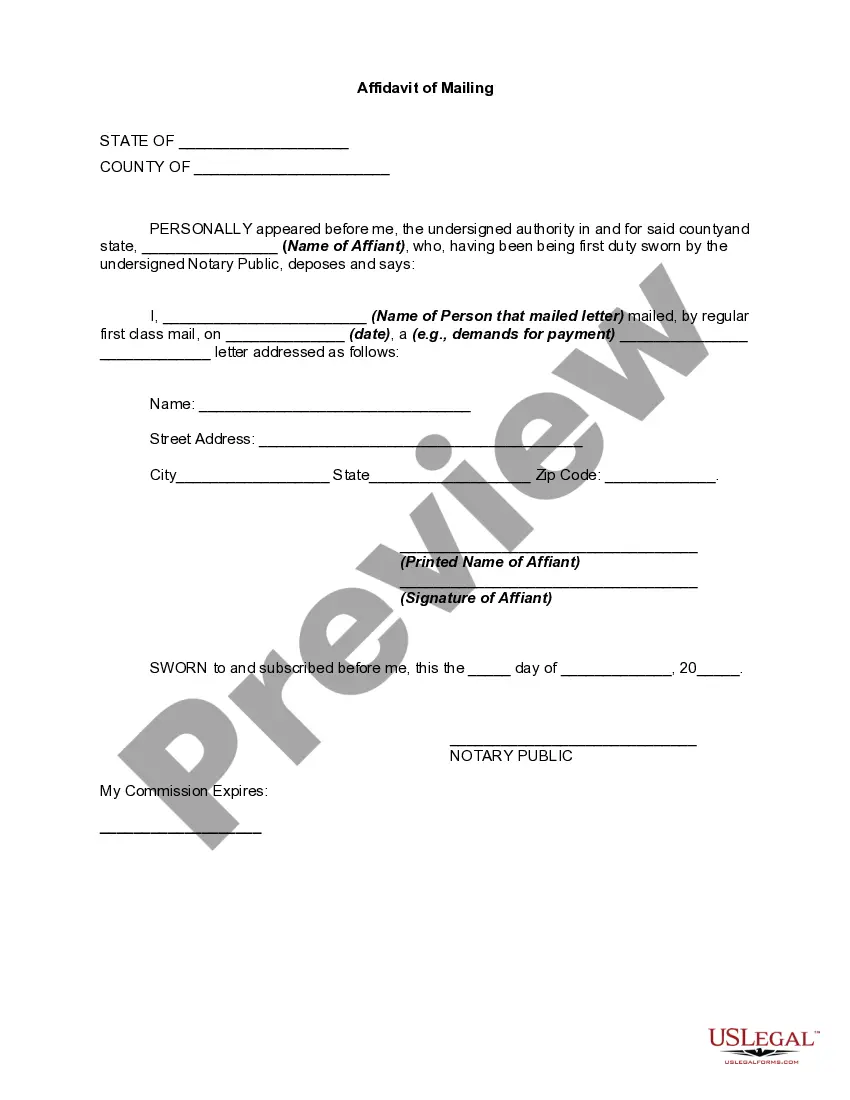

- Take advantage of the Preview key to analyze the shape.

- See the explanation to actually have selected the proper type.

- In case the type isn`t what you`re searching for, make use of the Look for industry to discover the type that fits your needs and requirements.

- When you obtain the correct type, click on Purchase now.

- Pick the prices program you desire, fill in the necessary info to produce your money, and pay for the order with your PayPal or bank card.

- Pick a convenient file structure and acquire your backup.

Discover all the papers themes you might have bought in the My Forms menu. You may get a additional backup of New Jersey Investment Management Agreement for Separate Account Clients whenever, if needed. Just click the necessary type to acquire or printing the papers format.

Use US Legal Forms, probably the most substantial collection of legal kinds, to save lots of efforts and stay away from errors. The service gives expertly created legal papers themes that you can use for a variety of purposes. Generate your account on US Legal Forms and begin generating your life easier.