Sample Application Letter For Lending Collector

Description

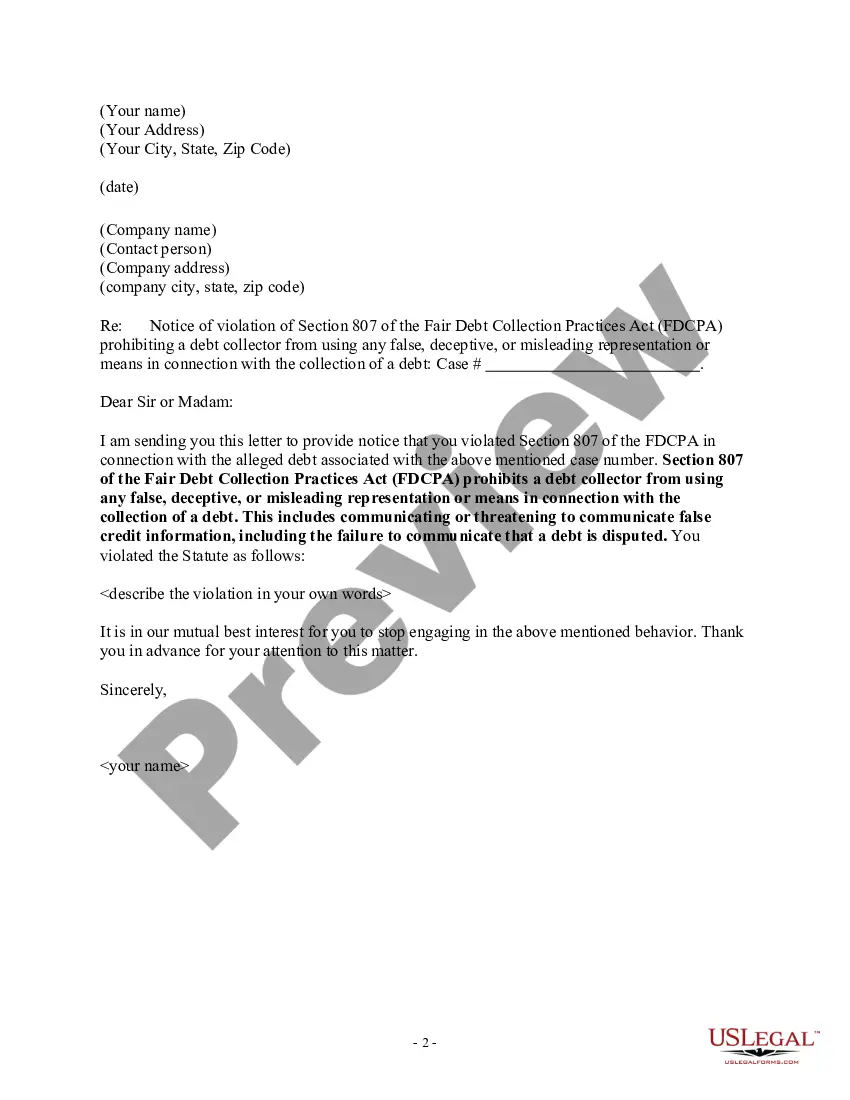

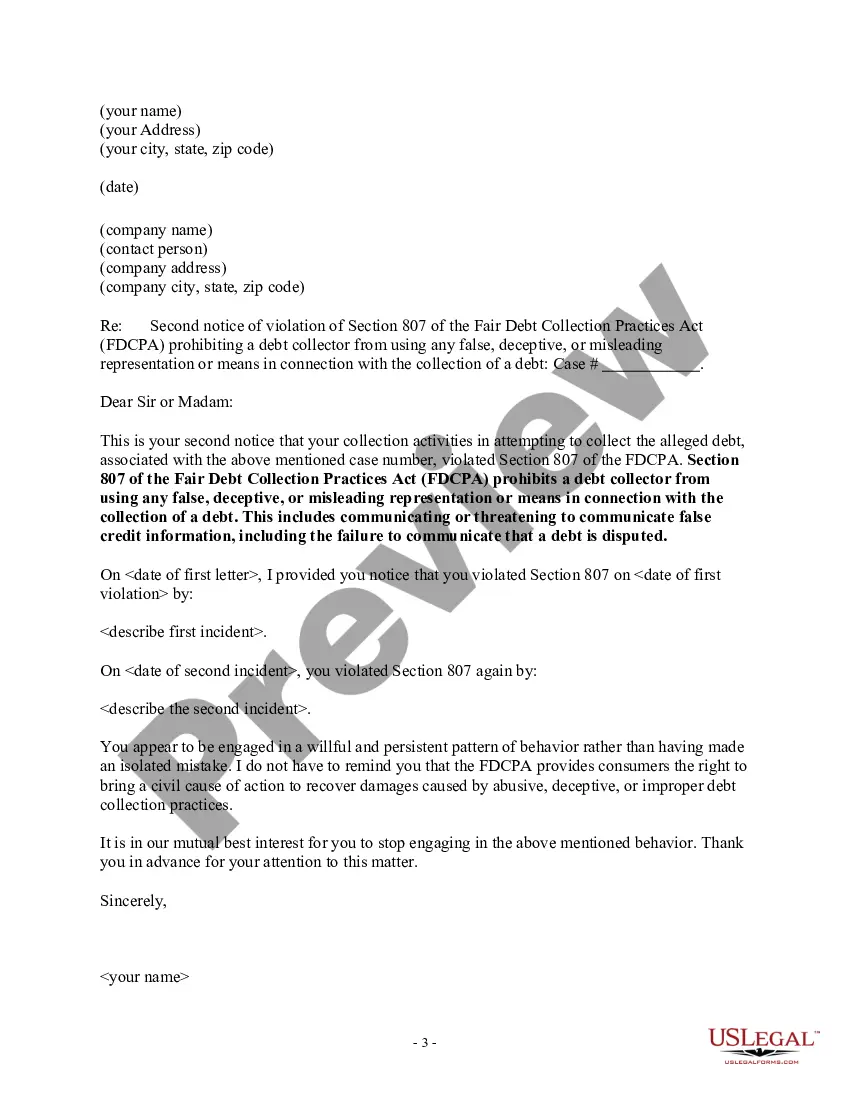

How to fill out New Jersey Notice Of Violation Of Fair Debt Act - False Information Disclosed?

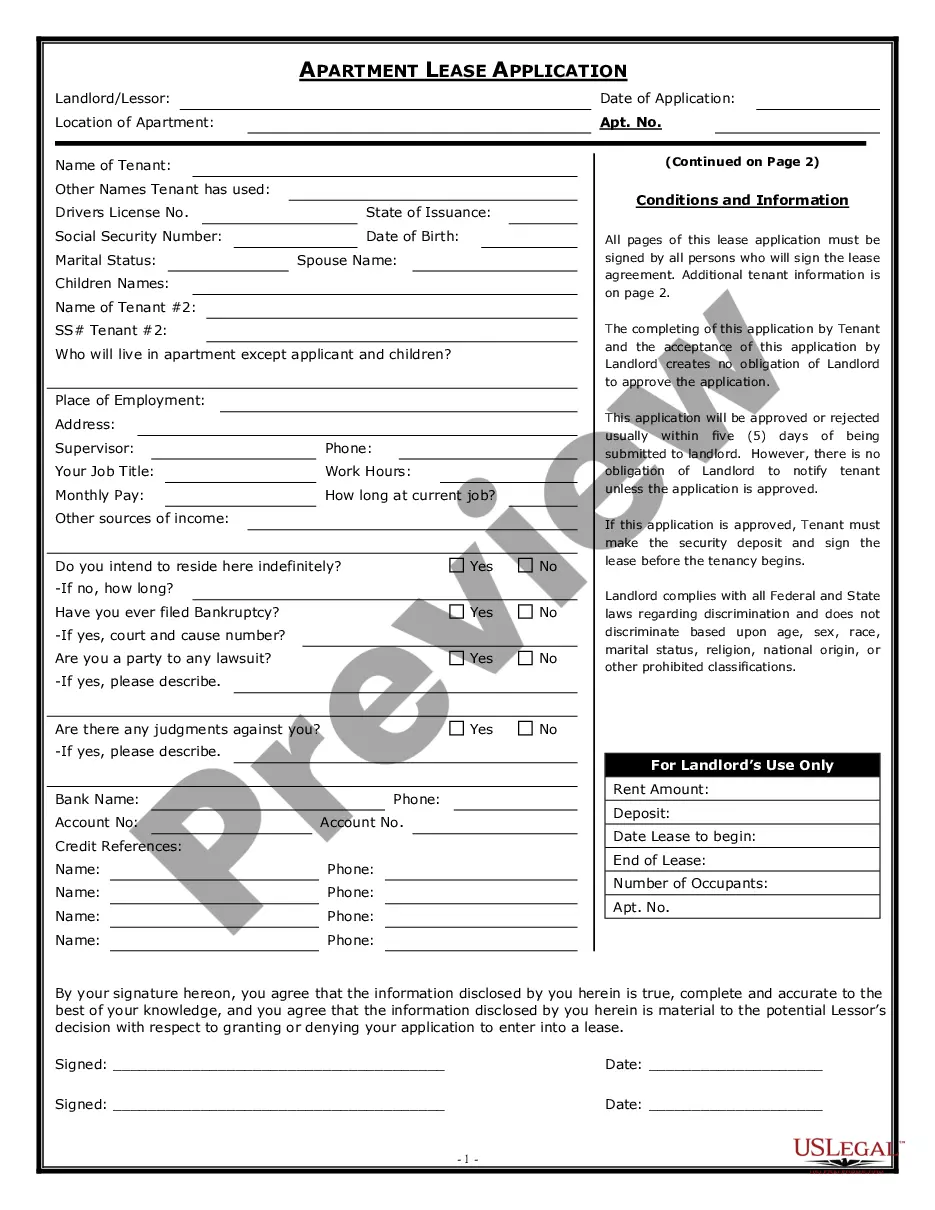

You may commit time on the Internet searching for the lawful record format that suits the state and federal demands you will need. US Legal Forms supplies thousands of lawful varieties that happen to be reviewed by pros. You can actually down load or produce the New Jersey Notice of Violation of Fair Debt Act - False Information Disclosed from our service.

If you have a US Legal Forms profile, you can log in and then click the Download key. Following that, you can comprehensive, revise, produce, or signal the New Jersey Notice of Violation of Fair Debt Act - False Information Disclosed. Each lawful record format you get is the one you have eternally. To acquire yet another copy associated with a bought type, check out the My Forms tab and then click the related key.

If you use the US Legal Forms web site initially, stick to the simple recommendations below:

- Initially, make sure that you have selected the right record format for that region/area of your choice. Browse the type description to ensure you have selected the proper type. If readily available, utilize the Preview key to check through the record format as well.

- In order to find yet another version from the type, utilize the Research area to obtain the format that suits you and demands.

- After you have discovered the format you want, click on Purchase now to continue.

- Pick the costs program you want, type in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal profile to pay for the lawful type.

- Pick the formatting from the record and down load it in your gadget.

- Make adjustments in your record if necessary. You may comprehensive, revise and signal and produce New Jersey Notice of Violation of Fair Debt Act - False Information Disclosed.

Download and produce thousands of record web templates while using US Legal Forms site, which offers the largest variety of lawful varieties. Use specialist and condition-specific web templates to take on your business or personal demands.

Form popularity

FAQ

You have the right to be treated fairly by debt collectors. The Fair Debt Collection Practices Act (FDCPA) applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

This becomes very confusing for merchants because New Jersey currently has no licensing law that specifically applies to debt buying or collecting agencies on the books, However, the court decision, clearly states you can't engage in any of debt buying or lending activities as a consumer lender or sales finance company

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

New Jersey consumers, like those in all states, are protected by the Federal Debt Collection Fair Practices Act. The law has restrictions for when and how debt collectors can contact consumers, and also has protections against deception and harassment by creditors.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The creditor or the debt collector still can sue you to collect the debt. The Fair Debt Collection Practices Act prohibits debt collectors from using abusive, unfair or deceptive practices when attempting to collect a debt.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.