New Jersey Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc.

Description

How to fill out Approval Of Employee Stock Purchase Plan Of Charming Shoppes, Inc.?

Are you in a place where you need to have files for possibly organization or individual purposes nearly every day time? There are tons of legal file web templates available on the net, but getting versions you can rely on isn`t effortless. US Legal Forms offers a huge number of kind web templates, such as the New Jersey Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc., which can be written to fulfill federal and state specifications.

If you are currently informed about US Legal Forms website and have your account, merely log in. Following that, you may down load the New Jersey Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc. template.

If you do not have an accounts and need to begin using US Legal Forms, abide by these steps:

- Obtain the kind you will need and ensure it is for your proper town/area.

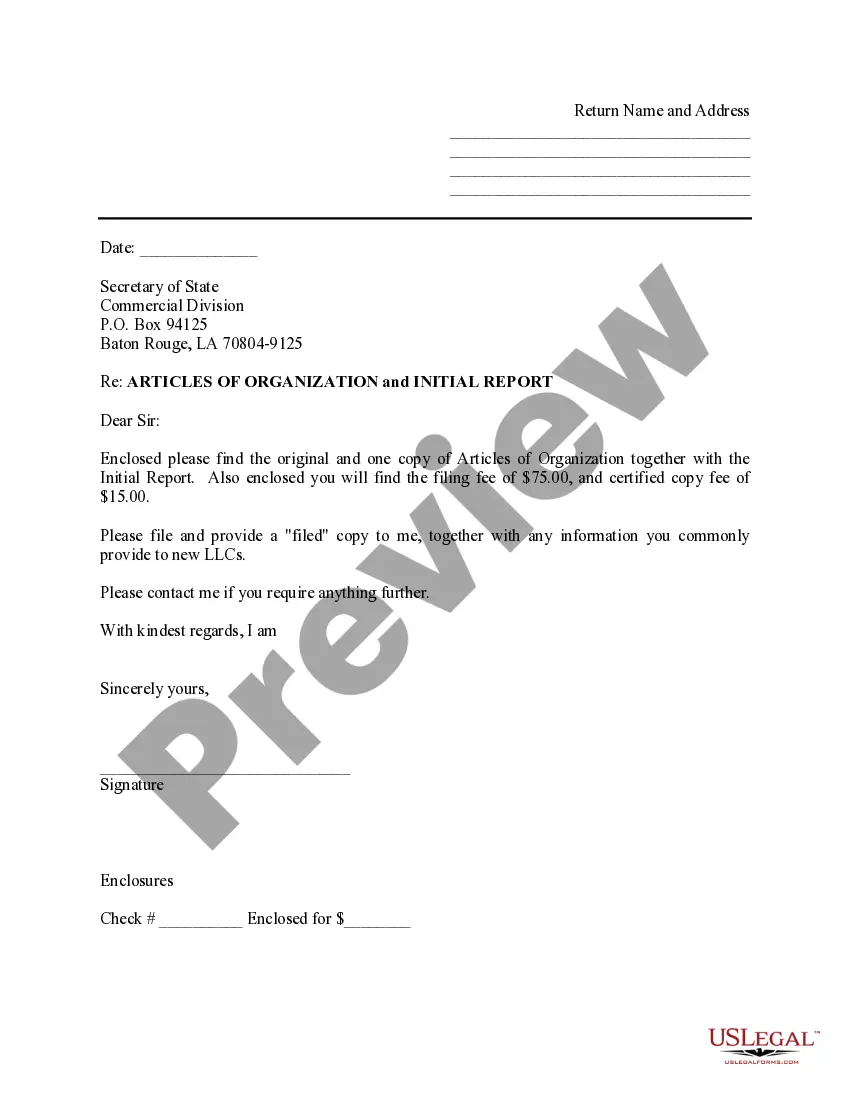

- Use the Review key to examine the shape.

- Read the information to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you`re seeking, use the Lookup field to find the kind that meets your needs and specifications.

- If you get the proper kind, simply click Acquire now.

- Pick the pricing prepare you want, complete the required details to create your bank account, and purchase your order making use of your PayPal or charge card.

- Pick a practical paper structure and down load your duplicate.

Get all of the file web templates you possess bought in the My Forms menus. You can aquire a further duplicate of New Jersey Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc. at any time, if required. Just select the needed kind to down load or print the file template.

Use US Legal Forms, probably the most considerable selection of legal kinds, in order to save time and stay away from mistakes. The service offers professionally created legal file web templates which you can use for an array of purposes. Create your account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

If you leave or terminate from the company, you will cease to participate in the ESPP and your contributions will be refunded as soon as administratively possible.

ESPP Process Offering Period: The offering period is an extension of the offering date. The extension can be as long as a maximum of 27 months. Purchase Period: The purchase period is a subset of the offering period that generally occurs every six months.

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

Offering Period is the period of time during which after-tax money is remitted from your paychecks into the plan in preparation for purchase; most common ESPP offering periods are 6, 12, or 24 months long. You can think of this as the length of an ESPP program at a certain price.