New Jersey Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Are you in a circumstance where you require documents for both business or personal reasons almost every day.

There are many legal document templates accessible online, but locating reliable ones is not easy.

US Legal Forms provides thousands of document templates, such as the New Jersey Liquidation of Partnership with Sale and Proportional Distribution of Assets, that are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

You can view all the document templates you have purchased in the My documents list. You can acquire an additional version of the New Jersey Liquidation of Partnership with Sale and Proportional Distribution of Assets at any time if desired. Click the required document to download or print the template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service offers expertly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Liquidation of Partnership with Sale and Proportional Distribution of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is appropriate for your city/state.

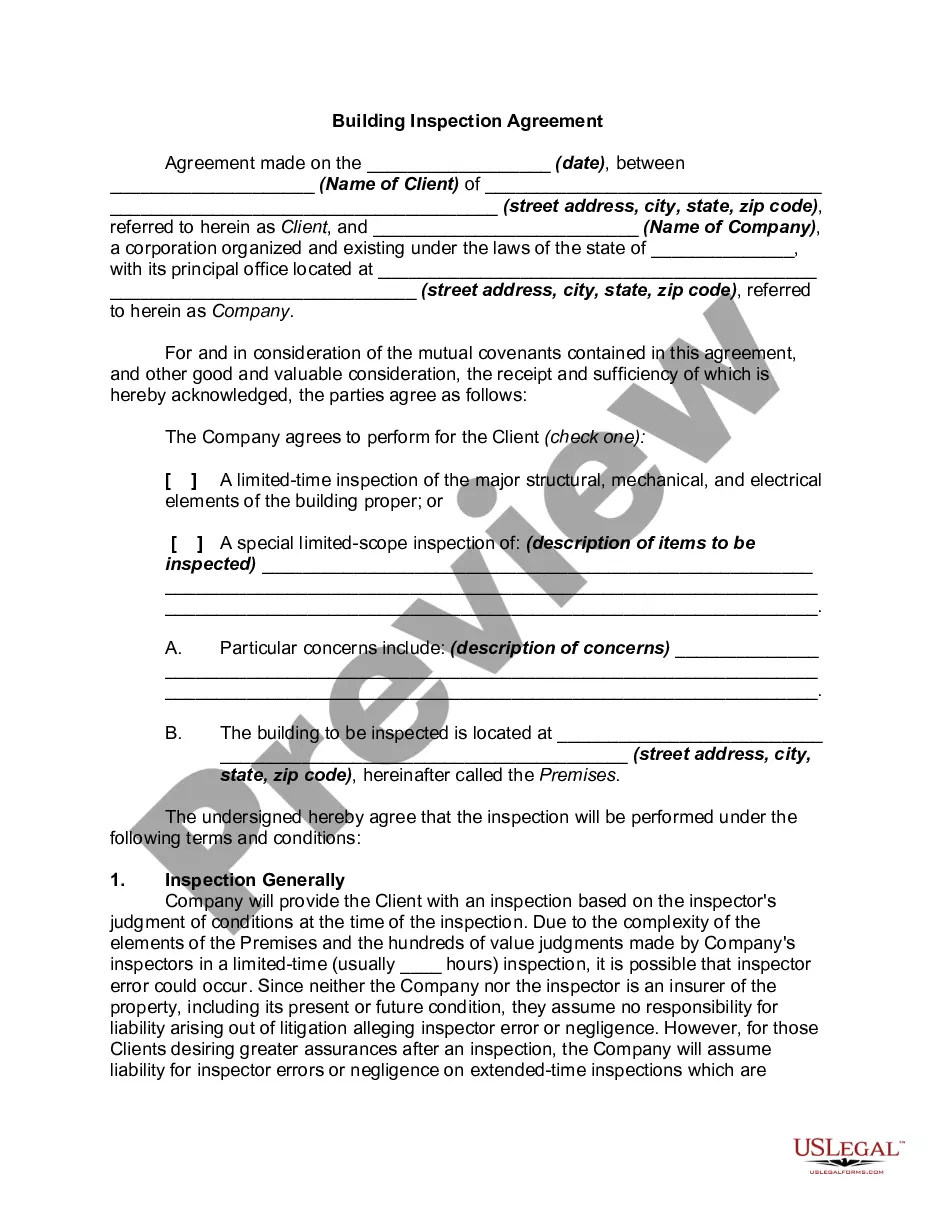

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct document.

- If the document isn’t what you’re looking for, use the Lookup field to find the document that meets your needs and criteria.

- When you find the right document, click Get now.

- Choose the pricing plan you wish, fill in the required information to create your account, and pay for your order using PayPal or Visa/Mastercard.

Form popularity

FAQ

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain on Schedule D.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

When a partnership business is terminated, partners are expected to pay taxes on the taxable gain distributed to them upon liquidation of current and fixed assets.

Under what conditions will a partner recognize gain in a liquidating distribution? In the situation in which a partnership distributes only money and the amount exceeds the partner's basis in her partnership interest, she will recognize a gain equal to the excess.