New Jersey Ratification of change in control agreements with copy of form of change in control agreement

Description

How to fill out Ratification Of Change In Control Agreements With Copy Of Form Of Change In Control Agreement?

You are able to commit several hours on the Internet trying to find the legal file format that suits the federal and state demands you require. US Legal Forms provides a large number of legal forms which are analyzed by specialists. It is possible to download or produce the New Jersey Ratification of change in control agreements with copy of form of change in control agreement from my support.

If you have a US Legal Forms account, you may log in and then click the Acquire key. Next, you may complete, modify, produce, or indicator the New Jersey Ratification of change in control agreements with copy of form of change in control agreement. Every single legal file format you get is yours forever. To have an additional copy associated with a purchased type, go to the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms website the very first time, keep to the straightforward instructions beneath:

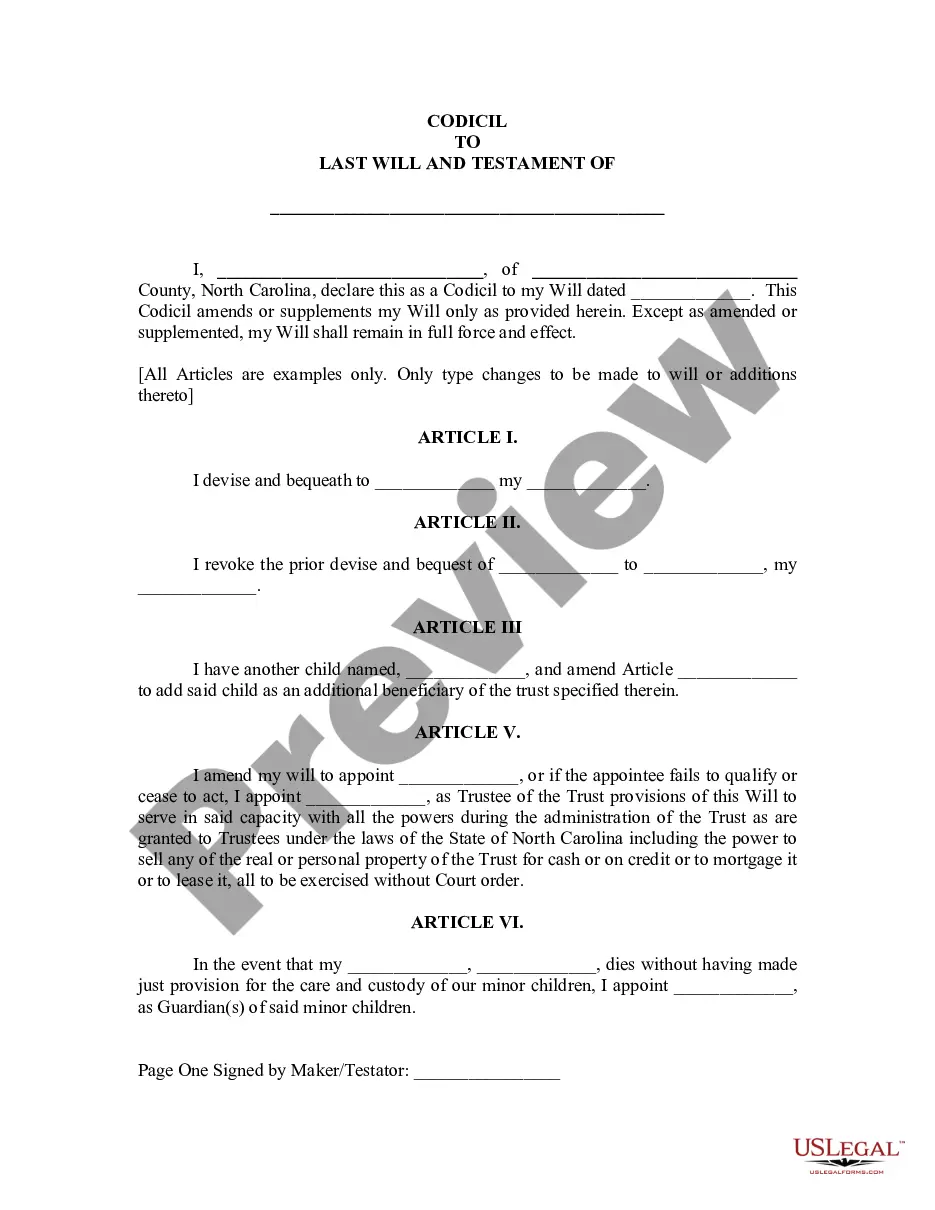

- Very first, be sure that you have chosen the best file format to the area/town of your choice. Browse the type outline to make sure you have picked the right type. If readily available, utilize the Review key to appear from the file format at the same time.

- If you wish to discover an additional version in the type, utilize the Look for area to get the format that fits your needs and demands.

- Once you have found the format you need, just click Purchase now to continue.

- Choose the prices program you need, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your credit card or PayPal account to fund the legal type.

- Choose the structure in the file and download it to your gadget.

- Make adjustments to your file if possible. You are able to complete, modify and indicator and produce New Jersey Ratification of change in control agreements with copy of form of change in control agreement.

Acquire and produce a large number of file web templates utilizing the US Legal Forms web site, which offers the largest selection of legal forms. Use specialist and express-particular web templates to take on your small business or personal requires.

Form popularity

FAQ

Change of Control Clause: Example The Customer shall have the right, without prejudice to its other rights or remedies, to terminate this Agreement by 3 months' written notice to the Supplier, if there is a Change of Control of the Supplier.

In finance, a Change of Control occurs when there is a material change in the ownership of a company. The exact criteria that determine such a change can vary and are defined by law and through contractual agreements.

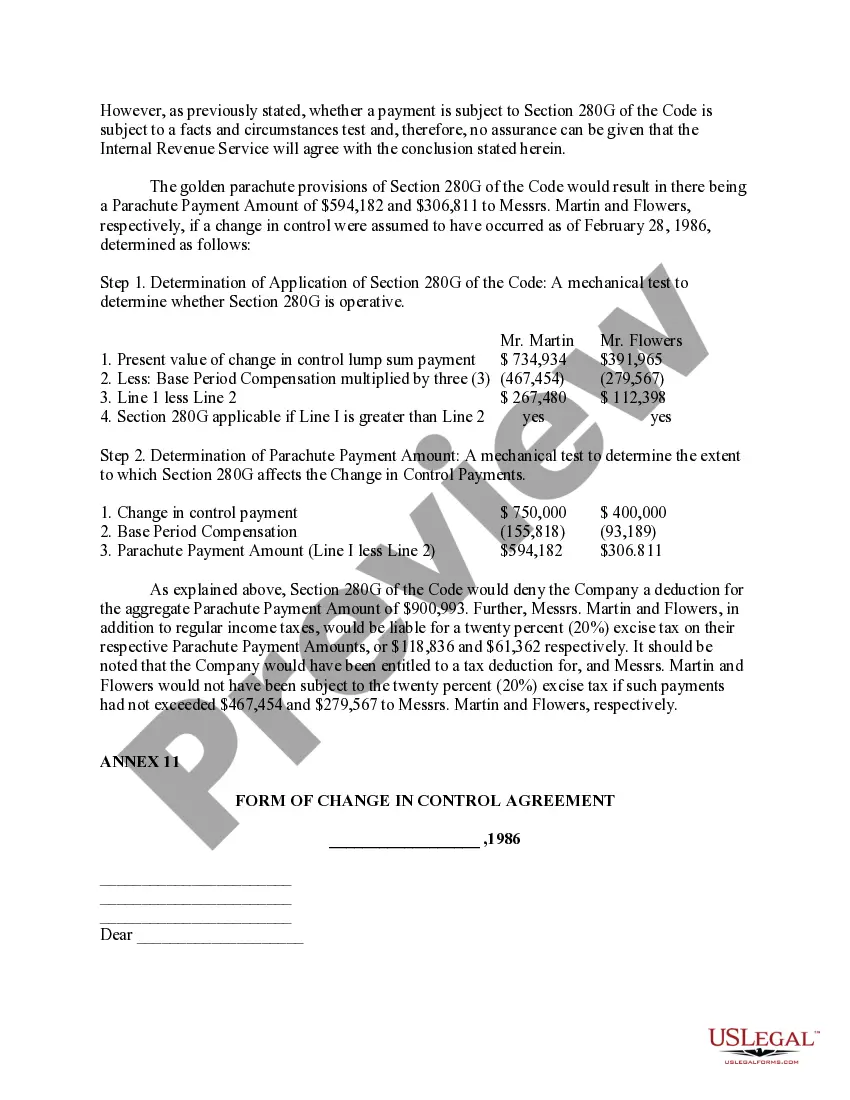

Change in control agreements are contracts that outline pay and benefits an executive will receive in the event of a change in company ownership. They are also sometimes known as ?golden parachutes,? as they provide protection for executives if they are forced out after a company takeover.

?Change in control? means: any sale, assignment, transfer, contribution or other disposition of all or substantially all of the assets used in a health care entity's operations; or any sale, assignment, transfer, contribution or other disposition of a controlling interest in the health care entity, including by ...

In commercial contracts a change of control clause will often give the party who is not subject to a change in ownership the right to terminate the agreement in the event of a change of control of the other party.

A change of control is a change in a company's ownership or management that results in the decision-making capacity of that entity being exercised by a different group of shareholders and/or directors.

Change of control refers to a scenario when the company's majority ownership and business decision-making powers move from one person or entity to another. It is quite common in corporarte sector where the rights are sold to potential buyers at a reasonable price.