Title: New Jersey Worksheet Analyzing a Self-Employed Independent Contractor — A Comprehensive Guide Introduction: In the state of New Jersey, understanding the intricacies of self-employment as an independent contractor is crucial. To help individuals navigate through the legal requirements and tax obligations, the New Jersey Worksheet Analyzing a Self-Employed Independent Contractor serves as an essential tool. This detailed worksheet assists in evaluating various aspects of self-employment, ensuring compliance with state regulations. Let’s explore the different types and key components of this valuable resource. 1. New Jersey Worksheet Analyzing Self-Employed Independent Contractor for Tax Purposes: This type of worksheet primarily focuses on assessing tax obligations and responsibilities associated with self-employment in New Jersey. It helps independent contractors analyze their income, deductions, and determine whether they qualify for specific tax incentives or credits provided by the state. 2. New Jersey Worksheet Analyzing Self-Employed Independent Contractor for Classification: The classification worksheet aims to assist independent contractors in determining their employment status. New Jersey law strictly defines who qualifies as an independent contractor, distinguishing them from regular employees. This worksheet provides a systematic approach for individuals to analyze their work relationship elements and ascertain their proper classification. 3. New Jersey Worksheet Analyzing Self-Employed Independent Contractor for Unemployment and Disability Insurance: Independent contractors in New Jersey may have different obligations when it comes to unemployment and disability insurance. This worksheet guides contractors in evaluating whether they meet the criteria for these insurance programs, helping them understand their eligibility and subsequent contribution requirements. 4. New Jersey Worksheet Analyzing Self-Employed Independent Contractor for Workers' Compensation: Workers' compensation insurance can be a complex aspect for self-employed independent contractors. This worksheet aids contractors in assessing their status under New Jersey law, determining whether they need to obtain workers' compensation coverage or are exempt based on certain criteria. 5. New Jersey Worksheet Analyzing Self-Employed Independent Contractor for Business Licensing: Certain self-employed contractors in New Jersey might require specific licenses or permits operating legally. This worksheet assists in analyzing whether the nature of their work necessitates obtaining any business licenses or permits mandated by state or local authorities. Conclusion: The New Jersey Worksheet Analyzing a Self-Employed Independent Contractor is a valuable resource that covers various aspects of self-employment in the state. Whether for tax evaluation, classification determination, insurance obligations, or licensing requirements, this comprehensive worksheet provides clear guidance to independent contractors. By utilizing this tool, individuals can ensure compliance with applicable New Jersey regulations, minimize legal risks, and manage their self-employment affairs more effectively.

New Jersey Worksheet Analyzing a Self-Employed Independent Contractor

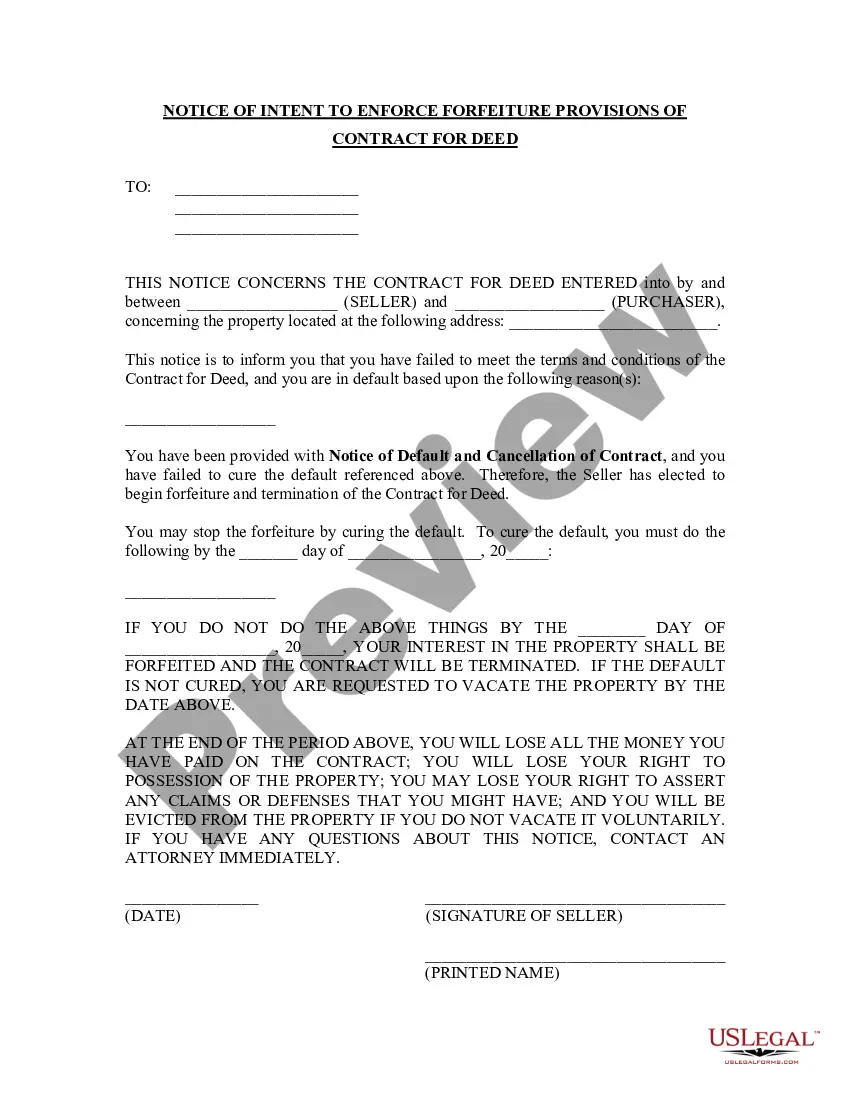

Description

How to fill out New Jersey Worksheet Analyzing A Self-Employed Independent Contractor?

Finding the right legitimate record web template can be quite a have a problem. Naturally, there are plenty of themes available on the net, but how do you get the legitimate develop you want? Make use of the US Legal Forms website. The assistance provides a huge number of themes, including the New Jersey Worksheet Analyzing a Self-Employed Independent Contractor, which can be used for company and private requires. Every one of the forms are examined by professionals and fulfill state and federal demands.

In case you are already listed, log in for your bank account and click the Acquire switch to obtain the New Jersey Worksheet Analyzing a Self-Employed Independent Contractor. Make use of bank account to look through the legitimate forms you have ordered earlier. Visit the My Forms tab of your bank account and acquire one more backup of the record you want.

In case you are a fresh user of US Legal Forms, here are simple recommendations for you to stick to:

- Initial, be sure you have chosen the correct develop to your metropolis/state. It is possible to examine the form making use of the Preview switch and browse the form description to make sure it is the right one for you.

- In case the develop does not fulfill your expectations, use the Seach industry to obtain the appropriate develop.

- Once you are sure that the form would work, go through the Buy now switch to obtain the develop.

- Select the pricing prepare you need and enter the necessary details. Make your bank account and buy the order utilizing your PayPal bank account or Visa or Mastercard.

- Choose the document structure and obtain the legitimate record web template for your gadget.

- Full, change and print and signal the obtained New Jersey Worksheet Analyzing a Self-Employed Independent Contractor.

US Legal Forms is the greatest local library of legitimate forms where you can see different record themes. Make use of the service to obtain appropriately-created files that stick to state demands.