Benefit Advisor Aflac Salary

Description

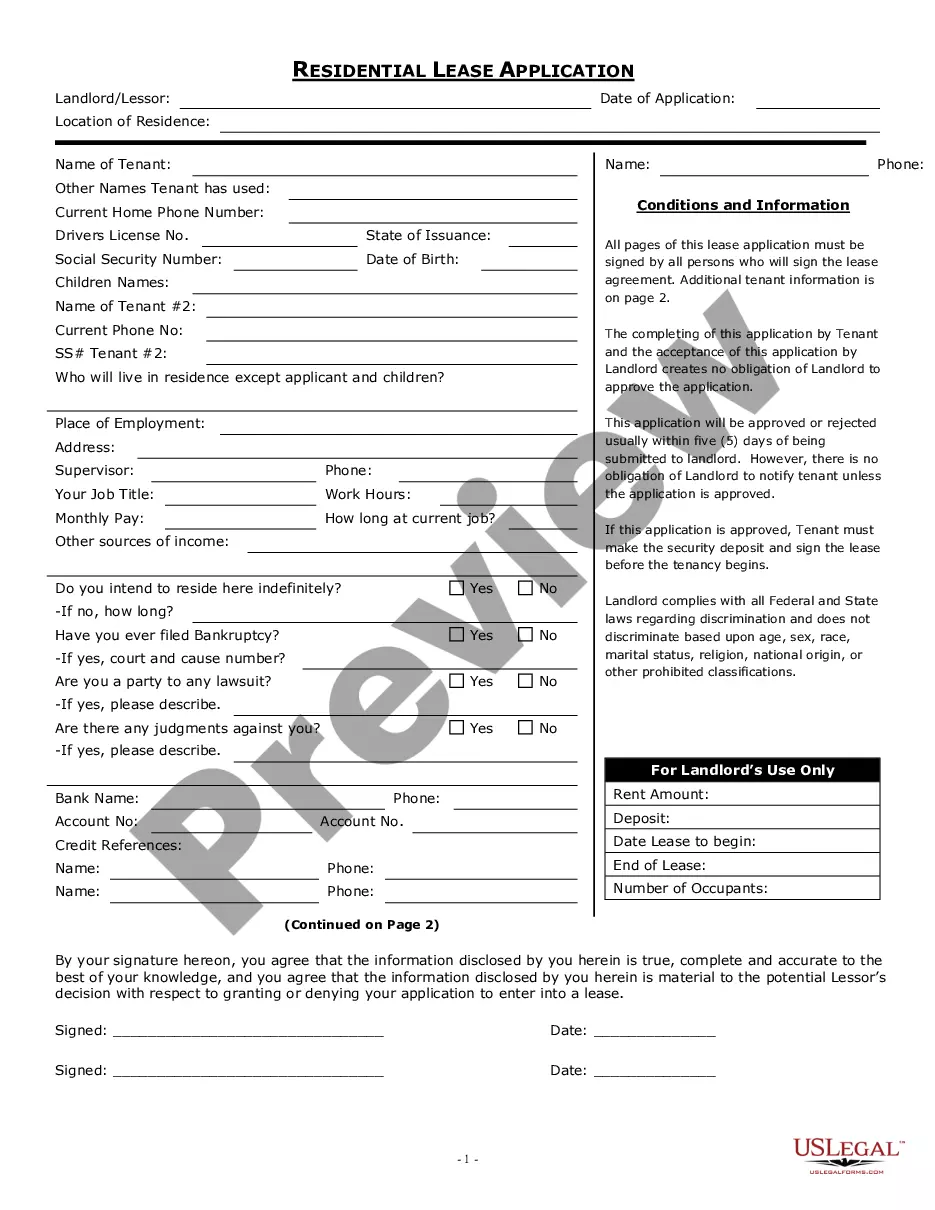

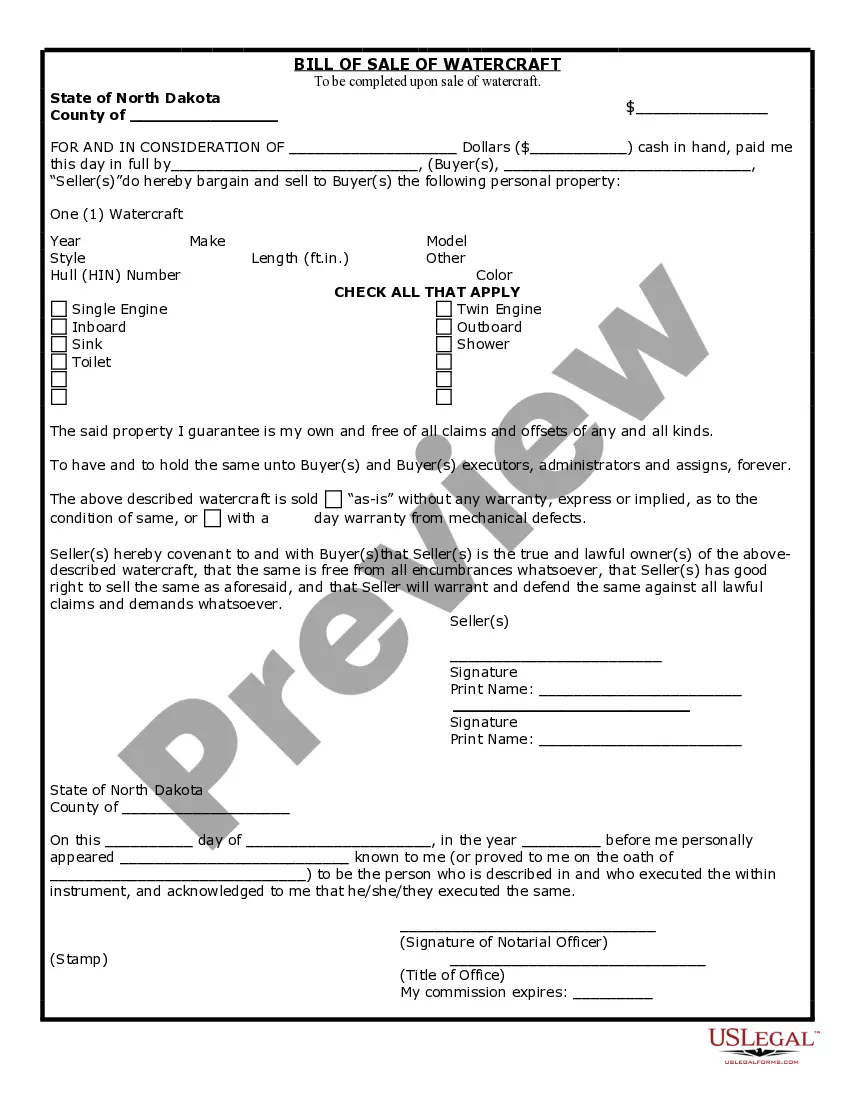

How to fill out New Jersey Benefits Consultant Checklist?

Discovering the right lawful file format could be a battle. Of course, there are a variety of templates available on the net, but how will you get the lawful kind you require? Make use of the US Legal Forms site. The support offers a huge number of templates, for example the New Jersey Benefits Consultant Checklist, which you can use for company and personal requirements. Each of the forms are examined by experts and fulfill federal and state needs.

Should you be previously signed up, log in in your accounts and click the Obtain button to have the New Jersey Benefits Consultant Checklist. Use your accounts to search through the lawful forms you may have bought formerly. Check out the My Forms tab of your accounts and have yet another duplicate from the file you require.

Should you be a new customer of US Legal Forms, here are straightforward recommendations so that you can adhere to:

- Initially, make certain you have chosen the proper kind for your area/county. You may look through the form utilizing the Review button and browse the form explanation to make sure it will be the right one for you.

- When the kind fails to fulfill your expectations, take advantage of the Seach discipline to get the appropriate kind.

- When you are certain the form is proper, go through the Buy now button to have the kind.

- Choose the pricing plan you need and enter in the necessary information. Make your accounts and pay for an order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the document format and download the lawful file format in your device.

- Complete, modify and print out and indication the attained New Jersey Benefits Consultant Checklist.

US Legal Forms is definitely the largest catalogue of lawful forms for which you can discover numerous file templates. Make use of the service to download professionally-created files that adhere to state needs.

Form popularity

FAQ

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

Benefits programs vary greatly, but typically they include medical insurance, life and disability insurance, retirement income plan benefits, paid-time-off benefits, and educational assistance programs. Benefits selection and design are critical components in the total compensation costs.

Common and best employee benefitsPrivate Health Care Plan (Medical, Dental & Vision)Retirement / Pension plans.Training and Development.Stock option plans.Work From Home and/or flexible hours.Food and snacks.Life insurance.Extended leave (Vacation, Sick)More items...

Benefit packages may offer such things as a car allowance, cellphone, gym membership or travel reimbursements to lure top talent from around the world, but they usually start with health insurance for employees, and if possible, for their families. Sometimes, a health care flexible spending account is included.

The Employee Benefits Guide is intended to be a summary of some of the benefits offered to you and your family including: health insurance, dental insurance, vision insurance, life insurance, short-term disability insurance, and flexible spending accounts.

You Probably Need More FriendsHere's How To Make ThemAim To Provide Value To All Employees.Offer Employee Ownership Opportunities.Provide Remote Work Benefits.Add Inclusion And Equity Efforts.Consider Soft Benefits.Offer Free Healthcare.Let Employees Choose.Conduct A Cost/Benefit Analysis.

It can include an annual salary or hourly wages combined with bonus payments, benefits, and incentives. These could include group health care coverage, retirement contributions, and short-term disability insurance.

How to Design an Employee Benefits ProgramStep 1: Identify the organization's benefits objectives and budget.Step 2: Conduct a needs assessment.Step 3: Formulate a benefits plan program.Step 4: Communicate the benefits plan to employees.More items...

Employee benefits plans consist of two parts: One part has mandated benefits, benefits that are required by law, and the other part consists of voluntary benefits, benefits which are offered by the employer out of the goodness of their hearts, so to speak.

Traditionally, most benefits used to fall under one of the four major types of employee benefits, namely: medical insurance, life insurance, retirement plans, and disability insurance.

More info

Up Job Interviews Internship Pay Internships Search Jobs Interviews Resumes Find Work Flag Benefits Consultant Salaries Glassdoor Jobs Companies Salaries Interviews Search Careers Employers Post Discover Jobs Discover Companies Compare Companies Write Review Discover Salaries Salary Calculator Salary Discover Careers Interview Questions Interview Sign Up Job Interviews Internship Pay Internships Search Jobs Interviews Resumes Find Work We'd like to hear from you! If you're curious about Glassdoor's salary data, you can view it here: Glassdoor's 2017 Employee Pay Study. The data includes salaries for all full-time employees — including self-employed individuals and contractors — regardless of whether an employer offers stock options, commissions, bonus pay, or other types of cash compensation.