New Jersey Charitable Gift Annuity is a financial arrangement that allows individuals to make a charitable donation to a nonprofit organization in New Jersey, while also receiving a fixed income for life. It is a combination of a charitable gift and an annuity, providing tax benefits and the potential for income stability. In a New Jersey Charitable Gift Annuity, individuals transfer assets such as cash, stocks, or real estate to a charitable organization. In return, the charity agrees to make fixed annuity payments to the donor for the remainder of their life. This allows individuals to support their favorite causes while ensuring a steady income stream during their retirement years. One of the main advantages of a New Jersey Charitable Gift Annuity is the tax benefits it offers. Donors can receive an immediate income tax deduction based on the present value of the charitable gift portion. They may also be eligible for reduced capital gains taxes if they contribute appreciated assets. There are different types of New Jersey Charitable Gift Annuities that individuals can explore based on their specific needs: 1. Immediate Payment Charitable Gift Annuity: This type provides an income stream that begins right after the gift is made. It is suitable for individuals who want to start receiving income immediately. 2. Deferred Payment Charitable Gift Annuity: With this option, donors can defer the commencement of annuity payments to a future date. This may be beneficial for individuals who plan to retire in the future and want to supplement their retirement income. 3. Flexible Payment Charitable Gift Annuity: This type allows donors to choose when they want annuity payments to begin within a specified timeframe. It provides flexibility in timing income streams according to an individual's financial goals. New Jersey Charitable Gift Annuities provide individuals with a way to support charitable causes close to their heart while receiving financial benefits. However, it is essential to consult with financial advisors or estate planners to determine the most suitable option based on individual circumstances and philanthropic goals.

New Jersey Charitable Gift Annuity

Description

How to fill out New Jersey Charitable Gift Annuity?

Are you in a placement in which you need to have papers for possibly organization or person reasons just about every working day? There are a lot of authorized record templates available on the Internet, but locating versions you can trust isn`t straightforward. US Legal Forms delivers 1000s of kind templates, just like the New Jersey Charitable Gift Annuity, which are written to satisfy state and federal demands.

In case you are already familiar with US Legal Forms website and also have your account, merely log in. Afterward, it is possible to download the New Jersey Charitable Gift Annuity web template.

Should you not come with an account and want to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is for your appropriate town/state.

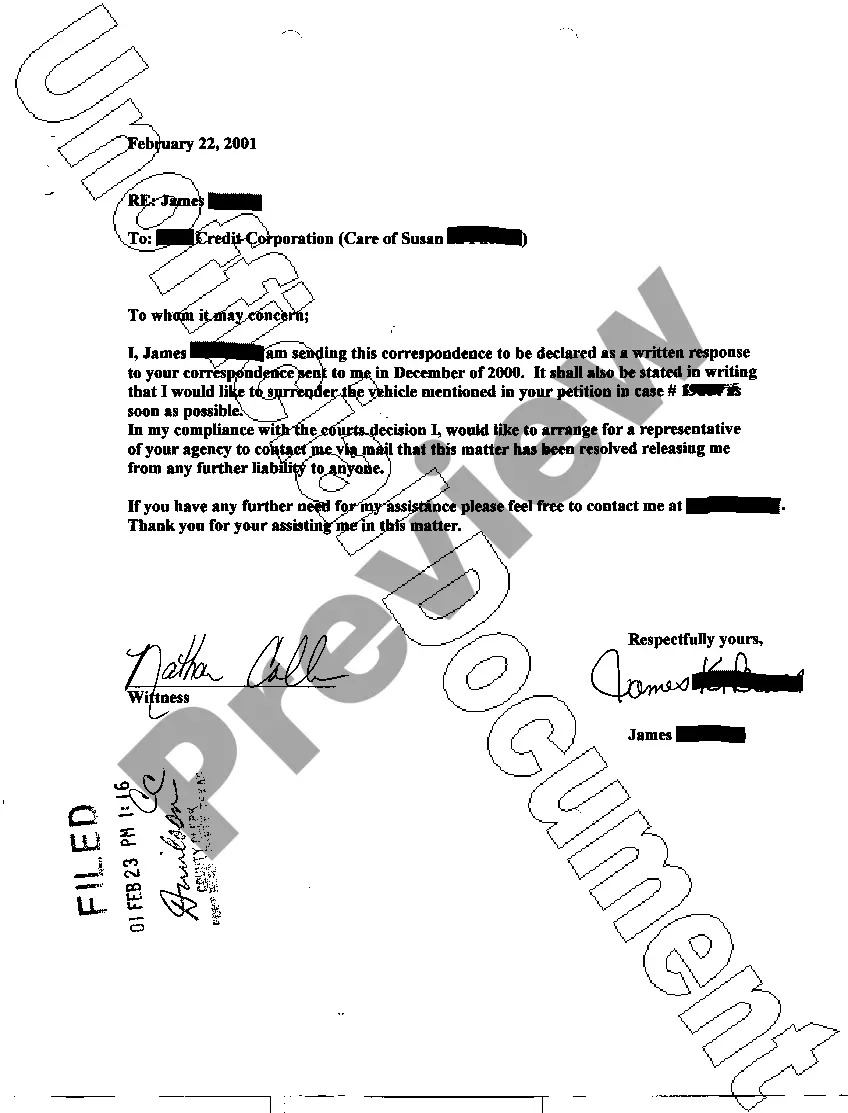

- Take advantage of the Preview key to review the form.

- Read the description to ensure that you have selected the right kind.

- If the kind isn`t what you`re looking for, take advantage of the Look for industry to find the kind that meets your requirements and demands.

- If you find the appropriate kind, click on Buy now.

- Pick the costs strategy you would like, submit the necessary information and facts to generate your money, and purchase your order with your PayPal or credit card.

- Decide on a hassle-free paper structure and download your duplicate.

Get each of the record templates you have purchased in the My Forms menus. You can aquire a more duplicate of New Jersey Charitable Gift Annuity anytime, if required. Just go through the necessary kind to download or print out the record web template.

Use US Legal Forms, the most substantial selection of authorized kinds, to conserve time as well as stay away from errors. The assistance delivers professionally made authorized record templates that you can use for a variety of reasons. Generate your account on US Legal Forms and begin creating your way of life easier.