New Jersey Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 is an important legal document used in bankruptcy proceedings. This form specifically focuses on unsecured priority claims, which are debts that hold a higher priority for repayment than regular unsecured debts in bankruptcy cases. Unsecured priority claims can include various types of debts, such as taxes owed to the state or federal government, child or spousal support arrears, certain types of employee wages and benefits, and claims for personal injury or wrongful death caused by the debtor's misconduct. The Schedule E — Form 6— - Post 2005 is used to list these unsecured priority claims in a bankruptcy case filed in New Jersey after the year 2005. This form is crucial for a fair distribution of assets based on the priority order set by bankruptcy laws. It's important to note that there may be different types of New Jersey Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 based on the specific nature of the claim. Some common types of priority claims may include: 1. Tax Claims: These can include federal income taxes owed, state income taxes, or even property taxes. 2. Domestic Support Obligations: This category includes any child or spousal support owed by the debtor, including arrears. 3. Wage Claims: Certain employee wages and benefits may have priority status, such as unpaid wages, commissions, or benefits earned within 180 days before the bankruptcy filing. 4. Personal Injury or Wrongful Death Claims: Claims resulting from personal injury or wrongful death caused by the debtor's misconduct may also hold a higher priority. 5. Certain other debts with priority status: This can include debts owed to the government for fines or penalties, debts incurred due to fraud or embezzlement, or debts arising from the operation of a motor vehicle while intoxicated. When filling out the New Jersey Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005, it is crucial to provide accurate and detailed information about each claim. This ensures that all priority claims are appropriately considered during the bankruptcy process and helps in achieving a fair distribution of available assets to creditors.

New Jersey Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

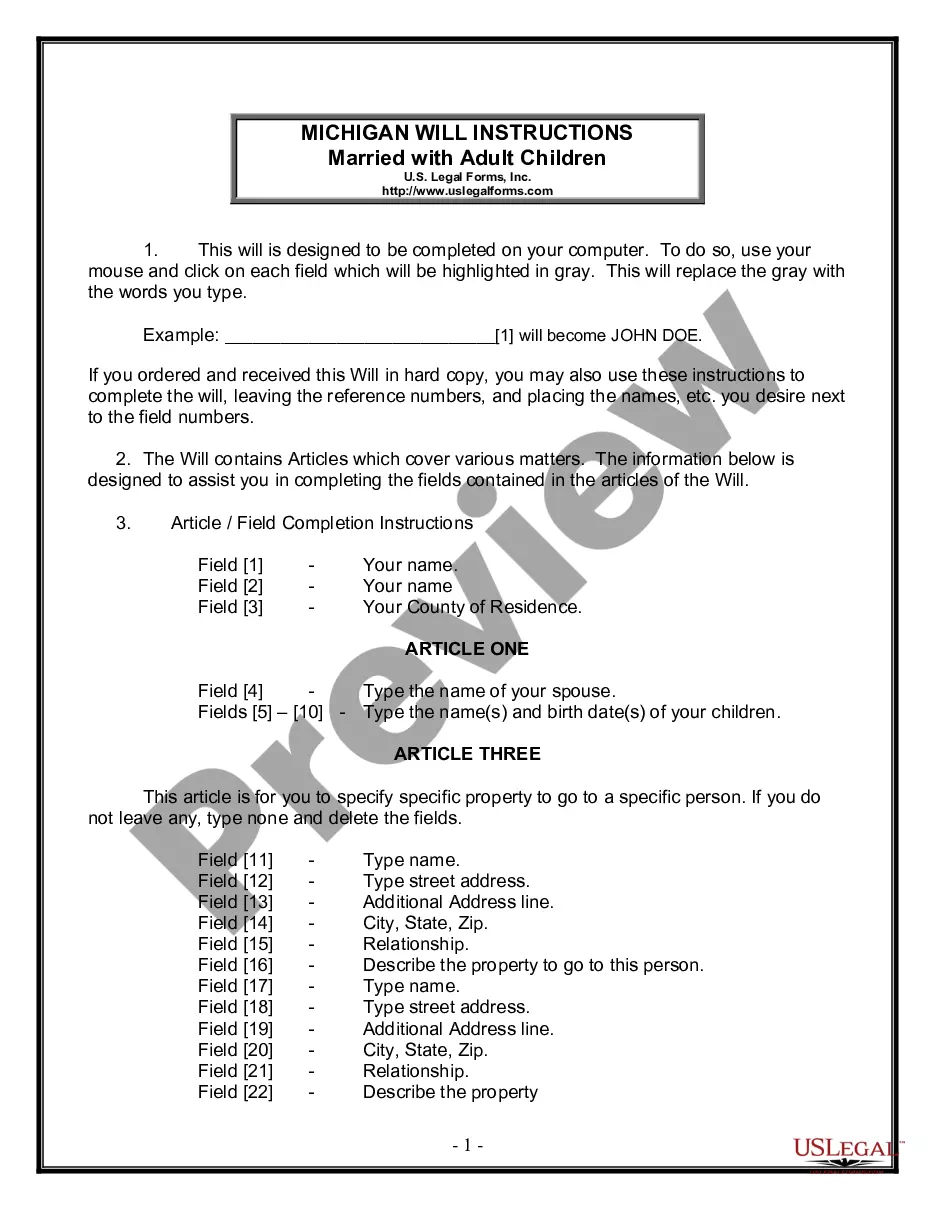

How to fill out New Jersey Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

US Legal Forms - among the biggest libraries of lawful kinds in America - gives a variety of lawful file templates it is possible to obtain or print. Utilizing the internet site, you may get 1000s of kinds for business and personal functions, sorted by classes, suggests, or keywords.You will find the most recent variations of kinds just like the New Jersey Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 in seconds.

If you already possess a membership, log in and obtain New Jersey Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 from your US Legal Forms catalogue. The Obtain button can look on every single develop you perspective. You have accessibility to all formerly downloaded kinds in the My Forms tab of your respective account.

If you want to use US Legal Forms initially, allow me to share easy directions to help you started off:

- Ensure you have selected the proper develop for the city/area. Click on the Review button to examine the form`s content material. Browse the develop description to actually have chosen the right develop.

- If the develop doesn`t suit your needs, make use of the Look for field at the top of the monitor to get the one that does.

- When you are pleased with the shape, affirm your option by visiting the Acquire now button. Then, opt for the prices strategy you prefer and offer your accreditations to sign up to have an account.

- Approach the deal. Utilize your bank card or PayPal account to accomplish the deal.

- Pick the structure and obtain the shape on your own system.

- Make modifications. Fill up, modify and print and signal the downloaded New Jersey Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Every single template you put into your money does not have an expiration day and is also the one you have forever. So, if you would like obtain or print another copy, just proceed to the My Forms portion and click on about the develop you need.

Gain access to the New Jersey Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms, by far the most considerable catalogue of lawful file templates. Use 1000s of expert and state-specific templates that fulfill your small business or personal requirements and needs.

Form popularity

FAQ

?Is the claim subject to Offset?? Asks if you have to pay back the whole debt. For example, if you owe the creditor $1,000 but the creditor owes you $200, then the claim can be ?offset?.

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

Examples of unsecured debts include credit cards, medical expenses, utility bills, most taxes, and personal loans.

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.

General unsecured claims have the lowest priority of all claims. After the bankruptcy estate pays administrative expenses, priority unsecured claims, and secured claims, general unsecured creditors will receive a pro rata (equal percentage) distribution of the remaining funds.

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.

An unsecured creditor is an individual or institution that lends money without obtaining specified assets as collateral. This poses a higher risk to the creditor because it will have nothing to fall back on should the borrower default on the loan.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.