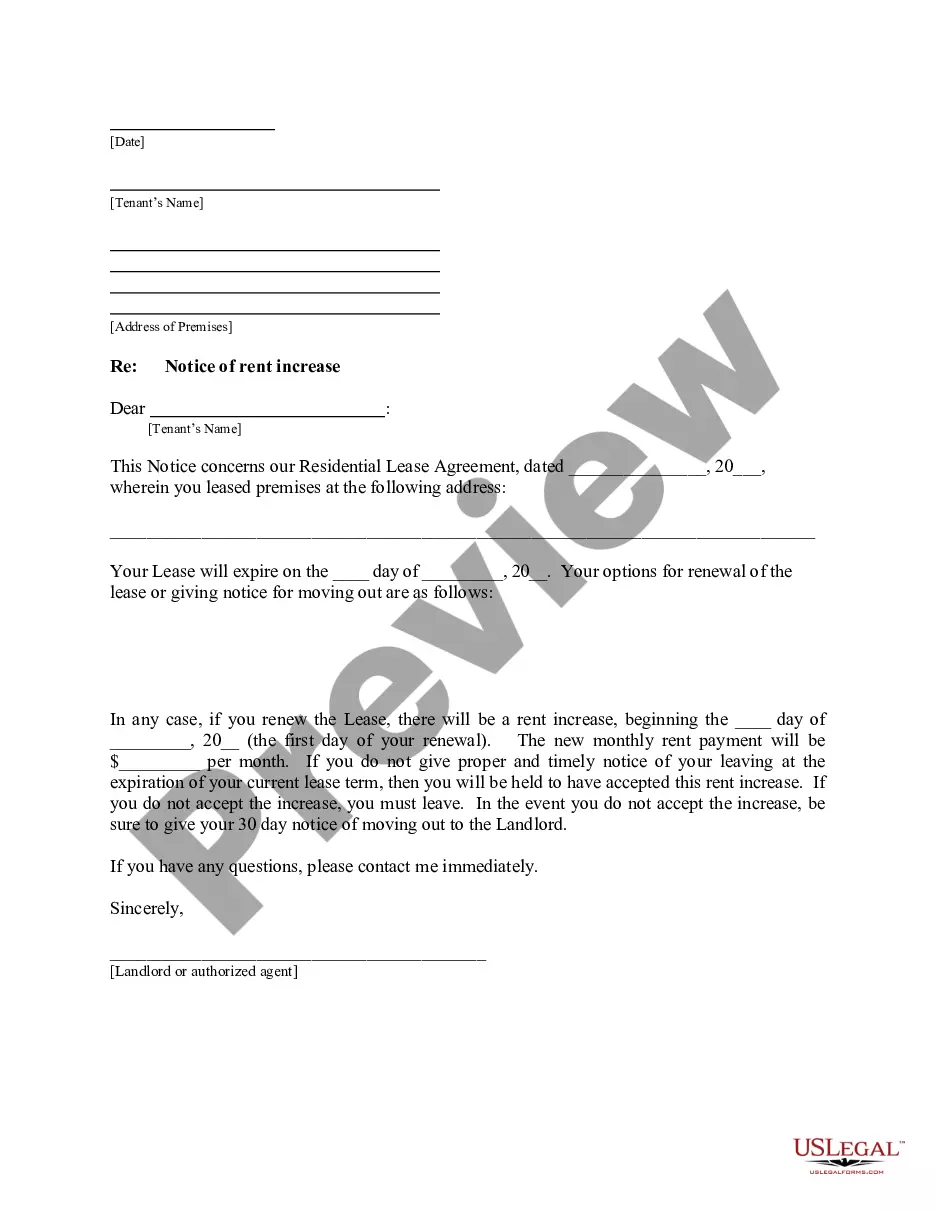

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

New Jersey Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges

Description

How to fill out New Jersey Letter Denying That Alleged Debtor Owes The Amount Of Finance Charges, Interest Or Penalties Being Charged On The Alleged Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes These Charges?

Are you currently inside a place that you need to have paperwork for possibly company or personal functions virtually every time? There are tons of authorized record layouts available on the net, but getting ones you can trust is not straightforward. US Legal Forms provides a large number of type layouts, much like the New Jersey Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges, which can be written to satisfy federal and state requirements.

When you are presently familiar with US Legal Forms site and have an account, merely log in. Next, you can acquire the New Jersey Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges format.

If you do not come with an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the type you want and ensure it is to the appropriate town/county.

- Make use of the Review switch to analyze the shape.

- Read the outline to ensure that you have chosen the right type.

- If the type is not what you are trying to find, utilize the Research field to find the type that fits your needs and requirements.

- Once you obtain the appropriate type, just click Purchase now.

- Pick the rates program you would like, fill in the necessary information to create your account, and pay money for your order making use of your PayPal or bank card.

- Select a convenient document format and acquire your copy.

Discover each of the record layouts you have purchased in the My Forms menus. You may get a additional copy of New Jersey Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges whenever, if required. Just click the necessary type to acquire or printing the record format.

Use US Legal Forms, by far the most substantial collection of authorized varieties, to save lots of time as well as steer clear of faults. The assistance provides professionally made authorized record layouts which you can use for a selection of functions. Create an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

A debt collector may not collect any interest or fee not authorized by the agreement or by law. The interest rate or fees charged on your debt may be increased if your original loan or credit agreement permits it and no law prohibits the increase, or if state law expressly permits the interest or fee.

If a creditor takes too long to take action to recover a debt it becomes 'statute barred', meaning it can no longer be recovered through court action. In practical terms, this effectively means the debt is written off, even though technically it still exists.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

A debt validation letter is a letter a consumer sends to a debt collector requesting the debt collector validate a debt they are trying to collect. It is your first chance to assert your rights before debt collectors.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.