New Jersey Resolution of Meeting of LLC Members to Borrow Money

Description

How to fill out Resolution Of Meeting Of LLC Members To Borrow Money?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal uses, organized by categories, states, or keywords.

You can find the latest versions of forms like the New Jersey Resolution of Meeting of LLC Members to Borrow Money in moments.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- If you possess a membership, sign in and download the New Jersey Resolution of Meeting of LLC Members to Borrow Money from the US Legal Forms library.

- The Download option will be displayed on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have chosen the appropriate form for your area/region.

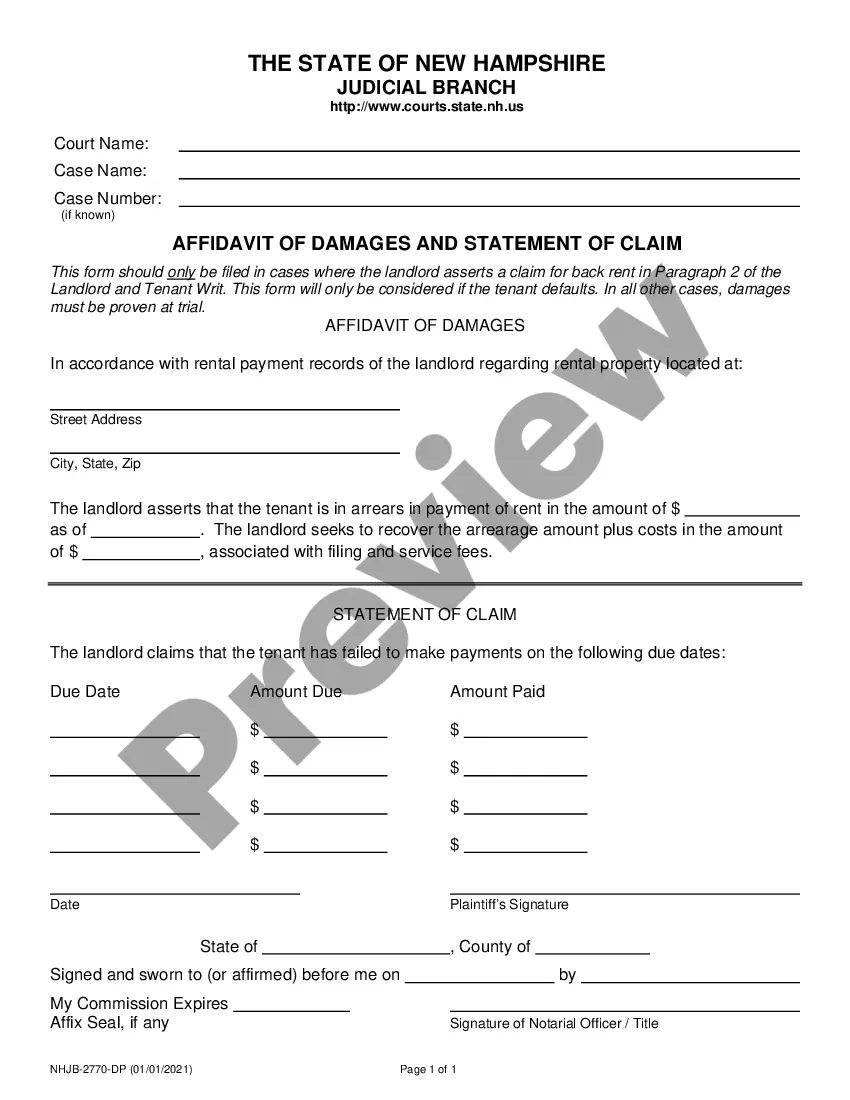

- Click the Preview button to review the content of the form.

Form popularity

FAQ

The resolution of borrowing is a specific document that details the authority granted to an LLC to secure funds via loans. This resolution must clearly articulate the terms agreed upon by the members during their meeting. In New Jersey, it ensures compliance with state regulations regarding borrowing. It is essential for transparency and to maintain trust among members.

To properly write a New Jersey Resolution of Meeting of LLC Members to Borrow Money, start by clearly stating the purpose of the meeting. Include details like the date, time, and location of the meeting, along with the members present. Specify the amount of money being borrowed and the purpose for which it will be used. Finally, ensure all members sign the resolution to validate it.

A resolution to authorize borrowing formally permits an LLC to acquire funds, typically outlined in a meeting among its members. This resolution serves as a protective measure, affirming that all financial decisions align with the company's goals. In the context of the New Jersey Resolution of Meeting of LLC Members to Borrow Money, this document must be documented accurately to present to lenders. Utilizing uslegalforms can assist in drafting this resolution correctly, ensuring compliance and clarity.

To write a written resolution, start by stating the purpose clearly, specifying the decision being made, such as borrowing money. Include relevant details like the amount to be borrowed and the rationale for the decision. Ensure all members of the LLC have the opportunity to review and sign the document, reflecting the New Jersey Resolution of Meeting of LLC Members to Borrow Money process. Using platforms like uslegalforms can simplify this process with templates and guidance.

A board resolution to borrow signifies the formal decision made by the members of an LLC to obtain funds from a lender. This document outlines the terms of the borrowing, including the amount and repayment provisions. In New Jersey, this resolution must reflect the consensus of the members during a meeting to ensure legal compliance. Understanding the New Jersey Resolution of Meeting of LLC Members to Borrow Money is crucial for any LLC seeking financing.

A resolution to borrow from an LLC is a formal authorization allowing the LLC to take on debt or secure loans. This resolution serves as a record that outlines the members' consent to borrow funds and the terms associated with this decision. When preparing a New Jersey Resolution of Meeting of LLC Members to Borrow Money, ensure it includes all relevant details to safeguard your business interests.

The resolution of members of an LLC is a formal document that expresses the collective decisions made by the members regarding business operations. This document may include approvals for borrowing, changes in management, or adjustments to business strategies. When focusing on a New Jersey Resolution of Meeting of LLC Members to Borrow Money, it is pivotal that this resolution reflects the members' consensus on financial actions.

Writing a resolution to borrow requires clear articulation of the decision-making process and approval from LLC members. Start by stating the purpose of the borrowing, detailing the amount, and outlining repayment terms. For assistance, consider utilizing resources like uslegalforms to craft a New Jersey Resolution of Meeting of LLC Members to Borrow Money that meets legal requirements and best practices.

A borrowing resolution is a formal agreement that authorizes an LLC or corporation to secure financing through loans. This resolution outlines the terms and conditions of borrowing and ensures that the transaction complies with legal standards. By creating a New Jersey Resolution of Meeting of LLC Members to Borrow Money, you take crucial steps toward responsible financial management for your business.

A resolution for an LLC manager refers to the document that details decisions made by the manager on behalf of the LLC. This resolution can authorize actions such as borrowing money or entering into contracts. In the context of a New Jersey Resolution of Meeting of LLC Members to Borrow Money, it signifies the support of members for the financial decisions taken by the manager.