Title: New Jersey Memorandum to Stop Direct Deposit: A Detailed Overview Description: In this article, we will provide a comprehensive description of the New Jersey Memorandum to Stop Direct Deposit, outlining its purpose, significance, and various types. This memorandum plays a crucial role in allowing individuals to halt automatic direct deposit transactions in the state of New Jersey. Keywords: New Jersey, Memorandum, Stop Direct Deposit, Types, Automatic Transactions 1. What is the New Jersey Memorandum to Stop Direct Deposit? The New Jersey Memorandum to Stop Direct Deposit is a legal document that enables individuals to suspend or terminate automatic direct deposit transactions within the state. This vital mechanism grants New Jersey residents the ability to control their financial transactions effectively. 2. Purpose and Significance: The purpose of the New Jersey Memorandum to Stop Direct Deposit is to empower individuals by providing them with a means to halt unwanted or inaccurate automated direct deposit transactions. This memorandum ensures greater control over one's financial affairs, protects against fraud or unauthorized transactions, and allows for swift resolutions in case of disputes. 3. Types of New Jersey Memorandum to Stop Direct Deposit: a) Temporary Stop Direct Deposit: This type of memorandum allows individuals to put a temporary pause on their direct deposit transactions for a specified period. It could be useful in situations such as changing banks, resolving account discrepancies, or preventing fraudulent activities temporarily. b) Permanent Stop Direct Deposit: With this type of memorandum, individuals can permanently disable direct deposit transactions. It is commonly utilized when changing payroll methods or transitioning to other preferred payment methods like live checks or online payment services. c) Specific Transaction Stop Direct Deposit: This type of memorandum allows individuals to block specific direct deposit transactions, addressing concerns like suspected unauthorized withdrawals or recurring payments for services no longer required. It offers precise control over which transactions are stopped while others continue uninterrupted. d) Complete Stop Direct Deposit: This type of memorandum completely stops all direct deposit transactions, eliminating any future automatic fund transfers. Individuals may opt for this option when switching to non-electronic payment methods entirely or when personal circumstances require discontinued automated transfers. 4. Process to Submit New Jersey Memorandum to Stop Direct Deposit: To initiate the New Jersey Memorandum to Stop Direct Deposit process, individuals must follow specific guidelines set by financial institutions or employers. Typically, one needs to: a) Obtain the official New Jersey Memorandum to Stop Direct Deposit form b) Fill out the required information accurately, including banking details and specific instructions c) Sign the form and provide any supporting documents if requested d) Submit the completed form to the relevant financial institution, employer, or designated authority e) Confirm the successful implementation of the memorandum and monitor account statements to ensure compliance. In conclusion, the New Jersey Memorandum to Stop Direct Deposit serves as a crucial legal instrument, offering individuals in New Jersey the power to control and stop automated direct deposit transactions. The memorandum's various types cater to different situations, ensuring flexibility and accuracy in managing one's financial affairs.

New Jersey Memorandum to Stop Direct Deposit

Description

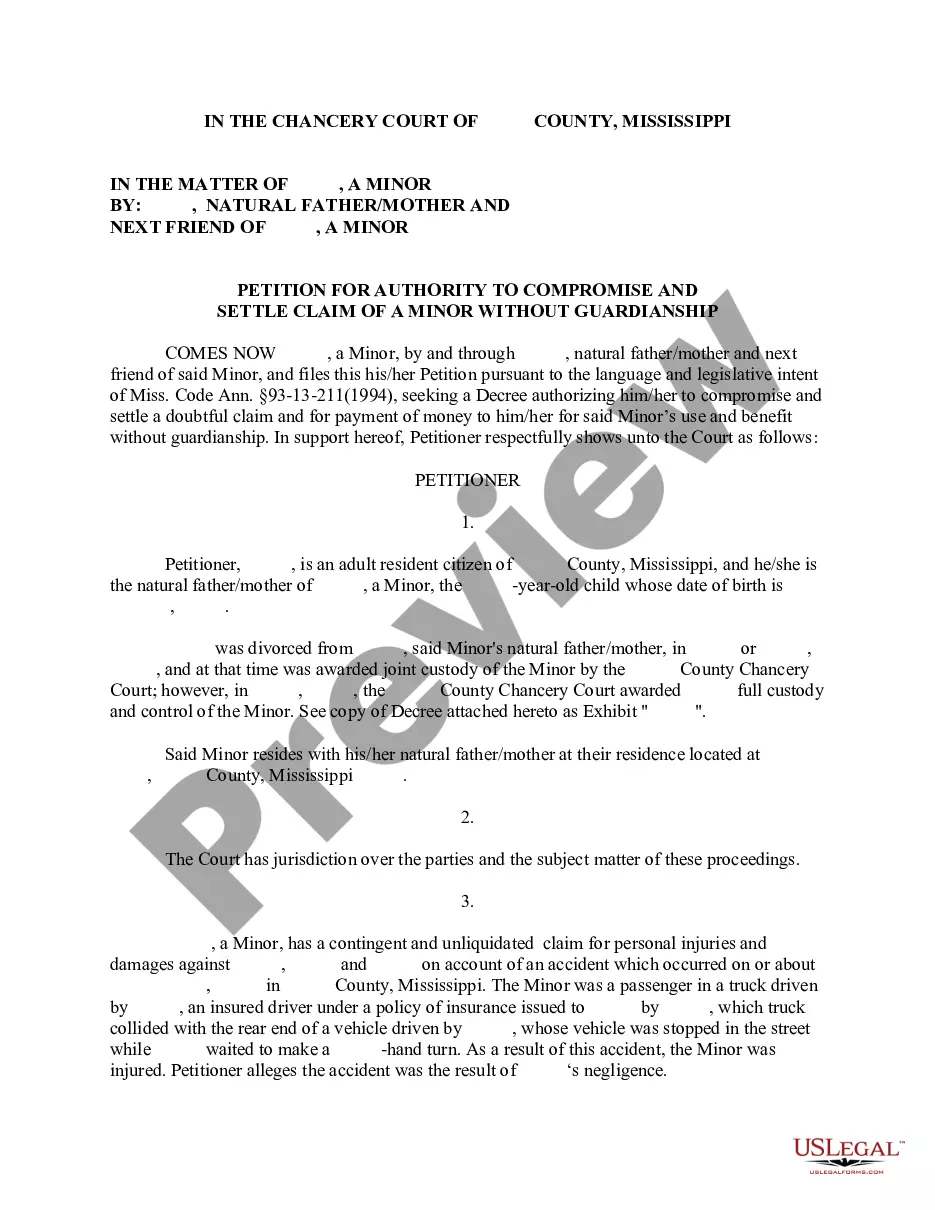

How to fill out New Jersey Memorandum To Stop Direct Deposit?

US Legal Forms - one of many greatest libraries of legitimate varieties in the USA - offers a wide range of legitimate file templates you can obtain or printing. While using internet site, you can find thousands of varieties for business and personal uses, categorized by groups, states, or key phrases.You will discover the most recent versions of varieties just like the New Jersey Memorandum to Stop Direct Deposit in seconds.

If you already have a registration, log in and obtain New Jersey Memorandum to Stop Direct Deposit through the US Legal Forms local library. The Download option will appear on each and every type you see. You have accessibility to all earlier acquired varieties in the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, allow me to share straightforward directions to obtain started off:

- Be sure to have chosen the proper type for your personal metropolis/state. Go through the Preview option to analyze the form`s information. Read the type description to actually have selected the appropriate type.

- In the event the type does not fit your needs, use the Search industry towards the top of the screen to obtain the one who does.

- Should you be pleased with the shape, affirm your decision by clicking the Purchase now option. Then, opt for the rates strategy you prefer and provide your accreditations to register for the profile.

- Procedure the purchase. Make use of credit card or PayPal profile to complete the purchase.

- Pick the structure and obtain the shape on your device.

- Make adjustments. Fill up, modify and printing and indicator the acquired New Jersey Memorandum to Stop Direct Deposit.

Every web template you included in your money does not have an expiry day and is your own forever. So, if you want to obtain or printing one more copy, just proceed to the My Forms segment and then click in the type you require.

Gain access to the New Jersey Memorandum to Stop Direct Deposit with US Legal Forms, one of the most considerable local library of legitimate file templates. Use thousands of professional and express-specific templates that satisfy your business or personal needs and needs.

Form popularity

FAQ

Fill in first page of the form, and click "Next." Select Trouble Creating an Account (Password Reset)" to submit a request to reset your password. After we review your request, we will email instructions so you can reset your password and/or security questions.

You must log in with your NY.gov ID and click on Unemployment Benefits to cancel or change your direct deposit information. The direct deposit system is available: Monday through Friday, am until midnight.

The easiest way to start or change direct deposit is to contact your employer's HR or payroll department, which will have you fill out a direct deposit authorization form. This form will ask for basic information that you can find in the welcome kit from your new bank: Name of bank or credit union. Routing number.

Call a Reemployment Call CenterNorth New Jersey: 201-601-4100.Central New Jersey: 732-761-2020.South New Jersey: 856-507-2340.Out-of-state claims: 888-795-6672 (you must call from a phone with an out-of-state area code)New Jersey Relay: 7-1-1.

The process required to change direct deposit can be cumbersome. They would need to contact your HR department and fill out a form with the credentials of their new institution, authorizing the new bank to receive the direct deposit. This process can take two-to-four weeks, or one-to-two pay cycles.

Log in to your account and choose "Update Direct Deposit" from the "Manage My Claim" section of the dashboard.

If you want to change the account where your support payments are being directly deposited you must complete a DIRECT DEPOSIT AUTHORIZATION form and check the box for a CHANGE in direct deposit. You may print the form from this website or you may receive a copy of the form by contacting 1-877-NJKIDS1 (1-877-655-4371).

Contact Bank of America if you are having your funds deposited onto a prepaid debit card. Customer service can be reached at 866-213-4074. You can also check the balance on your card by going to a local branch office or through an ATM machine.

Click on Unemployment Services. Click on Update Your Personal Information. Click on Update/Register for Direct Deposit.