New Jersey Voluntary Petition for Non-Individuals Filing for Bankruptcy

Description

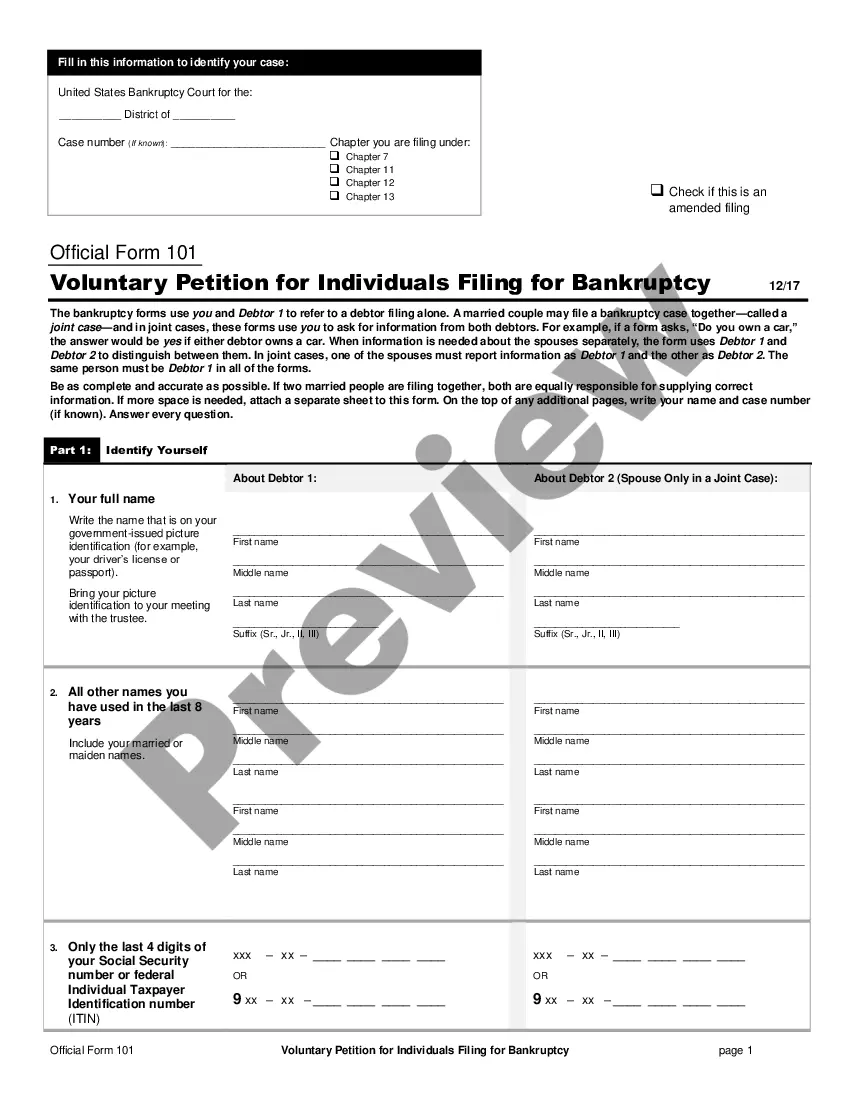

How to fill out Voluntary Petition For Non-Individuals Filing For Bankruptcy?

US Legal Forms - among the most significant libraries of lawful forms in the United States - offers an array of lawful papers web templates you are able to obtain or produce. While using web site, you can get thousands of forms for organization and specific reasons, sorted by categories, states, or keywords and phrases.You will find the most recent models of forms like the New Jersey Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act within minutes.

If you currently have a registration, log in and obtain New Jersey Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act in the US Legal Forms collection. The Obtain switch will show up on every type you look at. You have access to all formerly delivered electronically forms from the My Forms tab of your respective account.

In order to use US Legal Forms initially, here are straightforward guidelines to obtain started out:

- Be sure to have picked out the right type to your area/region. Go through the Review switch to examine the form`s articles. Browse the type explanation to actually have selected the proper type.

- If the type doesn`t satisfy your demands, utilize the Research discipline at the top of the display to obtain the one that does.

- In case you are pleased with the form, affirm your choice by simply clicking the Get now switch. Then, choose the rates plan you favor and offer your credentials to register on an account.

- Process the deal. Make use of Visa or Mastercard or PayPal account to accomplish the deal.

- Choose the file format and obtain the form on the system.

- Make adjustments. Fill out, revise and produce and indicator the delivered electronically New Jersey Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act.

Each and every web template you included with your bank account lacks an expiration day and is the one you have forever. So, if you would like obtain or produce yet another version, just visit the My Forms section and click on about the type you need.

Get access to the New Jersey Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act with US Legal Forms, one of the most comprehensive collection of lawful papers web templates. Use thousands of specialist and condition-particular web templates that meet your small business or specific needs and demands.

Form popularity

FAQ

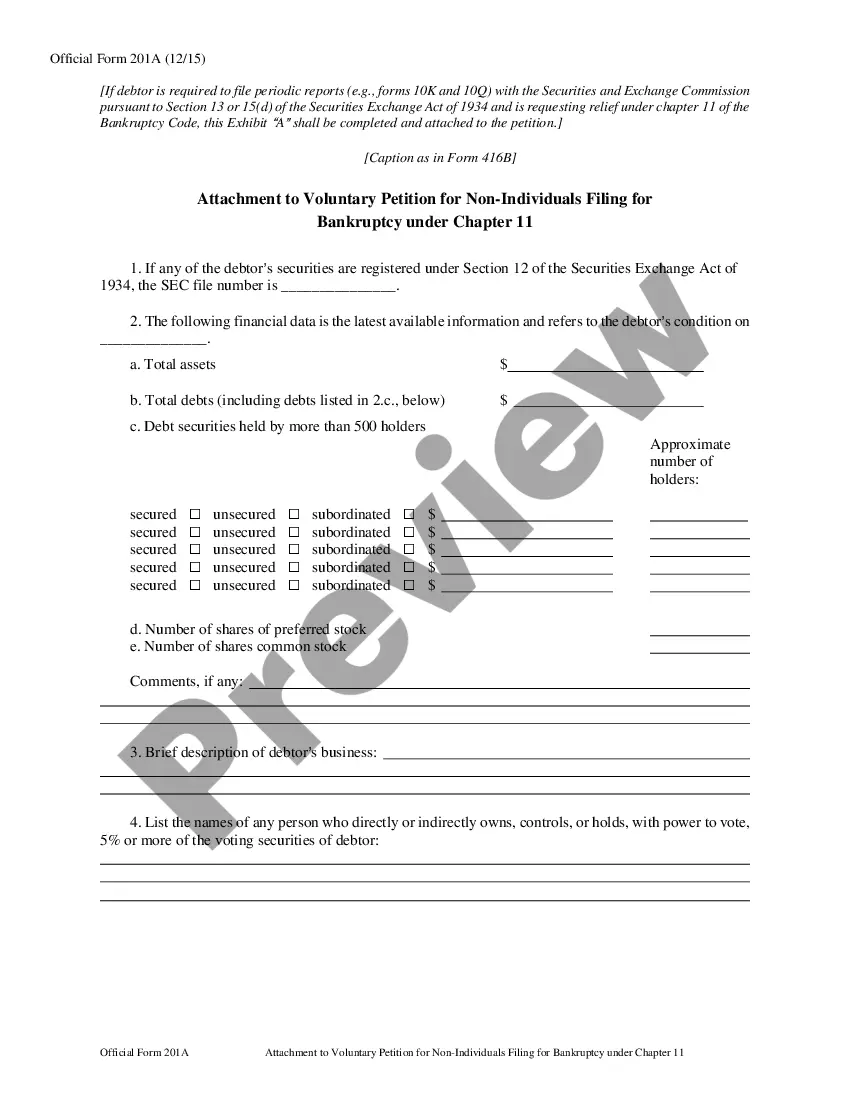

Most debts are discharged Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

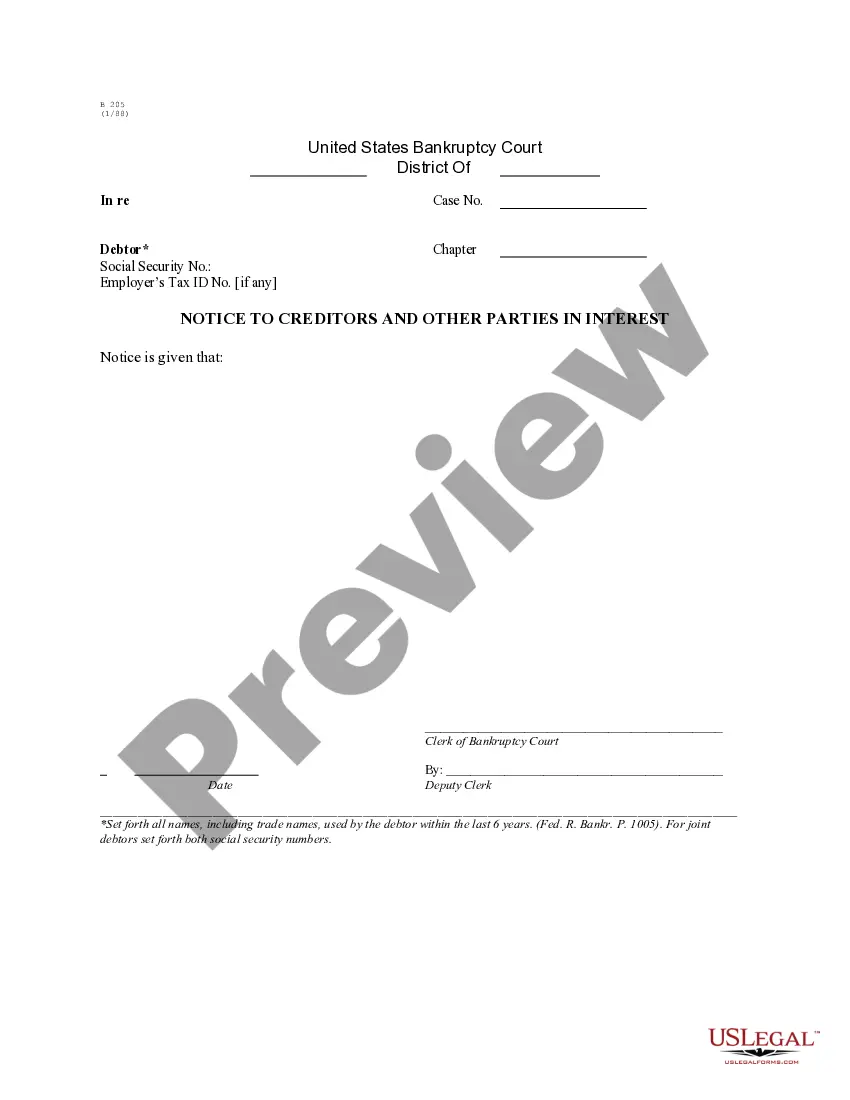

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.

Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time, help people who are owed money, or creditors, get paid from assets property the debtor has.

A Chapter13 bankruptcy may be filed by individuals with regular income. Debtors must present a plan to repay all or part of their debts. The plan must provide for fixed monthly payments to be made to the Chapter 13 trustee for a period of three to five years, depending on income and other factors.

In a Chapter 7 bankruptcy, your assets (other than your exempt assets) are gathered together and sold. Any unsecured debt that isn't paid off from the sale proceeds is discharged, giving the debtor a debt-free fresh start. Traditionally, Chapter 7 has been the most common type of bankruptcy proceeding.

One of the primary purposes of bankruptcy is to discharge certain debts to give an honest individual debtor a "fresh start." The debtor has no liability for discharged debts. In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations.

Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time, help people who are owed money, or creditors, get paid from assets property the debtor has.

Bankruptcy - Refers to statutes and judicial proceedings involving persons or businesses that cannot pay their debts and seek the assistance of the court in getting a fresh start. Under the protection of the bankruptcy court, debtors may discharge their debts, perhaps by paying a portion of each debt.