Title: Exploring the Various Types and Importance of New Jersey Letter to Shareholders Description: New Jersey Letter to Shareholders serves as a vital communication tool for companies registered in the state, allowing them to share important updates, announcements, financial performance, and future prospects with their valuable shareholders. This comprehensive description will delve into the different types of New Jersey Letters to Shareholders and their significance in maintaining transparent and fruitful shareholder-company relationships. 1. Annual New Jersey Letter to Shareholders: The Annual New Jersey Letter to Shareholders is a formal document prepared by companies in compliance with the New Jersey laws. This letter provides a comprehensive overview of the company's performance during the fiscal year, highlighting key achievements, challenges, financial statements, goals, strategies, upcoming projects, and initiatives. It also includes crucial information regarding the rights and responsibilities of shareholders, board of directors, and executive management. 2. Quarterly New Jersey Letter to Shareholders: Companies often send out Quarterly New Jersey Letters to Shareholders to keep them informed about the ongoing progress of the business and financial results for the preceding quarter. These letters update shareholders about sales figures, revenue growth, profit margins, market share, new product launches, expansion plans, and any significant events or changes within the company. They are crucial in keeping shareholders engaged and sharing the company's vision for the future. 3. Special New Jersey Letter to Shareholders: A Special New Jersey Letter to Shareholders is issued when the company wants to disclose important information that might impact the shareholders' decision-making process, such as mergers, acquisitions, divestitures, changes in leadership, legal matters, or notable developments affecting the company's growth trajectory. These letters are required by the state of New Jersey to ensure transparency and keep shareholders well-informed throughout critical decision-making processes. 4. New Jersey Letter to Shareholders for Non-Profit Organizations: Non-profit organizations registered in New Jersey also send out Letters to Shareholders to update their stakeholders about their activities, initiatives, community impact, new partnerships, fundraising efforts, and goals achieved. These letters highlight the organization's commitment to its mission and its responsible use of funds, ensuring accountability and maintaining the trust of shareholders. Conclusion: New Jersey Letter to Shareholders is a significant document that plays a vital role in enhancing shareholder-company relationships. Whether it is the Annual, Quarterly, Special, or Non-Profit Organization variation, these letters serve as a key medium to communicate financial performance, strategic decisions, and critical updates to shareholders based in New Jersey. Ensuring compliance with New Jersey laws, these letters aim to foster transparency, build trust, and keep shareholders well-informed to make informed decisions regarding their investments.

New Jersey Letter to Shareholders

Description

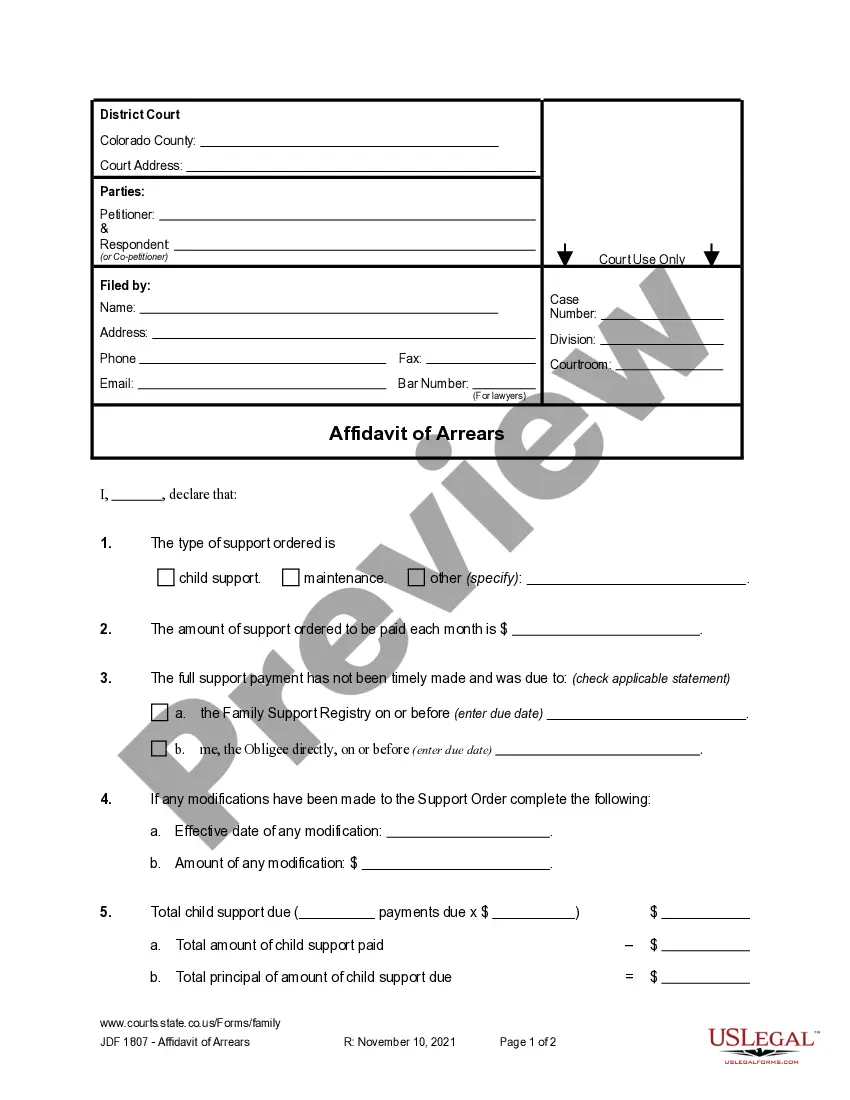

How to fill out New Jersey Letter To Shareholders?

You are able to spend time on the Internet searching for the legitimate papers web template which fits the state and federal demands you will need. US Legal Forms offers 1000s of legitimate kinds which are examined by professionals. It is simple to download or print out the New Jersey Letter to Shareholders from my service.

If you have a US Legal Forms account, it is possible to log in and click the Down load key. After that, it is possible to full, modify, print out, or indication the New Jersey Letter to Shareholders. Every legitimate papers web template you get is your own forever. To obtain yet another copy of the purchased develop, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms web site initially, follow the straightforward guidelines beneath:

- Very first, make sure that you have chosen the right papers web template to the region/area that you pick. Browse the develop explanation to make sure you have picked the correct develop. If readily available, make use of the Review key to check through the papers web template too.

- In order to find yet another version of your develop, make use of the Search discipline to find the web template that suits you and demands.

- When you have discovered the web template you would like, just click Get now to proceed.

- Pick the pricing program you would like, type in your credentials, and register for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to cover the legitimate develop.

- Pick the file format of your papers and download it for your system.

- Make modifications for your papers if needed. You are able to full, modify and indication and print out New Jersey Letter to Shareholders.

Down load and print out 1000s of papers layouts making use of the US Legal Forms Internet site, which offers the greatest collection of legitimate kinds. Use professional and condition-certain layouts to deal with your organization or specific needs.

Form popularity

FAQ

There could be unusual items on your tax returns, such as a category with unusually high expenses. If you filed an amended return with a claim for refund, it can increase your chances of an audit. A third party you use?such as a vendor or customer?could have been audited leading to a review of your business.

Nonconsenting Shareholders The S corporation is required to withhold Income Tax from your pro rata share of S corporation income if: You are a nonresident of New Jersey; and ? You become a shareholder in a New Jersey electing S corporation; and ? You failed to consent to that election.

Purpose - A corporation must file form CBT-2553 to elect to be treated as a New Jersey S corporation or a New Jersey QSSS or to report a change in shareholders.

If you receive a letter from us asking for documentation to support what you claimed on your return, it does not mean that you did anything wrong. This is just an extra step we take to ensure the correct information is reported on your tax return.

If you do not make your payment on time you will be charged additional fees. If a certificate of debt is issued, a fee for the cost of collection of the tax also may be imposed. If you can show reasonable cause for failing to file a return or pay any tax when due, we may waive part or all of your penalty. N.J.S.A.

The Shareholder Jurisdictional Consent is the shareholders' acknowledgement that New Jersey has the jurisdiction (right) to tax each shareholder's S corporation income, regardless of the shareholder's residency.

Starting a side hustle or changing jobs, underpaying estimated quarterly taxes if you're self-employed, reporting gambling winnings, getting married or divorced, or losing a child tax credit are just some of the many reasons why you might owe state taxes this year.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.