New Jersey Proposal to amend certificate of incorporation to authorize a preferred stock

Description

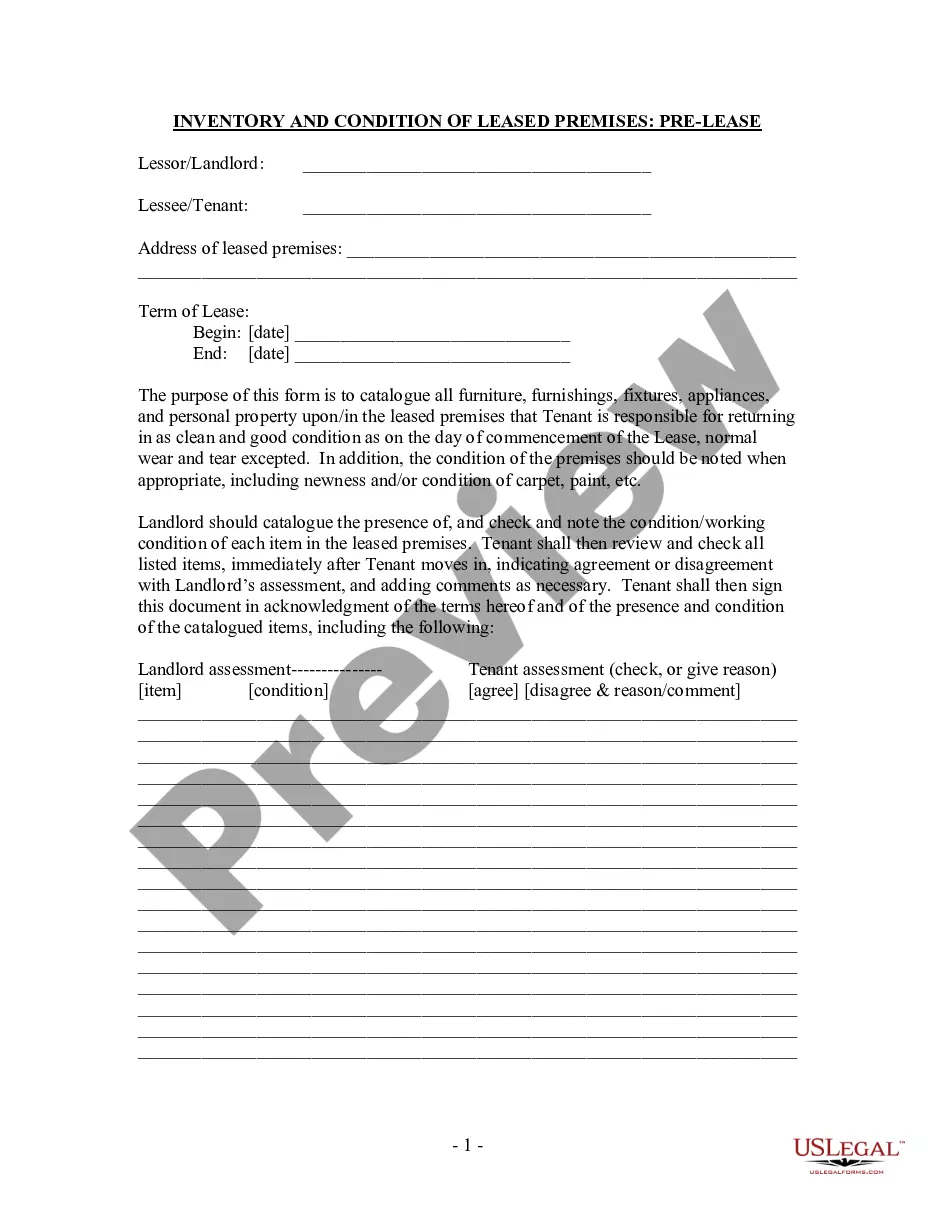

How to fill out Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

US Legal Forms - one of the biggest libraries of legitimate varieties in the USA - gives a wide range of legitimate record web templates you are able to acquire or printing. Using the web site, you can find a large number of varieties for enterprise and personal reasons, categorized by classes, claims, or search phrases.You can find the newest models of varieties much like the New Jersey Proposal to amend certificate of incorporation to authorize a preferred stock in seconds.

If you already have a registration, log in and acquire New Jersey Proposal to amend certificate of incorporation to authorize a preferred stock through the US Legal Forms local library. The Acquire key will appear on each develop you see. You have accessibility to all previously acquired varieties from the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, listed here are basic instructions to obtain started out:

- Make sure you have chosen the proper develop to your city/county. Go through the Review key to examine the form`s content material. Browse the develop outline to actually have selected the correct develop.

- If the develop doesn`t match your needs, make use of the Look for field towards the top of the monitor to get the one that does.

- In case you are happy with the form, verify your selection by clicking on the Get now key. Then, pick the prices strategy you favor and offer your credentials to register for an profile.

- Method the transaction. Make use of Visa or Mastercard or PayPal profile to complete the transaction.

- Choose the file format and acquire the form on your own gadget.

- Make changes. Fill up, change and printing and signal the acquired New Jersey Proposal to amend certificate of incorporation to authorize a preferred stock.

Each and every template you put into your money lacks an expiration time and it is your own property forever. So, if you want to acquire or printing another copy, just check out the My Forms portion and then click in the develop you need.

Get access to the New Jersey Proposal to amend certificate of incorporation to authorize a preferred stock with US Legal Forms, by far the most substantial local library of legitimate record web templates. Use a large number of skilled and express-distinct web templates that satisfy your organization or personal needs and needs.

Form popularity

FAQ

New Jersey articles of incorporation is a legal document required by law to establish a corporation in the state. Articles of incorporation provide a state with important information about a company like what purpose the business will serve.

Board approval, either by written consent or at a board meeting (for more about the differences between board consents and board meetings, please see our article), is required for every issuance of a security, whether that security is common stock, preferred stock, a warrant, an option or a note that is convertible ...

New Jersey accepts the filing of a certificate of formation form via U.S. mail. It also accepts the filing of the articles of organization form online via the New Jersey Secretary of State's online system for e-filing documents.

You would file Restated Certificate form to restate or restate and amend the certificate of incorporation. For profit corporations would file form C-100A Restated Certificate of Incorporation. There are two pages required to restate the certificate. Make sure you submit both pages to the Division of Revenue.

Each state has somewhat different requirements regarding what must be included in the articles of incorporation. Typically, the articles must contain, at the very least: the corporation's name and business address. the number of authorized shares and the par value (if any) of the shares.

The document required to form a corporation in New Jersey is called the Certificate of Incorporation. The information required in the formation document varies by state. New Jersey's requirements include: Officers. Officer names and addresses are not required to be listed in the Certificate of Incorporation.

Out-of-state businesses need to register in New Jersey. The forms you need to complete depend on your New Jersey business activities.