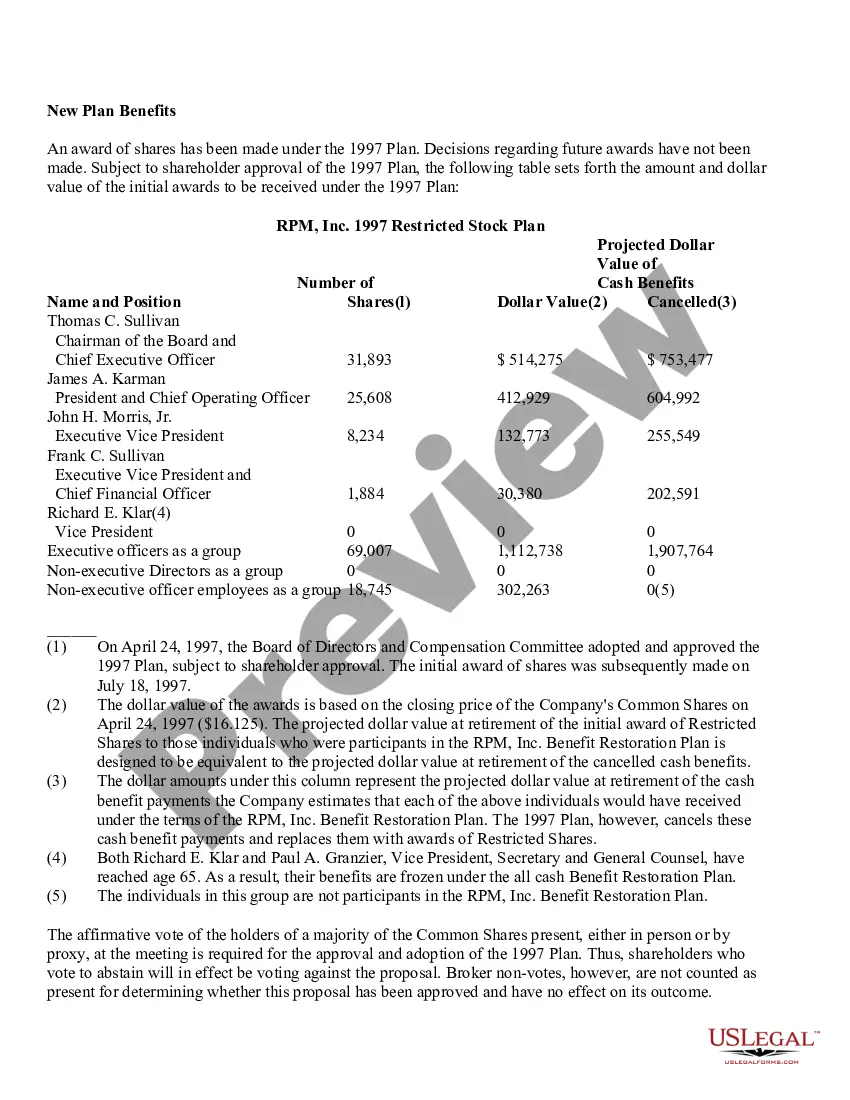

The New Jersey Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive program designed to offer incentives and rewards to eligible employees of RPM, Inc. The plan allows employees to receive restricted stock awards as a means to foster employee motivation, long-term commitment, and align their interests with the company's goals. With this plan, RPM, Inc. aims to attract, retain, and incentivize talented individuals to contribute to its growth and success. The key elements of the New Jersey Adoption of Restricted Stock Plan include: 1. Eligibility: The plan is open to eligible employees of RPM, Inc. This typically includes executives, directors, and other key employees who play a crucial role in the company's operations, strategies, and growth. 2. Restricted Stock Awards: The plan provides participants with restricted stock awards as a form of compensation. Restricted stock refers to company stock that is granted to employees, subject to certain restrictions and conditions. These conditions may include vesting periods and performance-based milestones. 3. Vesting Period: The plan outlines a vesting schedule, which specifies the period over which the awarded stock becomes unrestricted and fully owned by the employee. This incentivizes long-term commitment and encourages employees to contribute to the company's sustainable growth. 4. Performance-based Criteria: The plan may incorporate performance-based criteria that employees need to meet in order to unlock the restricted stock. This ensures that the awards are tied to the company's overall performance and individual contribution. 5. Tax Implications: The plan also addresses the tax implications associated with the restricted stock awards. Employees are provided with information regarding the treatment of the stock awards for tax purposes, helping them make informed decisions regarding their stock options. 6. Shareholder Rights: Participants in the plan may be granted certain shareholder rights, such as voting rights and dividend distributions, along with their restricted stock awards. This reinforces employees' alignment with shareholders' interests and allows them to actively participate in the company's decision-making process. Different types of New Jersey Adoption of Restricted Stock Plan of RPM, Inc. may include variations in eligibility criteria, vesting schedules, performance-based criteria, and the number of restricted stock awards granted. These variations are typically tailored to the specific needs and objectives of RPM, Inc., while still adhering to the relevant regulations and guidelines set by the state of New Jersey and any federal securities laws.

New Jersey Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out New Jersey Adoption Of Restricted Stock Plan Of RPM, Inc.?

It is possible to spend hrs on the web trying to find the legal file design that suits the federal and state requirements you want. US Legal Forms supplies thousands of legal forms that are evaluated by experts. It is possible to down load or print the New Jersey Adoption of Restricted Stock Plan of RPM, Inc. from the service.

If you already have a US Legal Forms accounts, you can log in and click on the Down load button. After that, you can complete, change, print, or indication the New Jersey Adoption of Restricted Stock Plan of RPM, Inc.. Each legal file design you buy is your own permanently. To obtain another backup of any obtained develop, check out the My Forms tab and click on the related button.

Should you use the US Legal Forms internet site the first time, follow the easy directions under:

- Initially, be sure that you have chosen the proper file design for your county/town of your choice. See the develop explanation to ensure you have chosen the right develop. If available, make use of the Review button to look with the file design at the same time.

- If you want to discover another model from the develop, make use of the Research field to get the design that fits your needs and requirements.

- Upon having found the design you would like, click on Buy now to proceed.

- Find the rates strategy you would like, type in your credentials, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your bank card or PayPal accounts to purchase the legal develop.

- Find the formatting from the file and down load it in your device.

- Make alterations in your file if needed. It is possible to complete, change and indication and print New Jersey Adoption of Restricted Stock Plan of RPM, Inc..

Down load and print thousands of file web templates using the US Legal Forms site, which provides the greatest collection of legal forms. Use professional and state-distinct web templates to handle your small business or personal requires.