New Jersey Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

You might spend hours online trying to locate the authentic document template that complies with the federal and state standards you require.

US Legal Forms provides a vast array of authentic forms that have been reviewed by specialists.

You can download or print the New Jersey Annuity as Consideration for Transfer of Securities using my assistance.

If available, use the Review option to search within the document template as well.

- If you already possess a US Legal Forms account, you can sign in and select the Obtain option.

- After that, you can complete, modify, print, or sign the New Jersey Annuity as Consideration for Transfer of Securities.

- Every authentic document template you obtain is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, make sure you have selected the correct document template for the area/town of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

If you receive annuity payments from a nonqualified retirement plan, you must use the General Rule. Under the General Rule, you figure the taxable and tax-free parts of your annuity payments using life expectancy tables that the IRS issues.

8 This form is a selfexecuting waiver affidavit for resident decedents.

If you made after-tax contributions to your pension or annuity plan, you can exclude part of your payments from your income. Determine the tax-free amount based on when your payments first began. This amount will always be the same, even if your payment amount changes.

Therefore, a waiver is not necessary. Non-resident decedents (bank accounts): Inheritance Tax and Estate Tax waivers are not required for intangible assets of a non-resident decedent. Waivers are required for real property located in New Jersey which was owned by a non-resident decedent (except as in #1 above).

Pension and annuity income is taxable and must be reported on your New Jersey Income Tax return.

What is the General Rule? The General Rule is one of the two methods used to figure the tax-free part of each annuity payment based on the ratio of your investment in the contract to the total expected return. The other method is the Simplified Method, which is discussed in Pub. 575, Pension and Annuity Income.

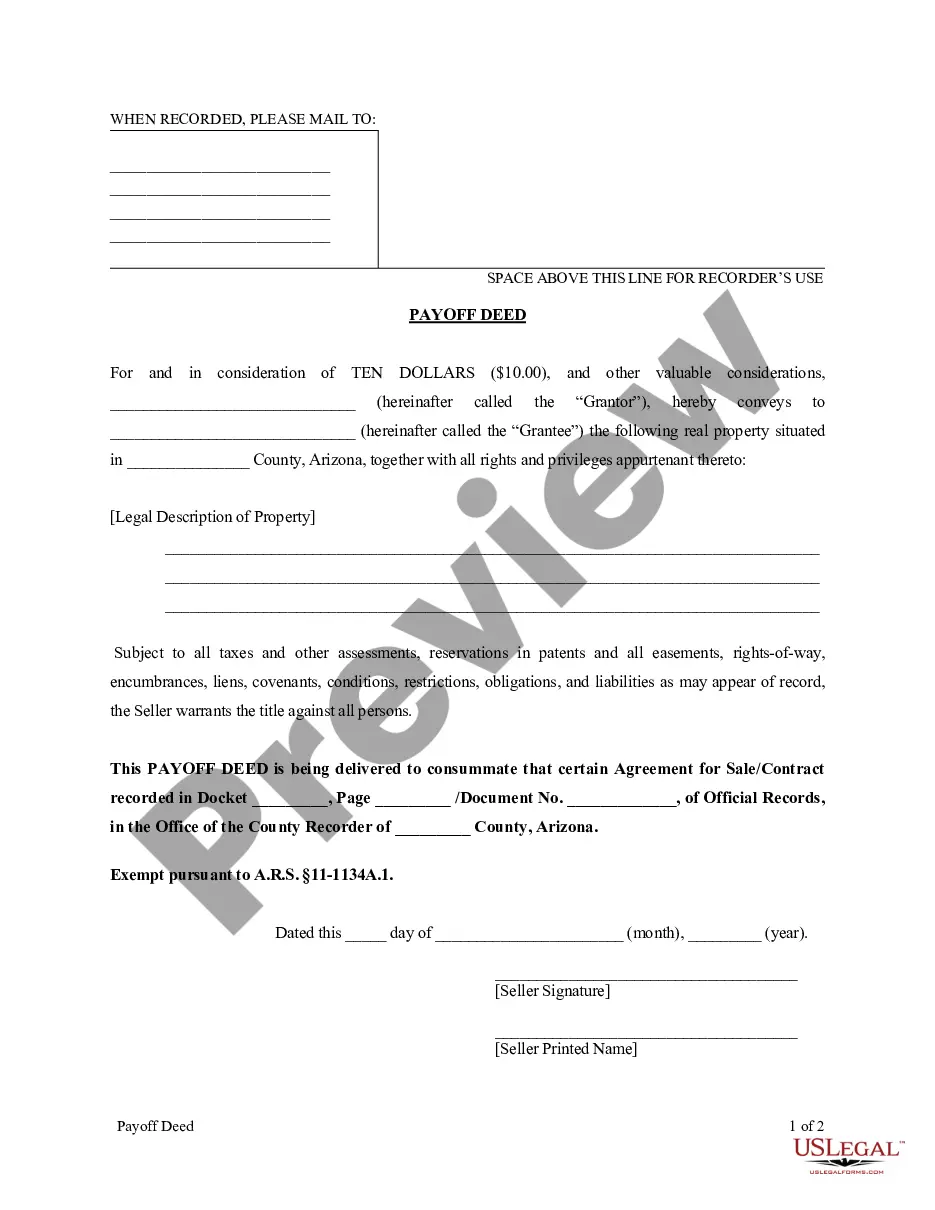

Form L-8 (Affidavit & Self-Executing Waiver) This form may be used in most cases to transfer bank accounts, stocks, bonds and brokerage accounts, when the transfer or release is to a Class "A" beneficiary.

Determining the tax-free portion of a pension The dollar amount is determined by dividing the total amount of your previously taxed contributions (you can find this amount on your IMRF Certificate of Benefits) by the number of pension payments you can expect to receive.

As a general rule all income paid to individuals is subject to taxation, unless a U.S. Internal Revenue Services (IRS) ruling (usually an associated form to file) allows partial or full exemption from income tax withholding.

Form 0-1 is a waiver" that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent. New Jersey property (such as real estate located in NJ, NJ bank and brokerage accounts, stocks of companies incorporated in NJ, and NJ bonds, etc.)