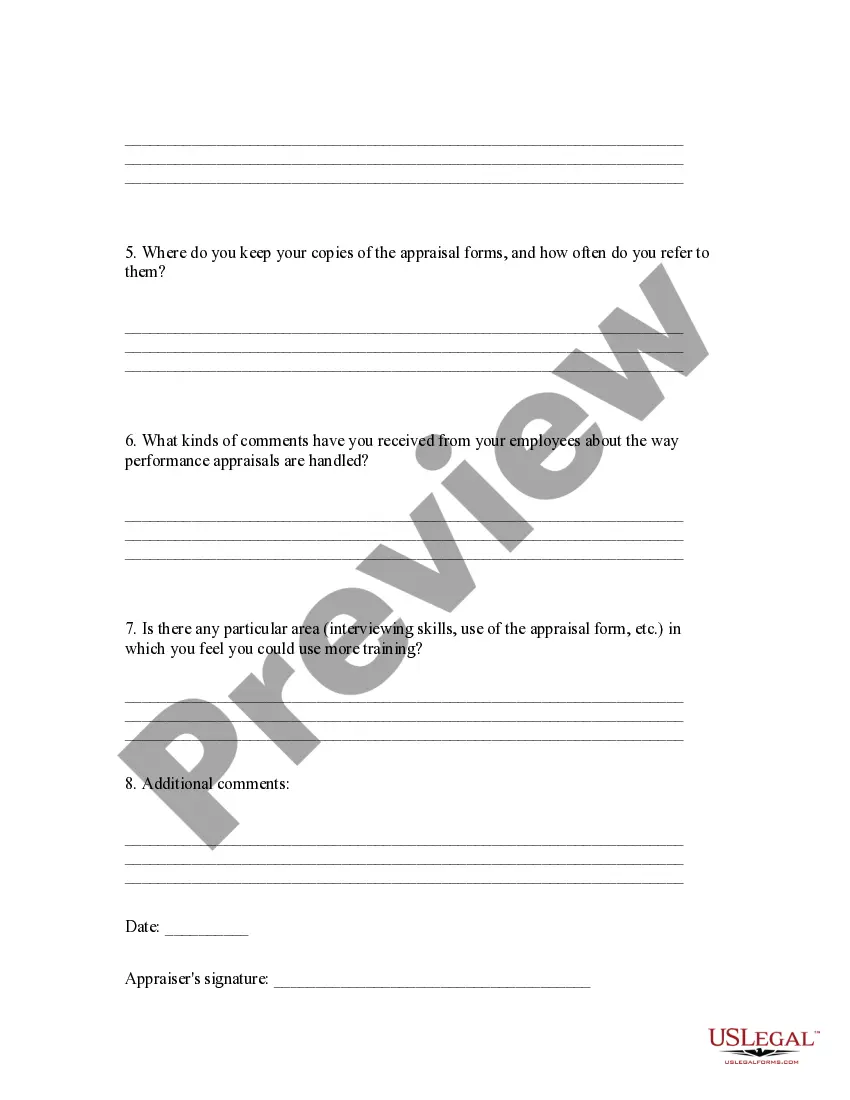

New Jersey Appraisal System Evaluation Form

Description

How to fill out Appraisal System Evaluation Form?

Selecting the ideal legal document template can be somewhat challenging. Of course, there are numerous templates available online, but how can you find the legal document you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Jersey Appraisal System Evaluation Form, which can serve both business and personal purposes. All documents are verified by professionals and comply with state and federal regulations.

If you are already registered, Log Into your account and click the Download button to access the New Jersey Appraisal System Evaluation Form. Use your account to search for the legal documents you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you seek.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired New Jersey Appraisal System Evaluation Form. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Utilize the service to obtain professionally created documents that adhere to state guidelines.

- First, ensure you have selected the appropriate form for your city/county.

- You can review the document using the Review button and read the document description to confirm it is the correct one for you.

- If the document does not meet your requirements, use the Search section to find the correct form.

- Once you are confident that the document is suitable, click the Get Now button to obtain the document.

- Choose the pricing option you prefer and provide the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

The four forms of appraisal include self-appraisal, peer appraisal, 360-degree feedback, and manager appraisal. Each of these methods provides unique insights into employee performance and can be tailored to fit specific organizational needs. When utilizing the New Jersey Appraisal System Evaluation Form, businesses can select the most suitable appraisal format to foster employee development effectively.

To calculate your individual property's effective tax rate, all you have to do is divide your annual tax bill by what you estimate to be the market value of your property. So, if you own a property worth $300,000 and your annual tax bill is $10,000, then your individual effective tax rate is 3.33%.

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owner's property. The assessed value estimates the reasonable market value for your home. It is based upon prevailing local real estate market conditions.

The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. Tax expense is usually the last line item before the bottom linenet incomeon an income statement.

Examples Of Special Assessment TaxesStreets, roads and sidewalk paving. Infrastructure projects. Streetlights. Parking structures.

The equalized assessed value, or EAV, is the result of applying the state equalization factor to the assessed value of a parcel of property. Tax bills are calculated by multiplying the EAV (after any deductions for homesteads) by the tax rate.

In New Jersey, the taxable value of a home is ordinarily 100% of its "true value," which is essentially what the home would sell for on the open market. Your county tax board can adjust this percentage figure, which is also known as the assessment ratio.

A town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its taxable property. An individual's property taxes are then calculated by multiplying that general tax rate by the assessed value of his particular property.

Sales Tax Formulas/Calculations:State Tax Amount = Price x (State Tax Percentage / 100)Use Tax Amount = Price x (Use Tax Percentage / 100)Local Tax Amount = Price x (Local Tax Percentage / 100)Total = Price + State Tax Amount + Use Tax Amount + Local Tax Amount.

With knowledge of a property's assessment and the municipal equalization ratio the true assessed value or Equalized Value of a property can be calculated. This is done by dividing the total assessed value by the municipal Equalization Ratio.