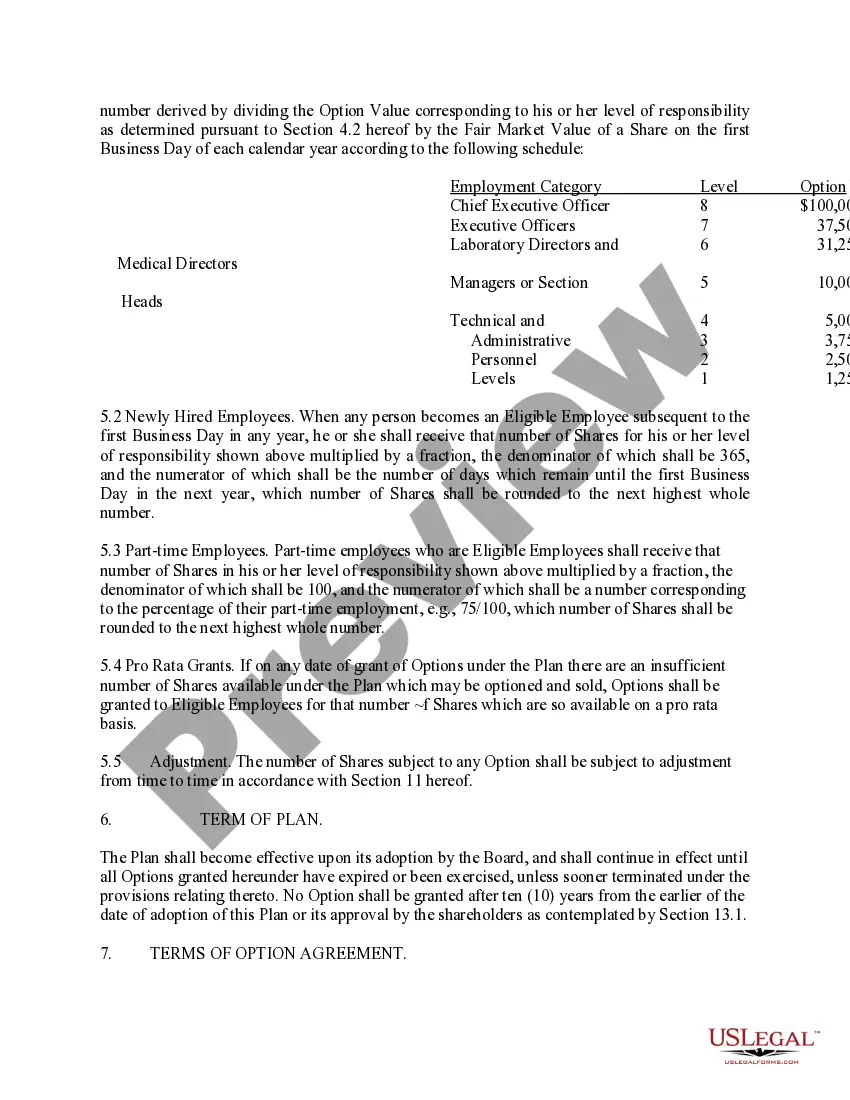

The New Jersey Employee Stock Option Plan (ESOP) of Vivien, Inc. is a robust employee benefit program aimed at motivating and rewarding the dedicated workforce of the company. This plan enables employees to purchase a specific number of company shares at a predetermined price within a designated time frame, offering them an opportunity to become shareholders in Vivien, Inc. through stock ownership. Vivien, Inc. understands the importance of retaining and attracting talented professionals who contribute significantly to the company's growth and success. The ESOP serves as a valuable tool to achieve this goal by aligning employee interests with company performance and fostering a sense of ownership and loyalty among the workforce. The New Jersey Employee Stock Option Plan of Vivien, Inc. provides employees with various benefits and features. Firstly, it grants eligible employees the opportunity to acquire company stock at a predetermined discount or market price, allowing them to benefit from potential increases in the stock's value over time. By participating in the ESOP, employees can build personal wealth and realize financial gains through the appreciation of Vivien, Inc.'s stock. Additionally, the ESOP helps to create a shared vision within the organization, as employees have a vested interest in the company's success. This encourages them to actively contribute to the company's goals and objectives, resulting in increased productivity and overall performance. Furthermore, the New Jersey Employee Stock Option Plan of Vivien, Inc. provides employees with flexibility in terms of exercising their stock options. It offers a range of exercise periods, allowing employees to choose when to exercise their options based on their individual financial circumstances and market conditions. Within the New Jersey Employee Stock Option Plan, Vivien, Inc. may offer different types of stock options to its employees. These options can include: 1. Non-Qualified Stock Options: These are stock options that do not meet the criteria for special tax treatment under the Internal Revenue Code. Employees typically receive these options at fair market value at the time of grant, and any gains upon exercise are subject to regular income tax rates. 2. Incentive Stock Options: These options are specifically granted to employees and come with certain tax advantages. To qualify for preferential tax treatment, employees must meet specific criteria, such as holding the stock for a specified period before selling and not exceeding a certain exercise price. 3. Restricted Stock Units (RSS): RSS are a form of compensation where employees are awarded units that convert into company stock at a predetermined schedule or upon meeting certain performance goals. RSS provide employees with an opportunity to accumulate company stock over time, promoting long-term commitment and loyalty. In conclusion, the New Jersey Employee Stock Option Plan of Vivien, Inc. is a valuable employee benefit program that enables employees to become shareholders in the company, aligning their interests with its success. Through various types of stock options, employees have the opportunity to accumulate wealth, actively contribute to the company's growth, and foster a sense of ownership and loyalty.

New Jersey Employee Stock Option Plan of Vivigen, Inc.

Description

How to fill out New Jersey Employee Stock Option Plan Of Vivigen, Inc.?

Are you currently in the place in which you require papers for possibly business or individual uses just about every working day? There are a variety of authorized file layouts available online, but discovering kinds you can rely on isn`t effortless. US Legal Forms offers a large number of kind layouts, such as the New Jersey Employee Stock Option Plan of Vivigen, Inc., which can be composed in order to meet state and federal specifications.

When you are presently familiar with US Legal Forms site and get a merchant account, just log in. After that, you can obtain the New Jersey Employee Stock Option Plan of Vivigen, Inc. web template.

Unless you provide an bank account and want to start using US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is to the correct town/state.

- Utilize the Preview button to analyze the shape.

- Read the outline to ensure that you have chosen the correct kind.

- If the kind isn`t what you`re looking for, take advantage of the Search industry to discover the kind that meets your needs and specifications.

- Once you get the correct kind, click on Purchase now.

- Pick the pricing strategy you would like, fill out the required info to make your account, and pay for your order with your PayPal or Visa or Mastercard.

- Decide on a handy paper structure and obtain your backup.

Discover all of the file layouts you possess purchased in the My Forms food selection. You may get a more backup of New Jersey Employee Stock Option Plan of Vivigen, Inc. anytime, if possible. Just click on the necessary kind to obtain or produce the file web template.

Use US Legal Forms, one of the most substantial assortment of authorized kinds, in order to save some time and stay away from faults. The assistance offers professionally created authorized file layouts which can be used for a range of uses. Generate a merchant account on US Legal Forms and start making your way of life a little easier.