The New Jersey Comprehensive Special Tax Notice Regarding Plan Payments is a document that provides detailed information regarding the tax implications and requirements for plan payments in the state of New Jersey. This notice is specifically designed to inform individuals who are part of comprehensive special tax plans about their obligations and rights concerning plan payments. Keywords: New Jersey, comprehensive special tax notice, plan payments, tax implications, tax requirements, comprehensive special tax plans, obligations, rights. The New Jersey Comprehensive Special Tax Notice Regarding Plan Payments covers various types of tax plans, including: 1. Comprehensive Special Tax Plan for Individuals: This plan is designed for individuals who have specific tax obligations in New Jersey. The notice provides instructions on how to make plan payments, including the payment schedule, accepted payment methods, and any penalties for non-compliance. 2. Comprehensive Special Tax Plan for Businesses: This plan is tailored to businesses operating in New Jersey. It outlines the tax payment requirements, such as estimated tax payments, installment agreements, and penalty provisions for non-compliance. 3. Comprehensive Special Tax Plan for Self-Employed Individuals: This plan is specifically designed for self-employed individuals who have tax obligations in New Jersey. The notice provides detailed information on how to calculate and submit plan payments, as well as the consequences of late or insufficient payments. 4. Comprehensive Special Tax Plan for Estates and Trusts: This plan focuses on tax obligations associated with estates and trusts in New Jersey. It clarifies the payment schedules, methods, and potential penalties for proper compliance. 5. Comprehensive Special Tax Plan for Non-Residents: This plan caters to individuals who are not residents of New Jersey but have income or tax obligations within the state. The notice provides guidance on how to determine the tax liability, complete the required forms, and make plan payments accordingly. The New Jersey Comprehensive Special Tax Notice Regarding Plan Payments is a crucial resource for individuals and businesses in New Jersey, ensuring compliance with tax regulations and avoiding potential penalties. It is recommended to carefully review and follow the instructions provided in the notice to fulfill tax obligations accurately and timely.

New Jersey Comprehensive Special Tax Notice Regarding Plan Payments

Description

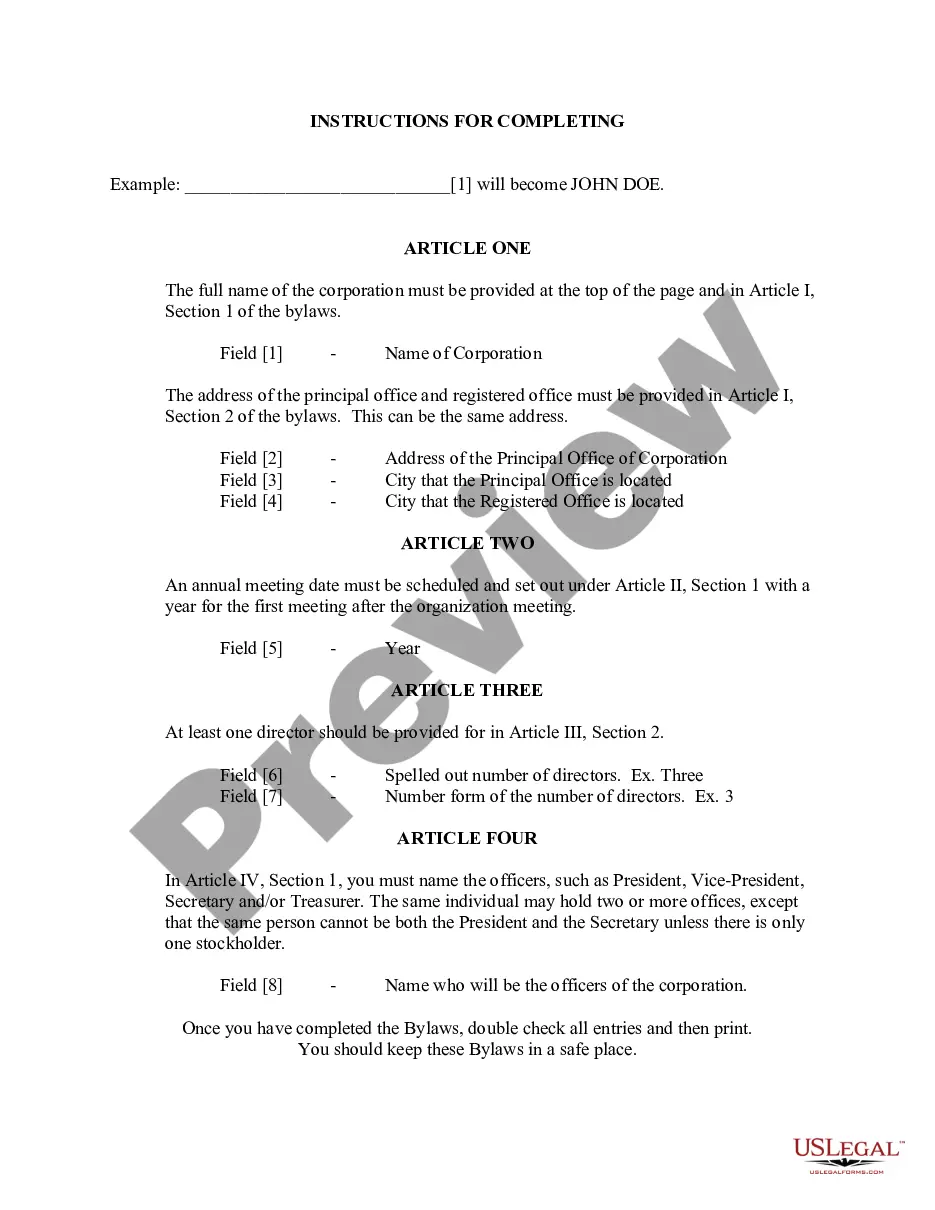

How to fill out New Jersey Comprehensive Special Tax Notice Regarding Plan Payments?

If you want to comprehensive, obtain, or print authorized document themes, use US Legal Forms, the greatest variety of authorized kinds, that can be found on-line. Utilize the site`s basic and practical research to discover the documents you require. Numerous themes for business and personal purposes are sorted by groups and states, or key phrases. Use US Legal Forms to discover the New Jersey Comprehensive Special Tax Notice Regarding Plan Payments in a number of mouse clicks.

If you are previously a US Legal Forms consumer, log in to your profile and click the Obtain button to find the New Jersey Comprehensive Special Tax Notice Regarding Plan Payments. You may also gain access to kinds you in the past downloaded inside the My Forms tab of your profile.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the shape to the right metropolis/country.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Don`t forget to read through the description.

- Step 3. If you are not satisfied with the form, make use of the Lookup field towards the top of the display to locate other models of the authorized form design.

- Step 4. When you have located the shape you require, go through the Purchase now button. Opt for the pricing strategy you favor and include your references to register for the profile.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal profile to accomplish the deal.

- Step 6. Select the structure of the authorized form and obtain it in your device.

- Step 7. Complete, edit and print or signal the New Jersey Comprehensive Special Tax Notice Regarding Plan Payments.

Every single authorized document design you purchase is your own property for a long time. You may have acces to every single form you downloaded inside your acccount. Click on the My Forms portion and select a form to print or obtain once more.

Compete and obtain, and print the New Jersey Comprehensive Special Tax Notice Regarding Plan Payments with US Legal Forms. There are many skilled and status-specific kinds you can use for your business or personal demands.

Form popularity

FAQ

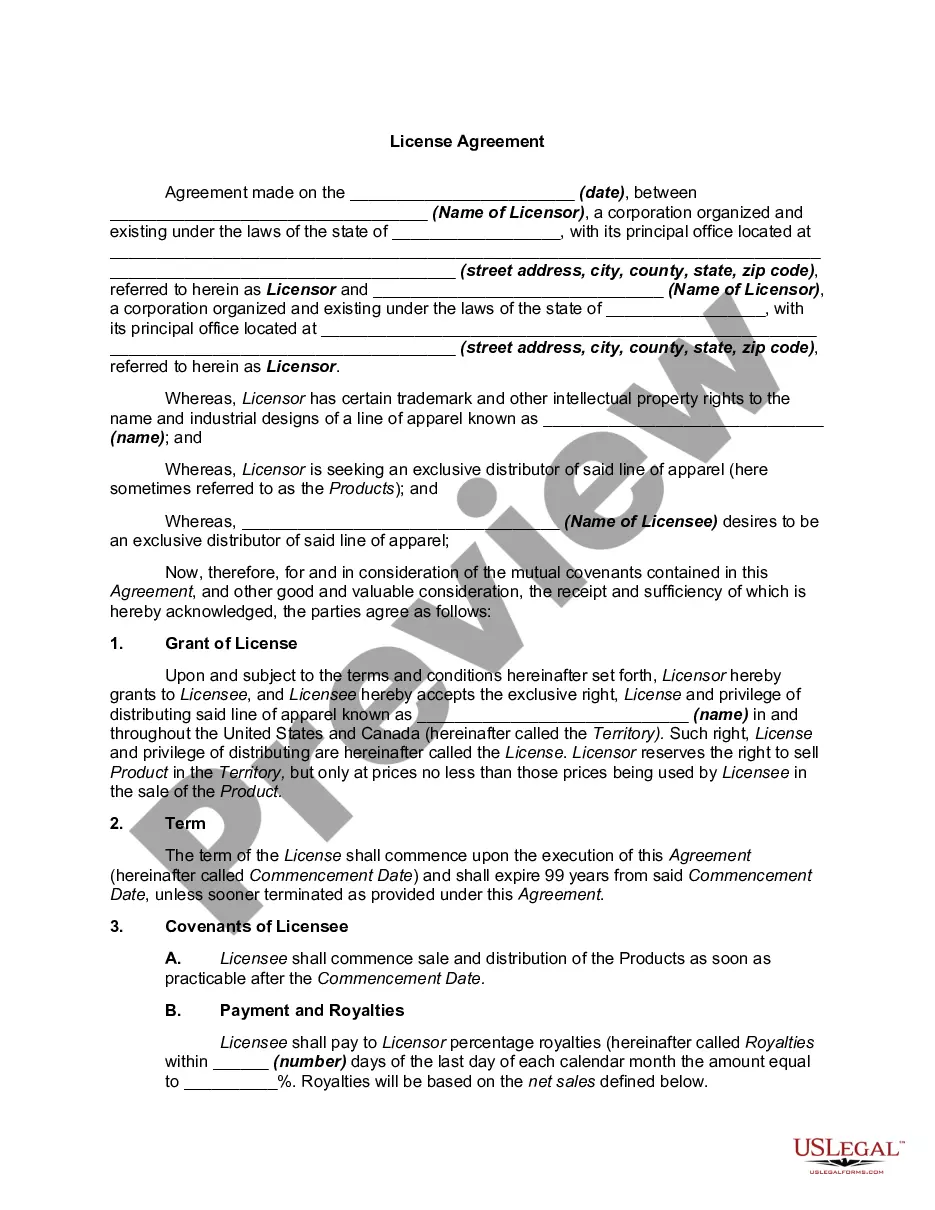

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

Part of the rationale for the special tax treatment on long-term capital gains, is to act as an incentive and reward for risking capital. To repeal or diminish this special treatment would serve as a penalty for taking risks.

Under the special rule, the net unrealized appreciation on the stock included in the earnings in the payment will not be taxed when distributed to you from the Plan and will be taxed at capital gain rates when you sell the stock.

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

Special Exclusion. This exclusion is for taxpayers who cannot receive Social Security or Railroad Retirement benefits. Since most taxpayers qualify for those benefits, few taxpayers are eligible to use the special exclusion. If you qualify, you can claim this benefit even if you used your maximum pension exclusion.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).