New Jersey Employee Evaluation Form for Accountant

Description

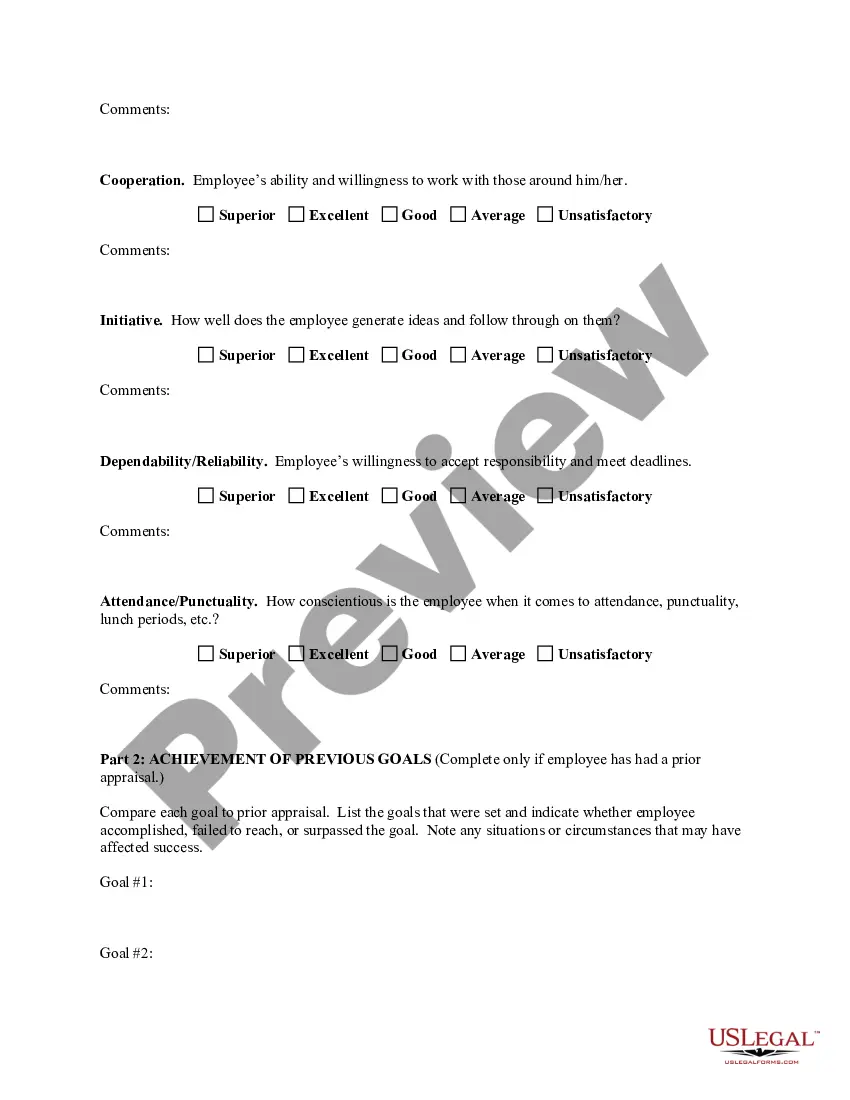

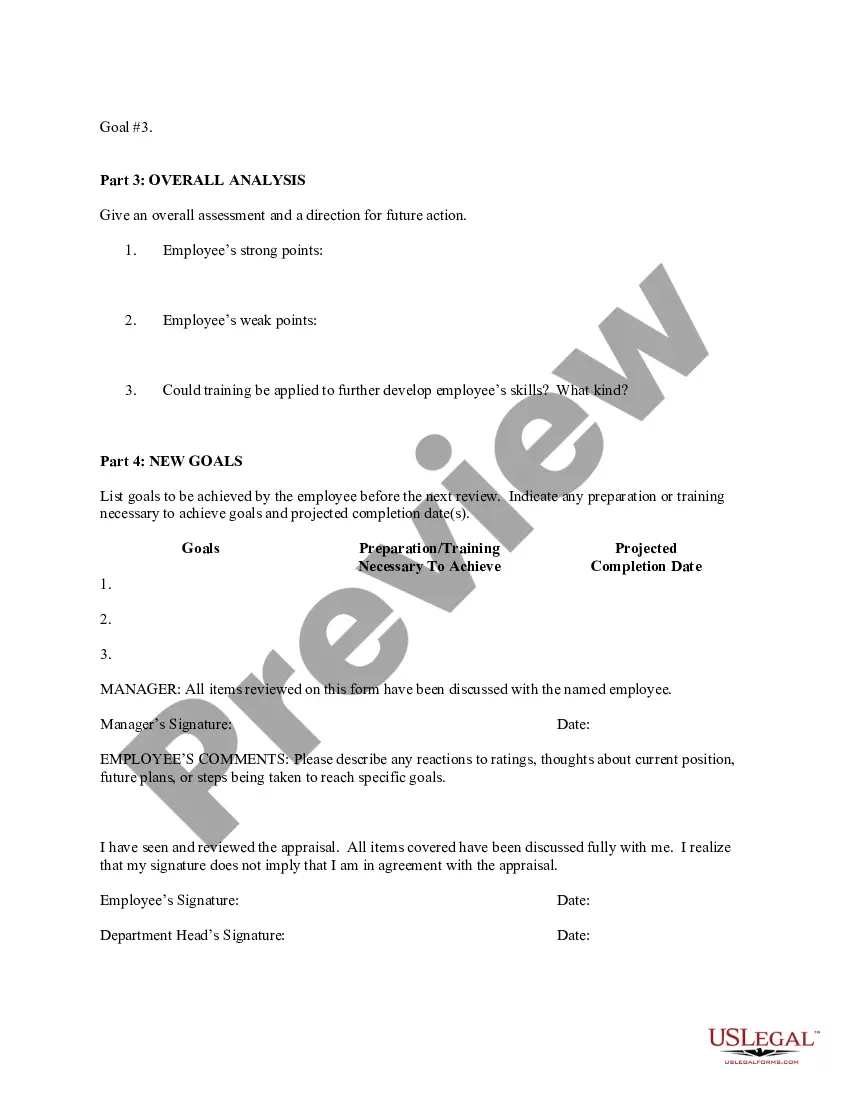

How to fill out Employee Evaluation Form For Accountant?

Are you in a situation where you require documents for either business or specific tasks almost every day.

There are numerous official form templates accessible online, but finding versions you can trust is challenging.

US Legal Forms offers thousands of form templates, like the New Jersey Employee Evaluation Form for Accountant, designed to meet state and federal regulations.

Once you have the correct form, click Purchase now.

Choose the pricing plan you want, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card. Pick a preferred paper format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the New Jersey Employee Evaluation Form for Accountant anytime you need it. Just follow the necessary form to obtain or print the document template. Use US Legal Forms, the most extensive collection of official forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Employee Evaluation Form for Accountant template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to examine the form.

- Check the details to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search area to locate the form that fits your requirements.

Form popularity

FAQ

Most agencies have a turnaround time of 2 weeks but can also vary from 5 business days to 8+ weeks.

To sit for the CPA Exam in New JerseyBachelor's degree or higher from accredited school/university.24 semester hours in accounting and 24 semester hours in business.Minimum of 120 semester hours.Degree can be in any field of study.

How many credit hours do I need to sit for the CPA Exam according to New Jersey rules and regulations? You need 120 credit hours and a bachelor's degree.

For a 3-year B.COM degree, you get 90 credit hours. In the past, a CA certificate gave you an additional around 40 credit hours. With 90+40=130 credit hours, you can get qualified for a few states.

New Jersey State Board of Accountancy.

Check with the CA State Board of Accountancy to ensure your CPA doesn't have outstanding complaints against them (do this when looking for a new CPA firm, as well). Assess Your Situation. Think about whether you need an Enrolled Agent (EA), a CPA or a tax lawyer.

The Foreign Academic Credentials Service assists people educated outside the United States in determining the equivalency of their international credentials in terms of an education in the U.S. FACS was established in 1982 at the request of the American Institute of Certified Public Accountants (AICPA) and the National

The education requirements for CPA exam eligibility vary across the boards of the different states or jurisdictions in the US, but the main requirement is that candidates must have completed either a bachelor's degree or 120 college credit hours.

Students often report that Financial Accounting and Reporting (FAR) is the most difficult part of the CPA Exam to pass, because it is the most comprehensive section.

According to the principle of Substantial Equivalency, jurisdictions that follow the same set of rules in granting CPA licenses could allow license holders in one state to practice in another. Most states have common licensing requirements.