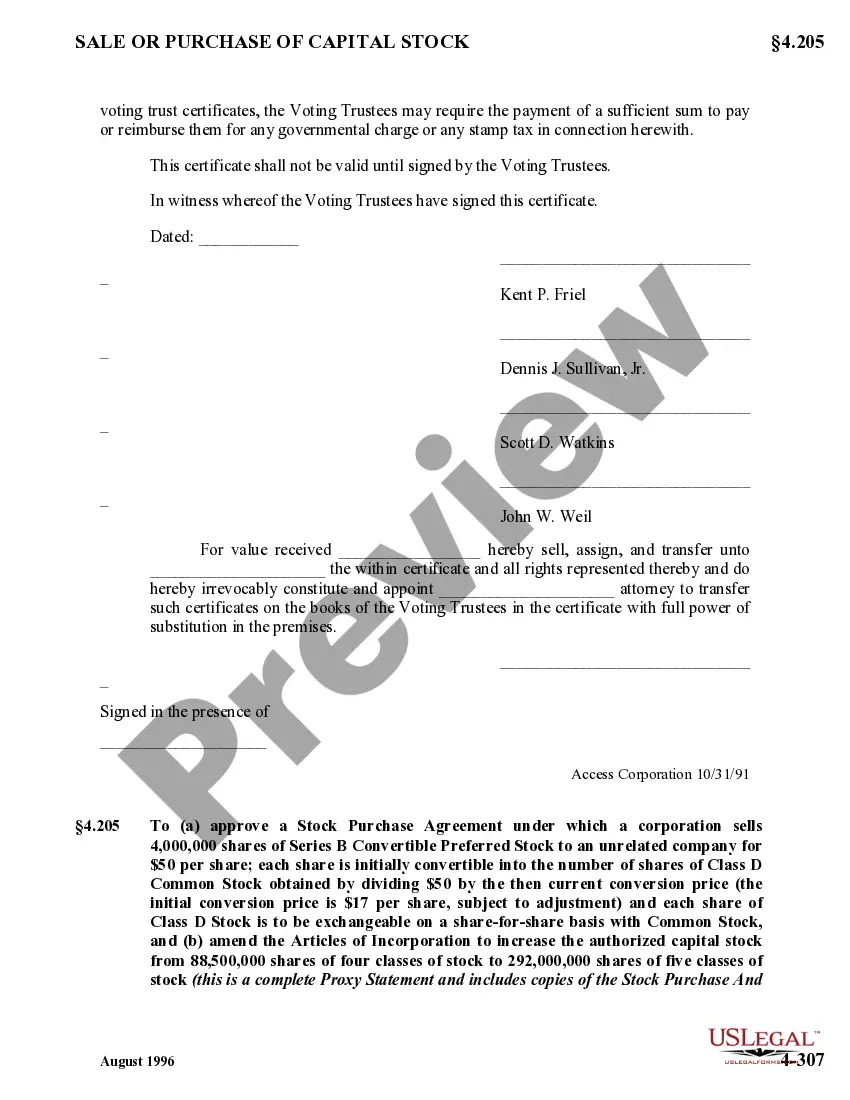

New Jersey Voting Trust Certificate

Description

How to fill out Voting Trust Certificate?

Are you currently in a place in which you need to have papers for possibly organization or person functions virtually every day time? There are a variety of legitimate record themes available online, but getting versions you can depend on is not straightforward. US Legal Forms provides thousands of form themes, just like the New Jersey Voting Trust Certificate, that happen to be published in order to meet federal and state demands.

If you are presently informed about US Legal Forms internet site and have an account, just log in. Following that, you are able to acquire the New Jersey Voting Trust Certificate web template.

Should you not have an accounts and need to begin to use US Legal Forms, abide by these steps:

- Get the form you will need and ensure it is to the right city/state.

- Utilize the Review key to review the form.

- Look at the information to actually have chosen the right form.

- When the form is not what you are looking for, take advantage of the Research field to find the form that fits your needs and demands.

- If you discover the right form, just click Get now.

- Select the rates program you would like, fill in the required details to make your bank account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a handy file file format and acquire your duplicate.

Find all the record themes you have bought in the My Forms food list. You may get a more duplicate of New Jersey Voting Trust Certificate any time, if needed. Just go through the required form to acquire or printing the record web template.

Use US Legal Forms, the most comprehensive selection of legitimate kinds, in order to save some time and stay away from errors. The assistance provides skillfully manufactured legitimate record themes which you can use for a selection of functions. Generate an account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Requirement of Trusts Your trust must include a written declaration of the intent of the document. As part of the trust, you must sign over all deeds for any property or asset gifted to an individual through the trust. Your trust must include a minimum of one beneficiary to be legally valid.

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting.

These beneficiaries, therefore, already have certain rights, including: Distributions as established in the trust document. Right to information in order to understand how to enforce their rights. Right to accounting ? a detailed report of income, expenses, and distributions of the trust.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

The trustee model of representation is a model of a representative democracy, frequently contrasted with the delegate model of representation. In this model, constituents elect their representatives as 'trustees' for their constituency.

Requirement of Trusts Your trust must include a written declaration of the intent of the document. As part of the trust, you must sign over all deeds for any property or asset gifted to an individual through the trust. Your trust must include a minimum of one beneficiary to be legally valid.

If you place your assets in a trust, they are not held up by the probate process and can be distributed immediately upon your death if that is what you wish. A trust also distributes property you own in other states, avoiding probate in those states as well.