New Jersey Employee Evaluation Form for Nonprofit

Description

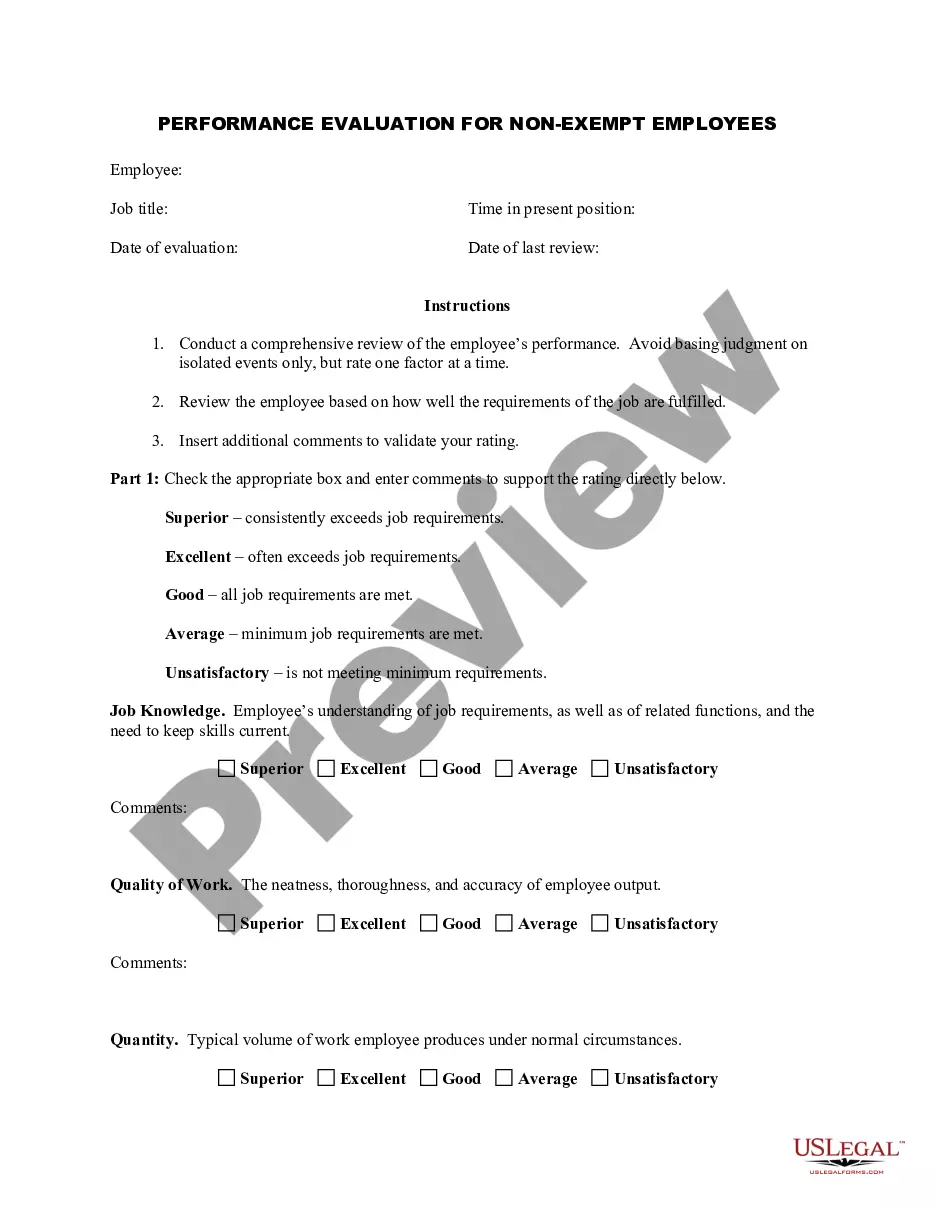

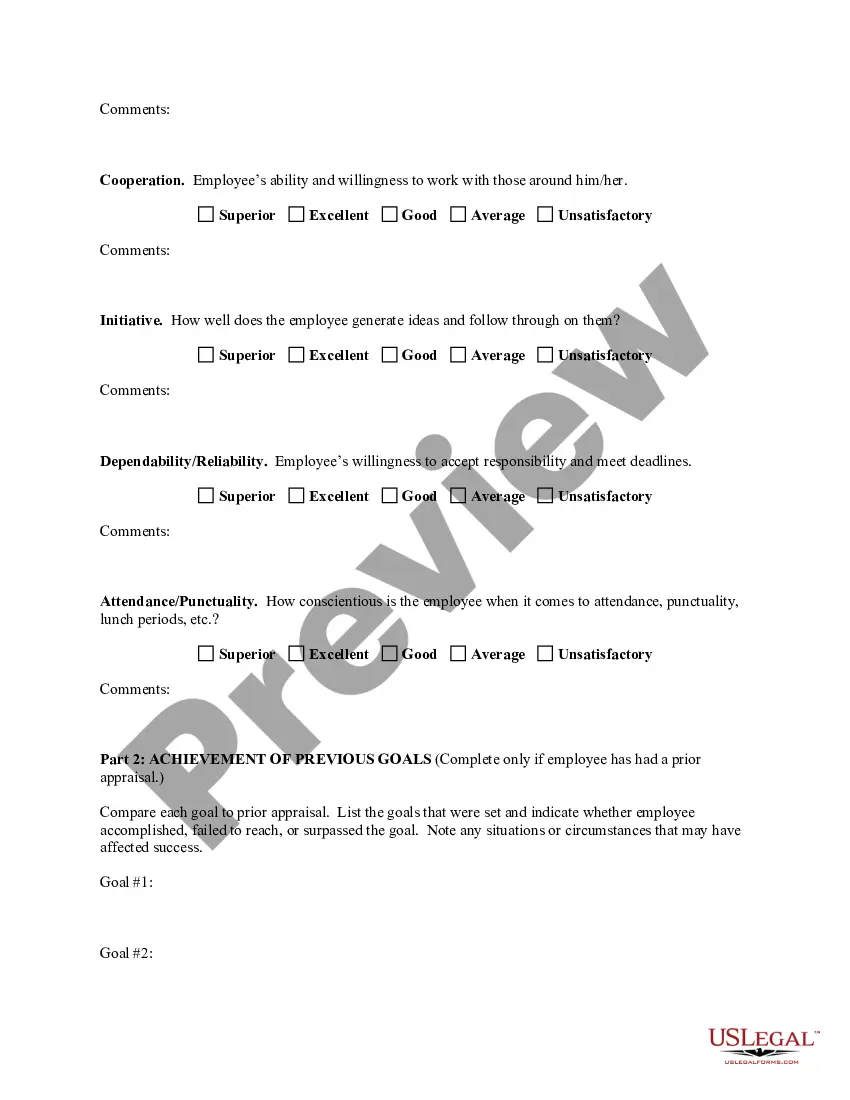

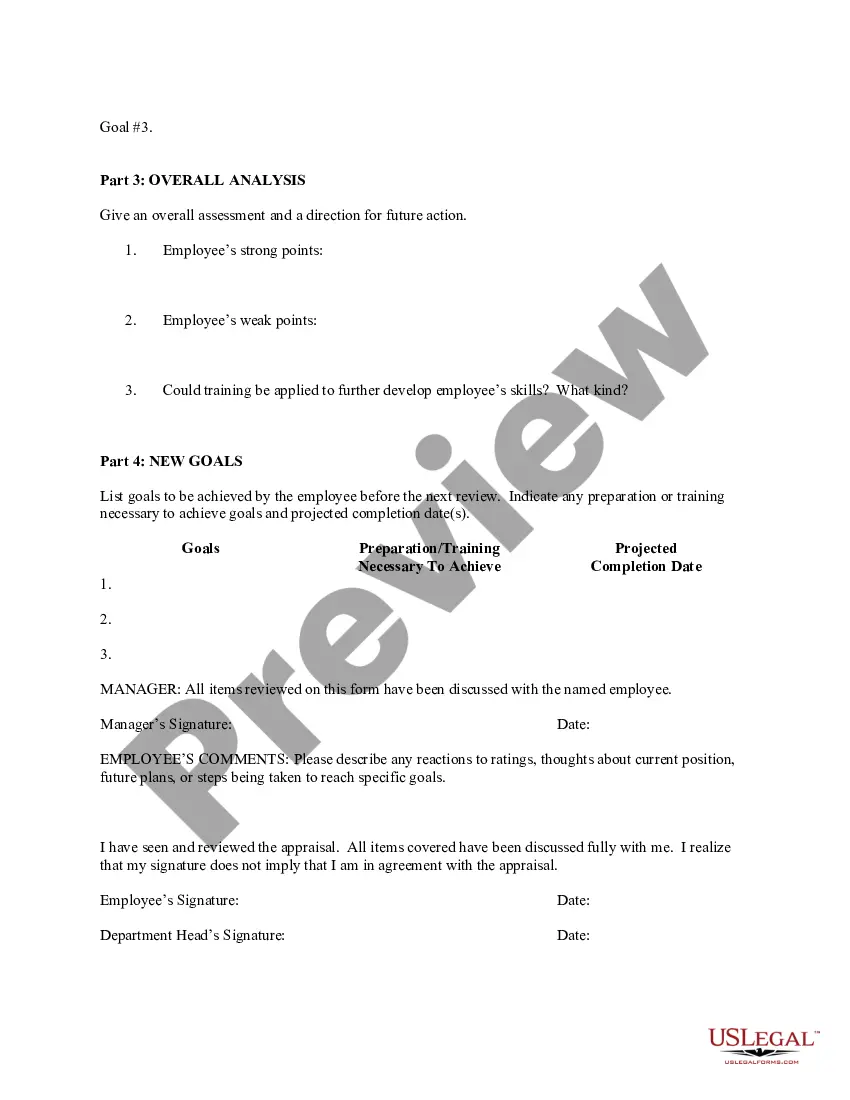

How to fill out New Jersey Employee Evaluation Form For Nonprofit?

If you have to comprehensive, acquire, or produce authorized file templates, use US Legal Forms, the biggest variety of authorized varieties, which can be found on the Internet. Use the site`s easy and convenient search to get the papers you will need. Various templates for company and individual functions are sorted by types and suggests, or key phrases. Use US Legal Forms to get the New Jersey Employee Evaluation Form for Nonprofit within a number of clicks.

If you are currently a US Legal Forms consumer, log in in your accounts and then click the Download switch to get the New Jersey Employee Evaluation Form for Nonprofit. You may also entry varieties you formerly acquired within the My Forms tab of the accounts.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have selected the shape for your right town/nation.

- Step 2. Utilize the Review solution to look through the form`s content. Do not forget to see the outline.

- Step 3. If you are not satisfied with the type, make use of the Lookup discipline at the top of the display screen to find other models of your authorized type template.

- Step 4. Once you have identified the shape you will need, click on the Purchase now switch. Pick the pricing plan you choose and include your accreditations to sign up to have an accounts.

- Step 5. Method the financial transaction. You should use your bank card or PayPal accounts to perform the financial transaction.

- Step 6. Select the structure of your authorized type and acquire it on the device.

- Step 7. Comprehensive, revise and produce or indicator the New Jersey Employee Evaluation Form for Nonprofit.

Every authorized file template you purchase is yours forever. You possess acces to each type you acquired in your acccount. Click on the My Forms section and select a type to produce or acquire again.

Contend and acquire, and produce the New Jersey Employee Evaluation Form for Nonprofit with US Legal Forms. There are thousands of expert and condition-distinct varieties you can use to your company or individual needs.

Form popularity

FAQ

What is Form ST-8? The Form ST-8 (certificate of exempt capital improvements) is to be used when the association is undertaking a capital improvement that is exempt from NJ sales tax.

ST-3 (3-17) The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. State of New Jersey. Division of Taxation. SALES TAX.

Most tax-exempt organizations that have gross receipts of at least $200,000 or assets worth at least $500,000 must file Form 990 on an annual basis. Some organizations, such as political organizations, churches and other religious organizations, are exempt from filing an annual Form 990.

Form ST-4 makes it possible for businesses to purchase production machinery, packaging supplies, and other goods or services without paying Sales Tax if the way they intend to use these items is specifically exempt under New Jersey law.

Even though nonprofits are exempt from income tax and not subject to withholding taxes, you must fill out and issue Form W-9 to the requesting business entities. In fact, all nonprofits must submit this form in order to be eligible for the tax-exempt status.

Websites like Economic Research Institute, and Pro Publica have free search tools to access 990s. Websites of the Secretary of State or Attorney General where the organization is incorporated. Some states may make 990s and other public documents available online or upon individual request.

Evaluations should include input from program participants and should monitor the satisfaction of participants. They should be candid and should be used by leadership to strengthen the organization's effectiveness, and, when necessary, be used to make programmatic changes.

Organizations seeking exemption from New Jersey Sales and Use Tax must complete all steps of the REG-1E application. You must also provide all pertinent information and supporting documentation to avoid a delay or the denial of your exemp- tion certificate request. The Division may require additional documentation.

Form 990 is the IRS' primary tool for gathering information about tax-exempt organizations, educating organizations about tax law requirements and promoting compliance. Organizations also use the Form 990 to share information with the public about their programs.

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.