The New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara is a legal document designed to protect the parties involved from potential losses or damages. This agreement outlines the terms and conditions under which the Financial Corporation of Santa Barbara will indemnify the other party. The New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara is intended to be used in New Jersey and follows the specific laws and regulations of the state. It is crucial for businesses and individuals seeking indemnification to ensure that they are using the appropriate document for their jurisdiction. This indemnity agreement is signed by both parties involved in a transaction, typically a borrower and a lender. It serves as a legally binding contract that outlines the extent to which the Financial Corporation of Santa Barbara will cover any losses or damages incurred by the other party. The New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara provides clarity on the responsibilities and liabilities of each party. It specifies the scope of indemnification, any exclusions or limitations that may apply, and the procedure for making a claim in case of losses or damages. Key terms that may appear in the agreement include indemnity (the Financial Corporation of Santa Barbara), indemnity (the party being indemnified), scope of indemnity, indemnification period, notice requirements, and the process for resolving disputes. While there may not be different types of New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara, it is essential to note that variations or amendments can be made to suit specific business arrangements, such as modifying the scope of indemnification or adding additional clauses to address unique concerns. In conclusion, the New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara provides a comprehensive and legally sound framework for businesses and individuals seeking protection from potential losses or damages. By outlining the responsibilities and liabilities of each party, this agreement ensures that all parties involved are adequately covered in the event of unforeseen circumstances.

New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara

Description

How to fill out New Jersey Form Of Indemnity Agreement By Financial Corporation Of Santa Barbara?

Are you inside a position that you need paperwork for both company or person purposes nearly every working day? There are a lot of legitimate file themes accessible on the Internet, but getting versions you can rely on is not easy. US Legal Forms provides thousands of kind themes, just like the New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara, that happen to be published to fulfill federal and state requirements.

Should you be presently knowledgeable about US Legal Forms internet site and get a merchant account, just log in. Next, you can obtain the New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara template.

If you do not come with an accounts and wish to start using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is for your right town/county.

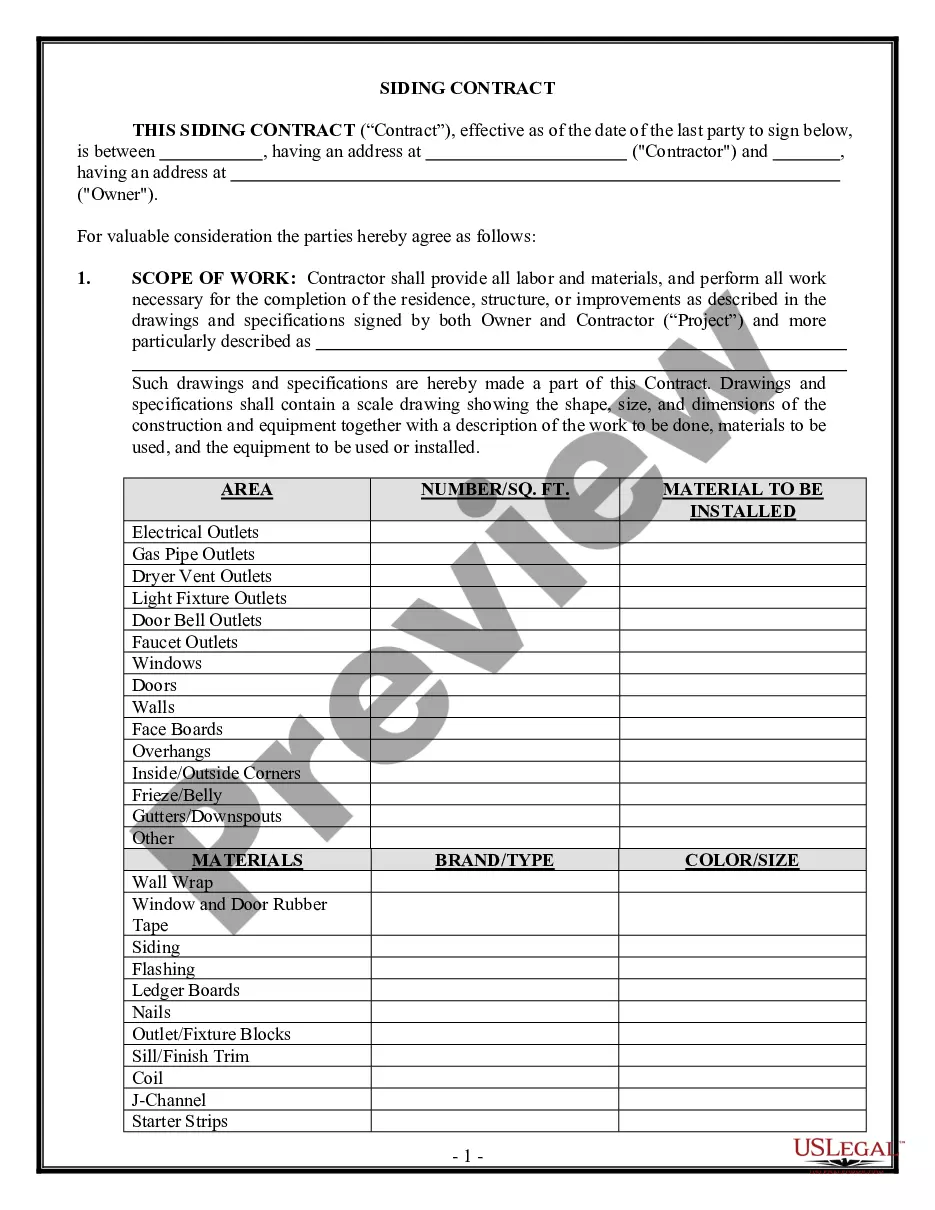

- Utilize the Preview option to examine the form.

- Read the information to actually have selected the appropriate kind.

- In case the kind is not what you are trying to find, utilize the Lookup field to discover the kind that fits your needs and requirements.

- If you obtain the right kind, click Buy now.

- Select the prices prepare you would like, fill in the necessary information to generate your account, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Decide on a convenient document format and obtain your copy.

Discover all of the file themes you possess bought in the My Forms food list. You may get a more copy of New Jersey Form of Indemnity Agreement by Financial Corporation of Santa Barbara anytime, if required. Just go through the necessary kind to obtain or print out the file template.

Use US Legal Forms, one of the most substantial variety of legitimate kinds, to save time and prevent errors. The assistance provides appropriately produced legitimate file themes that you can use for a range of purposes. Make a merchant account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

Most jurisdictions do not require notarization for an Indemnity Agreement to be valid. However, you can reinforce the validity of the parties' signatures if you choose to notarize the document.

An LOI must clearly list all of the parties involved (shipper, carrier and when applicable, consignee or recipient) and should include as much detail as possible (i.e. vessel name, ports of origin and destination, description of goods, container number, specifics from the original bill of lading, etc.).

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

Ensure the LOI is signed by a person authorised to sign on behalf of the grantor. Ensure the LOI is addressed to the correct party. If possible, incorporate the terms of the Contracts (Rights of Third Parties) Act 1999 or have the LOI addressed to 'The Owners/Disponent Owners/Charterers of the [vessel]'.

Such letters are traditionally drafted by third-party institutions like banks or insurance companies, which agree to pay financial restitution to one of the parties, should the other party fail to live up to its obligations.

An indemnity agreement should reveal how the indemnitee will notify the indemnitor of a dispute or claim covered under the legal document. That way, the indemnified party won't be in the dark when facing losses, damages, or legal issues.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

It's a legally binding promise to protect another person against loss from an event or series of events: they are indemnified and protected from liability. Sometimes, indemnities are implied into the terms of contracts automatically, due to the nature of the legal relationship between the two parties.