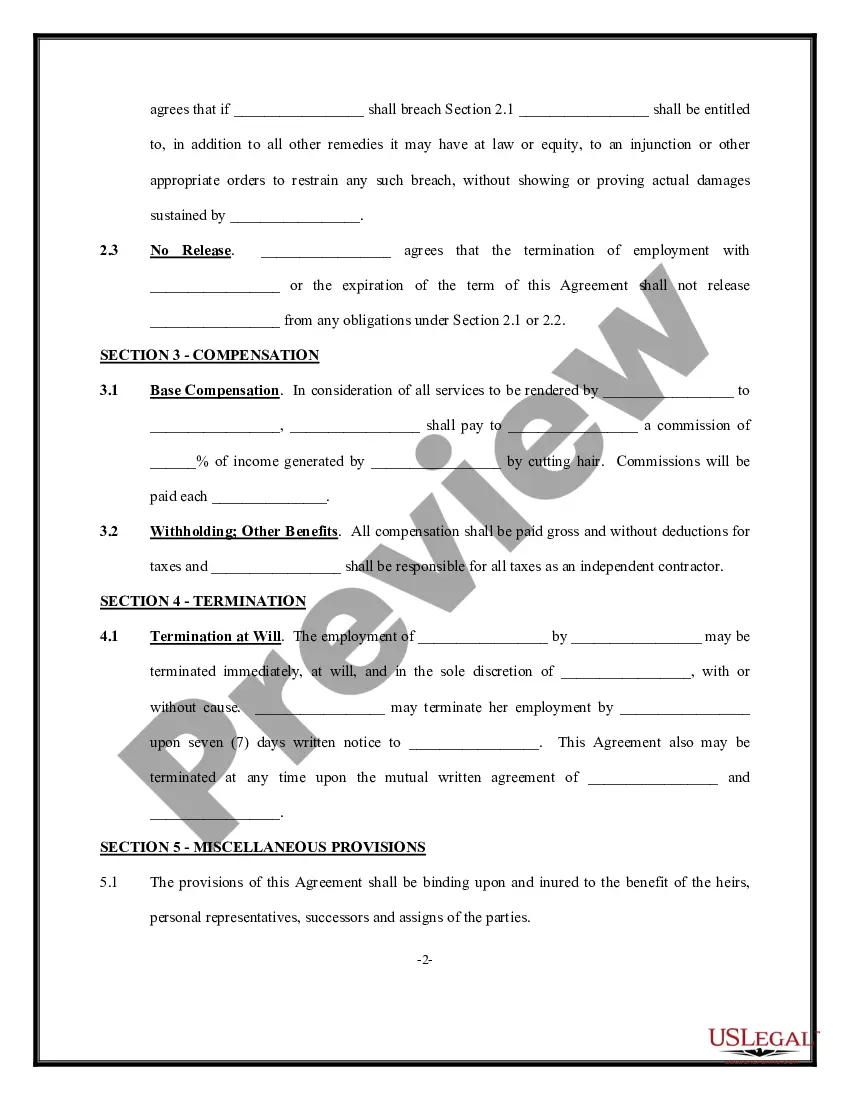

Keywords: New Jersey, Independent Contractor Agreement, Hair Stylist, types Detailed description: A New Jersey Independent Contractor Agreement for Hair Stylist is a legally binding document that outlines the terms and conditions of the working relationship between a hair stylist and a salon owner as an independent contractor. This agreement is essential to establish clarity and protect the rights and responsibilities of both parties involved. The agreement typically includes important details such as the stylist's name, address, the salon's name, and address, as well as the effective dates of the agreement. Additionally, it specifies the nature of the relationship, confirming that the stylist will work as an independent contractor, not an employee. Various types of New Jersey Independent Contractor Agreements for Hair Stylist may exist, depending on the specific terms agreed upon by the parties involved. Some common types include: 1. Basic Independent Contractor Agreement: This type of agreement typically covers the fundamental aspects of the hair stylist's services, compensation, and working hours. It outlines general expectations, such as providing hairstyling services, maintaining a clean work area, and complying with salon policies. 2. Commission-Based Independent Contractor Agreement: In this type of agreement, the stylist receives a percentage of the revenue generated from salon services. It details the commission percentage, how it is calculated, and any additional conditions related to commission payment. 3. Rental Space Agreement: This agreement is applicable when a hair stylist rents a designated space within a salon to operate their own business. It outlines the terms of rental, including the rental fee, duration, access to salon amenities, and any shared responsibilities with the salon owner. 4. Non-Compete Independent Contractor Agreement: This type of agreement restricts the stylist from working for or opening a competing salon within a defined geographical area for a specified period after termination of the agreement. It aims to protect the salon owner's business interests. It's important to note that while these are common types, each agreement can be customized to meet the specific needs of the hairstylist and the salon owner. Consulting with a legal professional experienced in New Jersey employment law is recommended to ensure the agreement is compliant, comprehensive, and fair for both parties involved.

New Jersey Independent Contractor Agreement for Hair Stylist

Description

How to fill out New Jersey Independent Contractor Agreement For Hair Stylist?

Are you currently inside a placement the place you require documents for sometimes company or person purposes nearly every working day? There are a lot of authorized record layouts available online, but locating types you can depend on is not simple. US Legal Forms offers thousands of form layouts, much like the New Jersey Independent Contractor Agreement for Hair Stylist, that are published to fulfill state and federal demands.

In case you are already informed about US Legal Forms site and get an account, simply log in. Following that, you may obtain the New Jersey Independent Contractor Agreement for Hair Stylist web template.

Unless you come with an account and need to start using US Legal Forms, adopt these measures:

- Find the form you require and ensure it is to the appropriate metropolis/region.

- Make use of the Review switch to check the form.

- Browse the description to actually have selected the appropriate form.

- If the form is not what you`re trying to find, utilize the Look for field to discover the form that suits you and demands.

- When you obtain the appropriate form, just click Buy now.

- Select the costs plan you need, fill out the desired information and facts to create your account, and pay money for the transaction making use of your PayPal or bank card.

- Pick a convenient document file format and obtain your copy.

Get each of the record layouts you possess purchased in the My Forms menu. You can get a extra copy of New Jersey Independent Contractor Agreement for Hair Stylist whenever, if necessary. Just click the needed form to obtain or print the record web template.

Use US Legal Forms, probably the most considerable selection of authorized kinds, to conserve some time and prevent mistakes. The support offers appropriately created authorized record layouts that can be used for a range of purposes. Make an account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

5 Things 1099 Employees Need to Know About TaxesYou're Responsible for Paying Quarterly Income Taxes.You're Responsible for Self-Employment Tax.Estimate How Much You'll Need to Pay.Develop a Bulletproof Savings Plan.Consider Software & Tax Pros.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

Here are eight questions you should be ready to answer about contract work:How long is the contract?What are the company and position like?What are the typical hours?Is this a temp-to-hire position?How much is the contract pay rate?Are there benefits available?How will this position help me professionally?More items...?

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.