New Jersey Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

US Legal Forms - among the largest libraries of lawful varieties in America - delivers an array of lawful file templates you may download or produce. Utilizing the website, you can get a huge number of varieties for organization and person uses, sorted by types, states, or keywords and phrases.You will discover the latest models of varieties much like the New Jersey Profit Sharing Plan within minutes.

If you currently have a registration, log in and download New Jersey Profit Sharing Plan from the US Legal Forms catalogue. The Down load switch will appear on every form you perspective. You gain access to all earlier acquired varieties inside the My Forms tab of your account.

In order to use US Legal Forms the very first time, here are basic instructions to obtain started off:

- Be sure to have picked out the correct form to your town/region. Click on the Review switch to examine the form`s content material. Browse the form outline to actually have selected the correct form.

- In case the form doesn`t satisfy your specifications, make use of the Research field towards the top of the screen to find the the one that does.

- In case you are satisfied with the shape, confirm your option by clicking on the Purchase now switch. Then, choose the pricing prepare you like and provide your references to sign up to have an account.

- Procedure the deal. Use your charge card or PayPal account to complete the deal.

- Pick the format and download the shape in your system.

- Make adjustments. Fill out, revise and produce and indicator the acquired New Jersey Profit Sharing Plan.

Every format you included with your account lacks an expiry date and it is your own permanently. So, if you wish to download or produce another backup, just go to the My Forms segment and click on around the form you require.

Get access to the New Jersey Profit Sharing Plan with US Legal Forms, by far the most extensive catalogue of lawful file templates. Use a huge number of professional and express-distinct templates that meet your small business or person needs and specifications.

Form popularity

FAQ

Profit sharing may increase compensation risks for employees by making earnings more variable. Profit sharing may incur high administrative costs. There is a negative link between unionization and profit sharing as most unions oppose such organizational incentive programs.

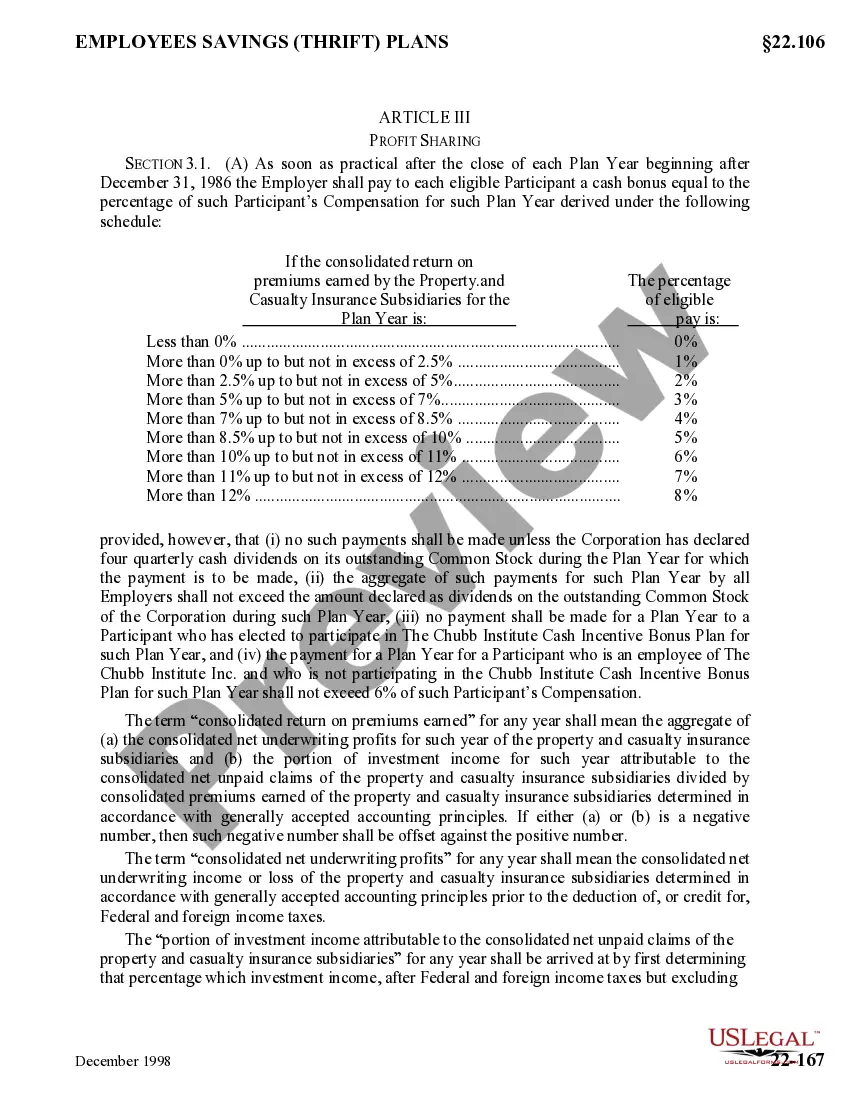

The simplest and most common is known as the comp-to-comp method, where contributions are based on the proportion of an employee's compensation to the total compensation of all employees of the organization. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.

The simplest and most common is known as the comp-to-comp method, where contributions are based on the proportion of an employee's compensation to the total compensation of all employees of the organization. There's no required profit-sharing percentage, but experts recommend staying between 2.5% and 7.5%.

sharing plan is a great way for a business to give its employees a sense of ownership in the company, but there are typically restrictions as to when and how a person can withdraw these funds without penalties.

sharing plan accepts discretionary employer contributions. There is no set amount that the law requires you to contribute. If you can afford to make some amount of contributions to the plan for a particular year, you can do so. Other years, you do not need to make contributions.

Profit sharing plan rules Typically: You cannot withdraw money in a profit sharing plan before age 59 1/2 without a 10% early withdrawal penalty. But administrators of a profit sharing plan have more flexibility in deciding when a worker can make a penalty-free withdrawal than they would with a traditional 401(k).

Profit sharing helps create a culture of ownership. As owners, employees have more incentive to increase the company's profitability. However, this strategy will work only if the company and its management create ways for employees to understand the company's challenges and contribute to the solutions.

For small businesses considering a retirement plan, profit sharing plans can be a powerful tool to promote financial security in retirement, as they provide benefits to both employees and their employers. A profit sharing plan is a type of plan that gives employers flexibility in designing key features.