New Jersey Exempt Survey

Description

How to fill out Exempt Survey?

It is feasible to spend hours online trying to locate the valid document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can readily obtain or print the New Jersey Exempt Survey from our platform.

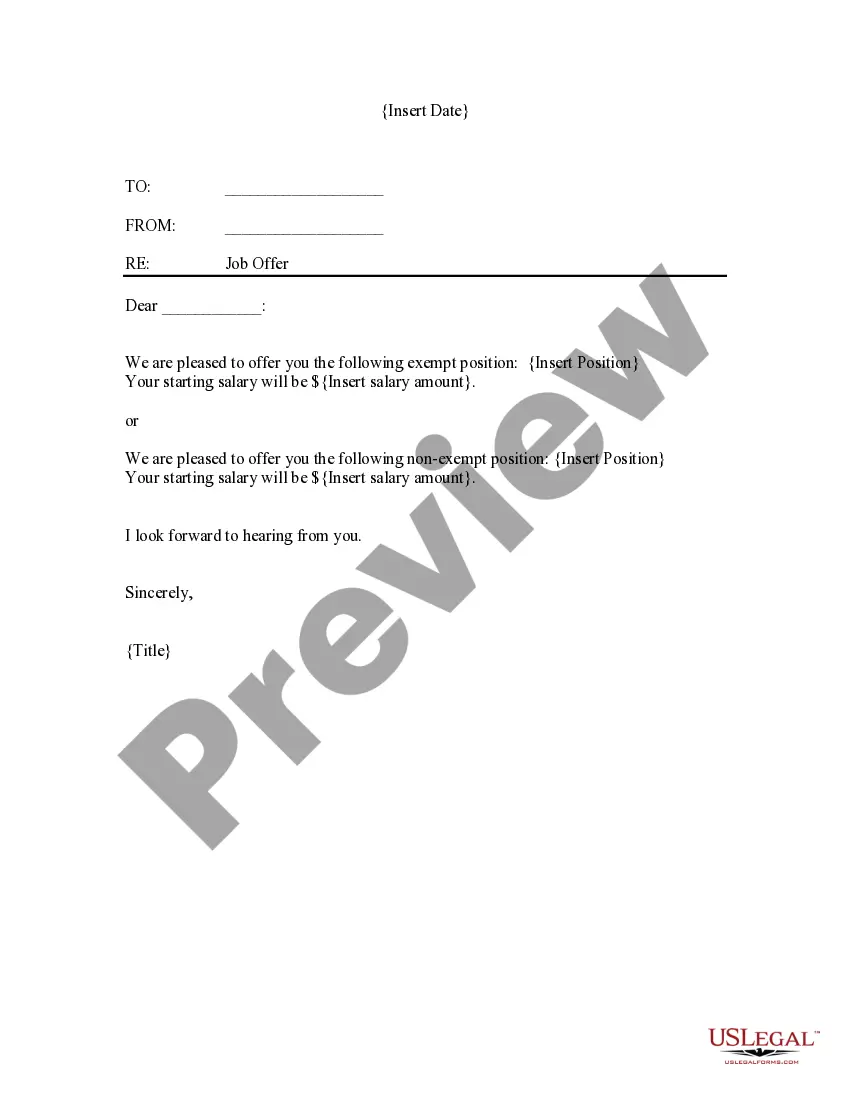

If available, make use of the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download option.

- Subsequently, you can complete, edit, print, or sign the New Jersey Exempt Survey.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding option.

- If you are accessing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your selected state/city.

- Review the form description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

To obtain an ST5 form in New Jersey, visit the official state website or contact your local tax office. The ST5 form is essential for claiming further tax exemptions, and the New Jersey Exempt Survey is a useful tool in this process. Ensure you have all necessary documentation on hand to facilitate your request. After obtaining the form, fill it out and submit it according to the guidelines provided.

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

If you Wish to Use a New Jersey Resale CertificateNew Jersey has two separate resale certificates, here are the links to both: Form ST-3 Resale Certificate for in-state sellers. Form ST-3NR Resale Certificate for Non-New Jersey sellers.

Sellers are not required to accept resale certificates, however, most do. If the vendor doesn't accept the certificate, the buyer will have to pay sales tax on the merchandise being purchased. In most cases, a credit is available when filing the New Jersey sales tax return.

ST-3 (3-17) The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. State of New Jersey. Division of Taxation. SALES TAX.

A seller must be registered with New Jersey to accept exemption certificates. A Public Records Filing may also be required depending upon the type of business ownership.

Form ST-4 makes it possible for businesses to purchase production machinery, packaging supplies, and other goods or services without paying Sales Tax if the way they intend to use these items is specifically exempt under New Jersey law.

Exempt items include most food sold as grocery items, most clothing and footwear, disposable paper products for household use, prescription drugs, and over-the-counter drugs.

Agencies of the federal government and the United Nations as well as the State of New Jersey and its political subdivisions are exempt from paying Sales Tax provided the agency making the purchase supplies the seller with a copy of a valid purchase order or contract signed by an authorized official.