New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time

Description

How to fill out Partnership Agreement With One Partner To Work Full Time For Partnership And Other Partner To Work Part Time?

Are you currently in an establishment that requires documentation for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

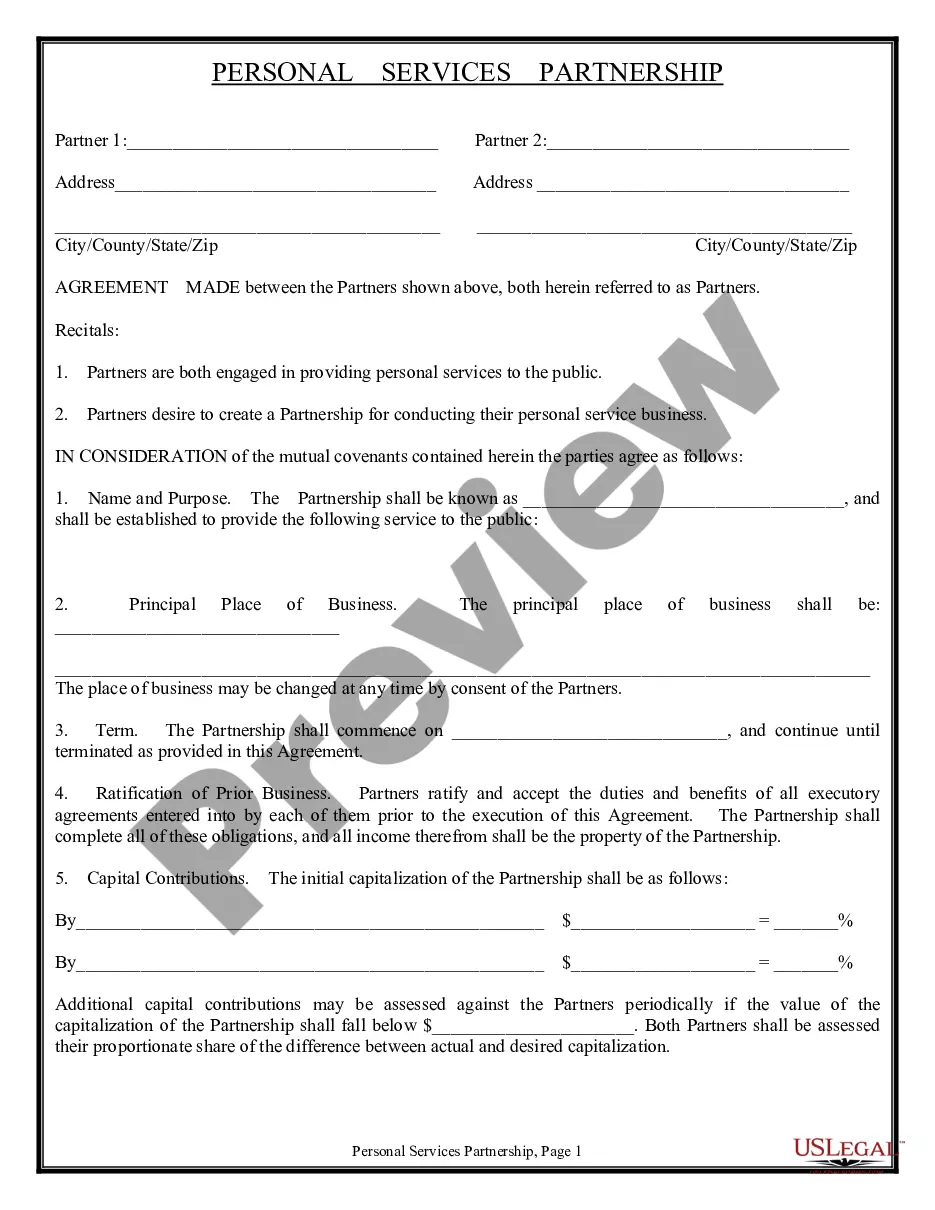

US Legal Forms offers a wide array of form templates, such as the New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, which are designed to meet federal and state requirements.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct state/region.

- Utilize the Preview option to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

- Once you find the appropriate form, click Purchase now.

Form popularity

FAQ

In New Jersey, partnerships are subject to the Corporation Business Tax (CBT) if they earn income from business operations within the state. Specifically, a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time should take into account the revenue and activities conducted in New Jersey. This tax can impact how profits are split between partners and how the overall business is structured. To navigate these tax obligations, consider utilizing platforms like uslegalforms for comprehensive documentation.

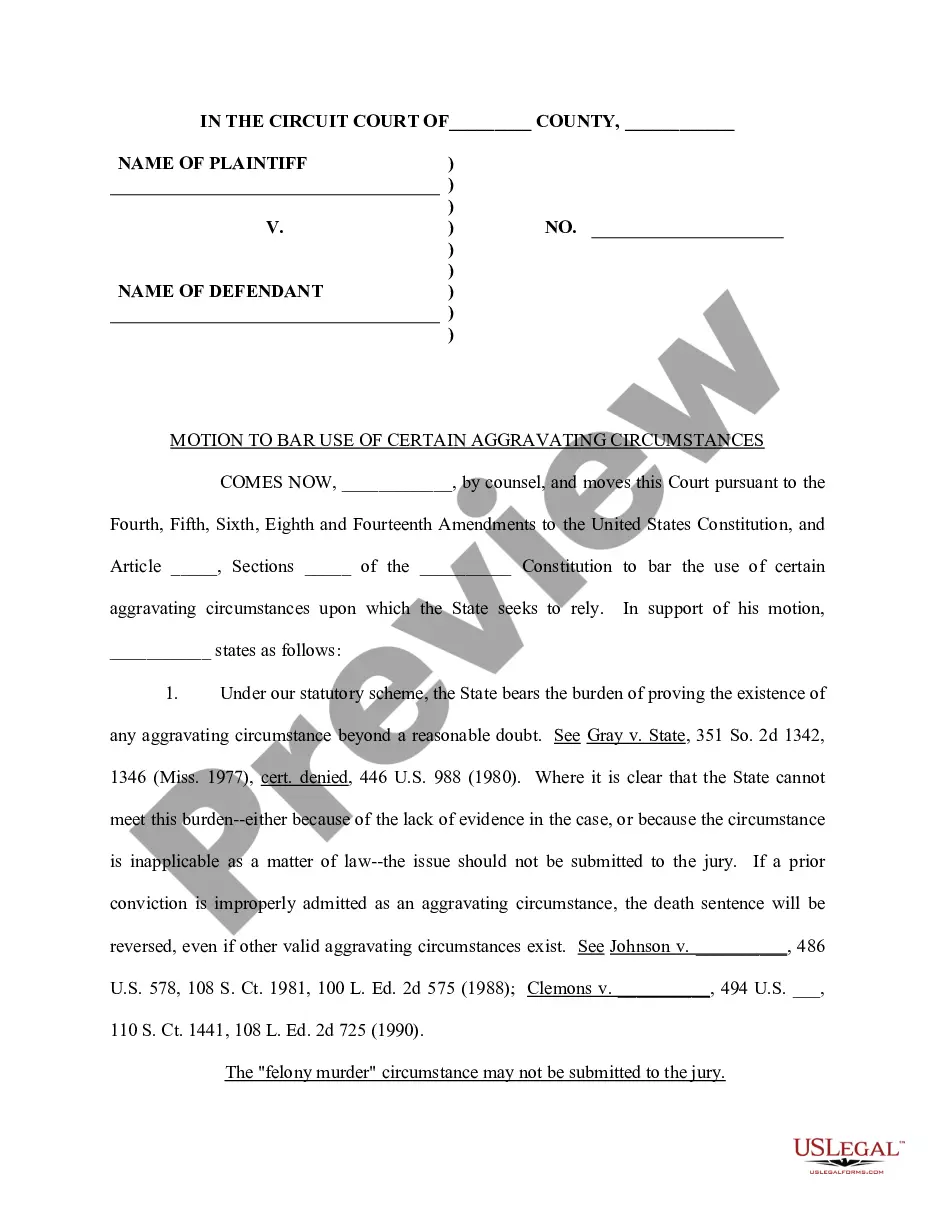

In New Jersey, the general partnership law outlines the rights and responsibilities of partners involved in a business venture. A New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time must clearly define each partner’s role, profits, and decision-making authority. This law ensures that all agreements are legally binding and provides a framework for resolving disputes. Understanding these regulations is crucial for effective partnership management.

In New Jersey, CBT tax is a tax levied on corporations and partnerships based on their net income. This tax is essential for funding state services and infrastructure. If you are forming a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, being aware of CBT tax obligations can help secure your partnership's financial health and legal compliance.

CBT stands for Corporation Business Tax, which applies to businesses operating in New Jersey, including partnerships. This tax is based on the income generated by the business and affects how partnerships report their earnings. For those involved in a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, understanding CBT is vital for accurate tax planning and compliance.

NJ CBT 1065 refers to the New Jersey Corporation Business Tax return that partnerships must file. This form outlines the income, deductions, and other financial details of partnerships operating in New Jersey. Filing the NJ CBT 1065 is crucial for a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, ensuring compliance with state tax regulations.

In the context of a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, the IRS recognizes different types of partnerships that can file Form 1065. These include general partnerships, limited partnerships, and limited liability partnerships. Each type has its own implications for liability, management structure, and tax treatment, making it essential for partners to choose the right structure for their needs.

A NJ tiered partnership refers to a multi-level partnership structure where one partnership owns interests in another. This model allows flexibility and can optimize financial and operational efficiency for partners, such as in a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. It is important to understand how this affects tax obligations and distributions. USlegalforms can assist in navigating the specifics of such arrangements.

For tiered partnerships in New Jersey, the schedule involves detailed reporting of each tier's income and expenses. Each partnership must submit a NJ-1065 to report its share of the income, while the upper-tier partners report their share as well. It’s important for partners, especially in a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, to maintain clear records. Platforms like USlegalforms can guide you in tracking and preparing this documentation effectively.

A NJ qualified investment partnership is a specific type of partnership that meets criteria established by New Jersey law, primarily focusing on investments. Such partnerships allow for specific tax benefits, which can be particularly advantageous for partners, including those in a New Jersey Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. To learn more about these details, consider accessing resources available through USlegalforms.

The NJ-1065 is the partnership return form for reporting income, gains, losses, and deductions. In contrast, the NJ CBT 1065 is specifically for Corporate Business Tax purposes. If your New Jersey Partnership Agreement includes a corporate structure, you might need to file both. Utilizing a service like USlegalforms can simplify understanding when to use each form.