Title: New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance Introduction: In the state of New Jersey, insurance agencies commonly enter into General Agency Agreements with Exclusive Representation for All Lines of Insurance to establish a mutually beneficial partnership between the agency and the insurance carrier(s). This detailed description explores the nature, benefits, and types of New Jersey Insurance General Agency Agreements with Exclusive Representation for All Lines of Insurance. Keywords: New Jersey, insurance, general agency agreement, exclusive representation, all lines of insurance, partnership, carrier, benefits, types. Overview of a New Jersey Insurance General Agency Agreement: A New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is a legally binding contract formed between an insurance agency and an insurance carrier operating within the state. The agreement grants the agency the exclusive rights to distribute and sell all lines of insurance offered by the carrier in New Jersey. Benefits of a New Jersey Insurance General Agency Agreement: 1. Exclusivity: The agreement allows the insurance agency to exclusively represent the carrier, giving them the advantage of being the only authorized channel for selling the carrier's insurance products in New Jersey. 2. Increased Revenue: The agency benefits from a commission-based compensation structure, earning income on premiums collected from policies sold. 3. Extensive Product Portfolio: The agency gains access to a broad range of insurance products, allowing them to offer comprehensive coverage options to clients. 4. Support and Training: The carrier provides continuous support, training, and marketing resources to help the agency effectively represent their products. 5. Strong Partnership: Through regular communication and cooperation, a strong partnership is fostered between the agency and the carrier. Types of New Jersey Insurance General Agency Agreements with Exclusive Representation for All Lines of Insurance: 1. Personal Lines Agency Agreement: This type of agreement focuses on personal lines of insurance, such as auto, homeowner's, and renter's insurance. The agency acts as the exclusive representative for all personal lines policies sold by the carrier in New Jersey. 2. Commercial Lines Agency Agreement: This agreement is tailored towards commercial lines of insurance, including general liability, property, and workers' compensation insurance. The agency gains exclusive representation rights for all commercial lines products offered by the carrier in New Jersey. 3. Specialty Lines Agency Agreement: This type of agreement concentrates on specialty lines of insurance, such as professional liability, cyber insurance, or aviation insurance. The agency becomes the exclusive representative for all specialty lines products provided by the carrier in New Jersey. Conclusion: A New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is a strategically advantageous partnership between an insurance agency and an insurance carrier. It grants the agency exclusive distribution rights, revenue opportunities, a diverse product portfolio, and ongoing support. Whether focusing on personal, commercial, or specialty lines, this agreement strengthens the ties between agencies and carriers, ultimately benefiting both parties involved.

New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance

Description

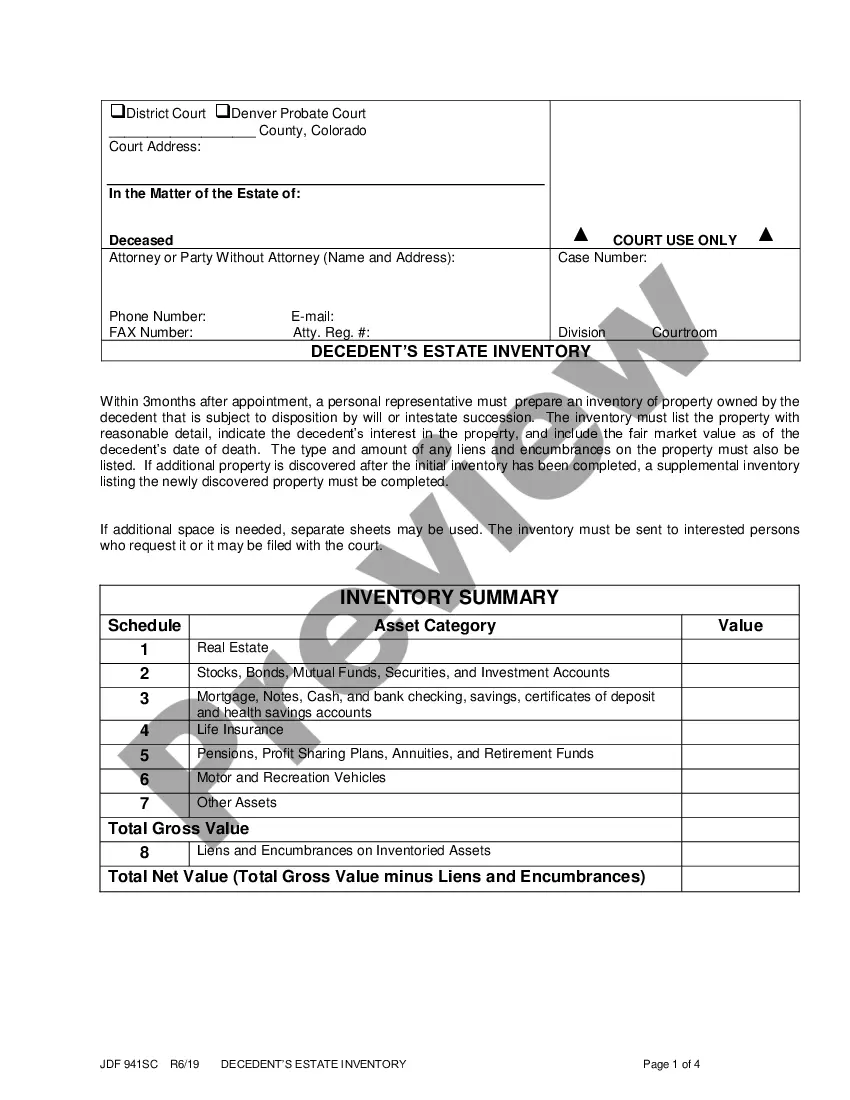

How to fill out New Jersey Insurance General Agency Agreement With Exclusive Representation For All Lines Of Insurance?

You can invest time online searching for the legal document template that satisfies the federal and state requirements you will require.

US Legal Forms offers thousands of legal templates that are evaluated by experts.

You can obtain or create the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance from our service.

If you want to find another version of the form, use the Search field to find the template that suits your needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, create, or sign the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/area of your preference.

- Review the form description to confirm that you have selected the appropriate form.

- If available, use the Review button to browse through the document template as well.

Form popularity

FAQ

The two main types of underwriting agreements are standard and binding. A standard agreement usually requires the insurer to approve risks before coverage begins, whereas a binding agreement allows the agent to provide immediate coverage based on specified criteria. Knowing these distinctions helps you make informed decisions within the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. Each type serves particular needs in the insurance process, providing flexibility and efficiency.

An agency agreement focuses on the relationship between an agent and an insurer, detailing terms of representation and commissions. Conversely, an underwriting agreement emphasizes risk assessment and management, laying out how premiums and coverage are determined. Both agreements are essential to the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, working together to ensure smooth operations in insurance transactions. Understanding their differences clarifies their unique roles in the insurance landscape.

The primary purpose of an agency agreement is to outline the relationship between the insurance company and the agent. This agreement sets the terms of representation, including responsibilities, commission structures, and the scope of authority. In the context of the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, it ensures all parties are aligned for effective collaboration. By clarifying expectations, the agency agreement promotes successful partnerships.

An exclusive agency agreement grants a single broker the sole rights to represent an insurance company within a specific territory. This type of agreement is foundational within the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. By establishing exclusivity, insurers can streamline their distribution and enhance relationship management with the broker. Such arrangements also encourage dedication and commitment from the agency.

An agent primarily facilitates the selling of insurance policies to clients, acting as the intermediary between the client and the insurer. In contrast, an underwriter assesses risks, determining the appropriate premiums and coverage levels. Understanding the distinction is vital, especially when considering the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. Each role is essential in delivering effective insurance solutions.

An underwriting agreement outlines the responsibilities and terms between an insurer and an agent. This document plays a crucial role in the New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. It ensures both parties understand their roles in the insurance process. In essence, the agreement clarifies how risks will be assessed and premiums set.

The length of an exclusive agency agreement can vary, but it usually ranges from one to five years, depending on the specifics of the contract. Many agreements include options for renewal, ensuring continued representation if both parties are satisfied. If you're considering entering into a New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, it's wise to review the duration terms carefully to align with your goals.

A buyer's agency exclusive contract is an agreement where a client commits to work solely with one agency for their insurance needs. This contract secures the agency's fees and ensures dedicated representation for the client. By entering into a New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, clients can benefit from personalized services and expert guidance, tailored specifically to their needs.

In New Jersey, the Department of Banking and Insurance is responsible for issuing insurance licenses. They ensure that agents and agencies meet all necessary qualifications and comply with state regulations. Having a license is crucial for operating under a New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, as it affirms your credibility and dedication to lawful practices.

Yes, it is possible to terminate an exclusive buyer agency agreement, but the process depends on the terms outlined in the contract. Usually, you may need to provide written notice and valid reasons for termination, such as a lack of satisfactory service. If you're navigating complexities, consider consulting uslegalforms for guidance on dissolving contracts effectively, especially in the context of a New Jersey Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

Interesting Questions

More info

IA AIR Business Insurance Broker Discount Plan AIR Commercial Insurance Services AIR Government AIR Group Insurance Specialty Products & Services AIR Life Insurance Specialties AIR Health Insurance Specialties AIR Liability Insurance Specialties AIR Mortgage Insurance Specialties Top Rated Independent Agents & Brokers Top-rated independent agents and brokers have proven themselves in more than 300 Million dollars of transactions in the last 7 years and received ratings of: Top Rated Insurance Brokers in South Alabama We at IndependentInsurance Brokerage are pleased to make your lives easier by providing you with the information we are confident you require to get you the business.