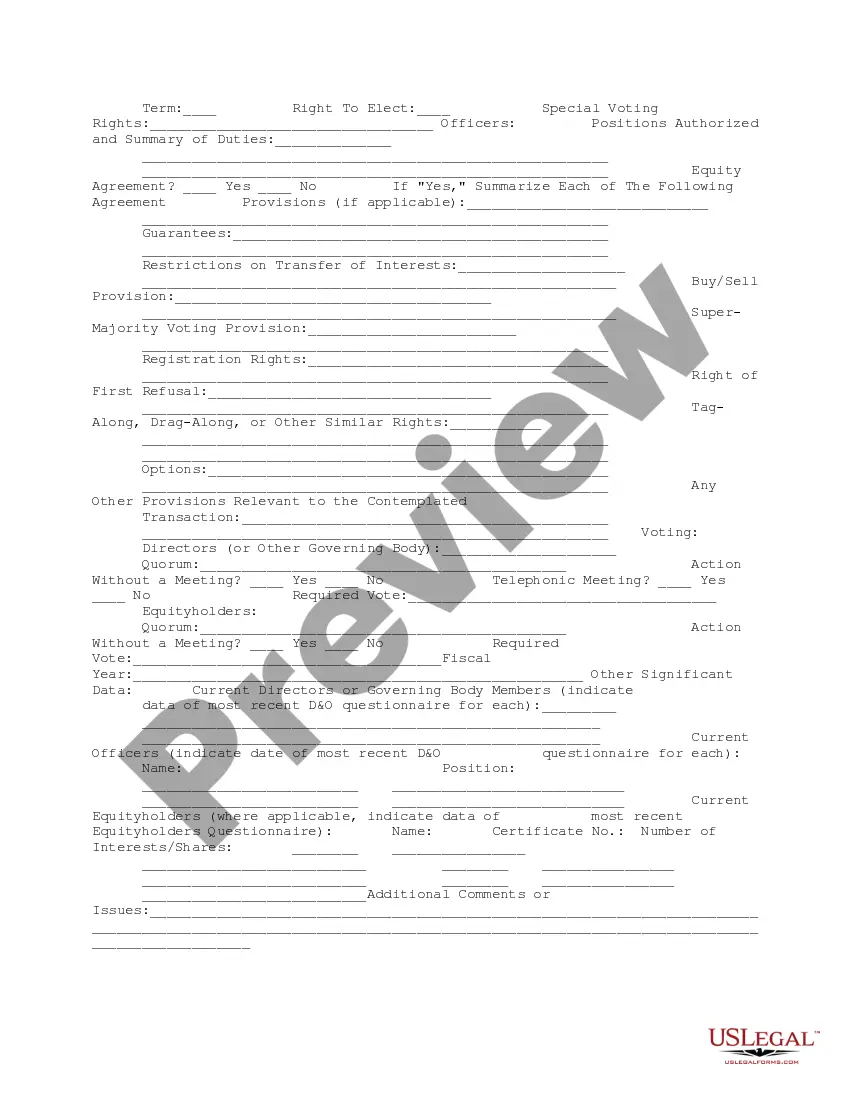

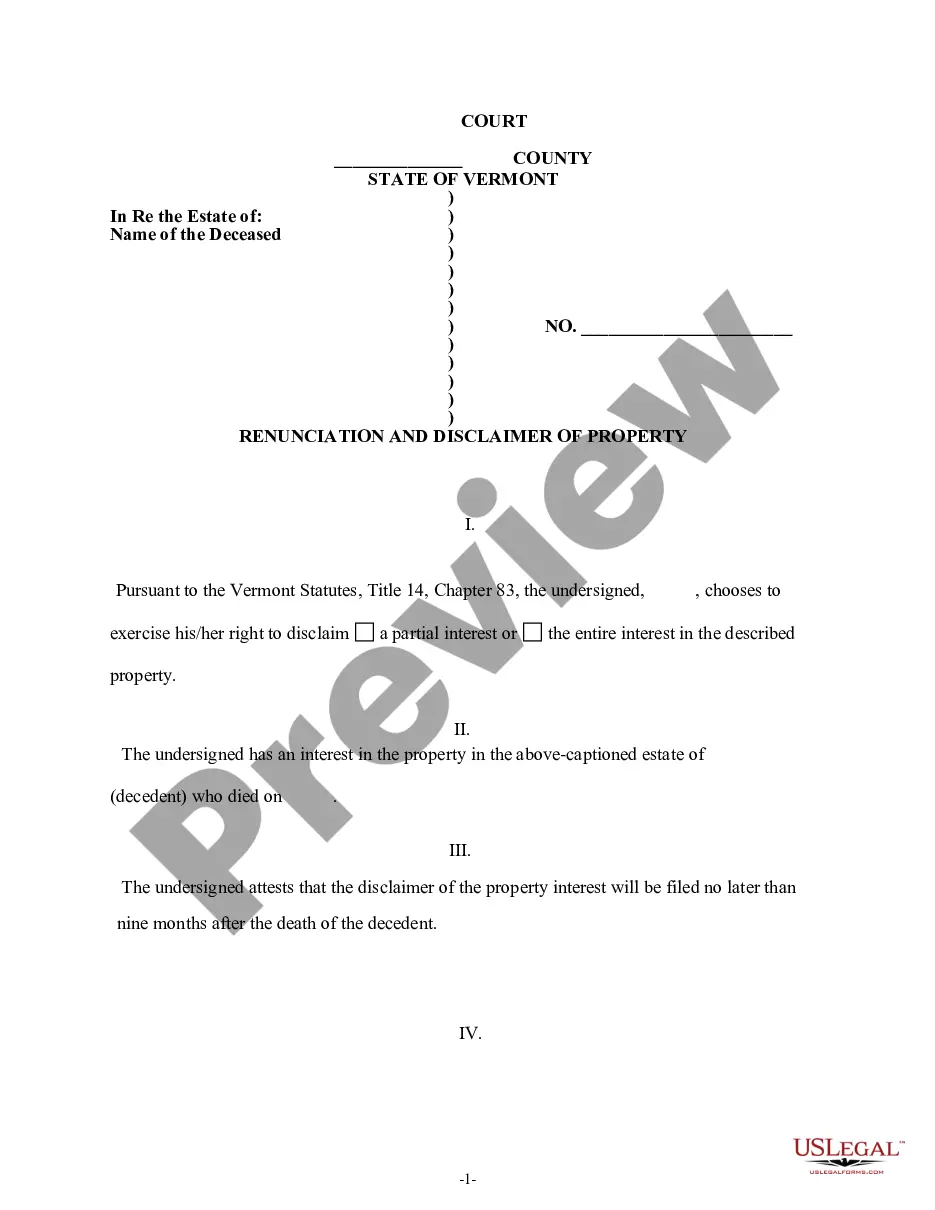

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

New Jersey Company Data Summary

Description

How to fill out New Jersey Company Data Summary?

Discovering the right legal record web template might be a have a problem. Obviously, there are plenty of templates accessible on the Internet, but how do you get the legal kind you need? Utilize the US Legal Forms site. The support gives thousands of templates, like the New Jersey Company Data Summary, that can be used for enterprise and private requirements. Each of the varieties are inspected by specialists and satisfy state and federal demands.

If you are already authorized, log in to your account and click the Acquire option to have the New Jersey Company Data Summary. Use your account to check with the legal varieties you might have ordered previously. Go to the My Forms tab of your respective account and obtain another version of your record you need.

If you are a brand new end user of US Legal Forms, listed below are simple instructions that you can adhere to:

- Very first, make certain you have chosen the right kind for your town/county. You are able to look over the shape while using Review option and look at the shape information to guarantee this is the right one for you.

- In the event the kind will not satisfy your requirements, make use of the Seach area to obtain the right kind.

- When you are certain that the shape is suitable, select the Acquire now option to have the kind.

- Opt for the costs strategy you want and type in the needed information. Build your account and pay for your order utilizing your PayPal account or charge card.

- Choose the data file structure and down load the legal record web template to your device.

- Full, change and print out and signal the acquired New Jersey Company Data Summary.

US Legal Forms is definitely the greatest local library of legal varieties where you can discover different record templates. Utilize the company to down load expertly-created paperwork that adhere to condition demands.

Form popularity

FAQ

A NJ Annual Report is a yearly document that nonprofit and profit-based corporations must file. In addition, Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs) must file the same report. The content of the report outlines the status of an organization.

NJ Revenue Businesses that fail to file annual reports for two consecutive years may have their charter voided or authority to do business in New Jersey revoked. Similarly, corporations that fail to file corporation business taxes may be voided or revoked.

A NJ Annual Report is a yearly document that nonprofit and profit-based corporations must file. In addition, Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs) must file the same report. The content of the report outlines the status of an organization.

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee. The report is due on the last day of the month in the month in which you completed your business formation (LLC, Corporation etc).

Yes, New Jersey LLCs must pay a $75 annual report fee every year.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting.

NJ Revenue Businesses that fail to file annual reports for two consecutive years may have their charter voided or authority to do business in New Jersey revoked. Similarly, corporations that fail to file corporation business taxes may be voided or revoked.

After failing to file your corporation's annual report on time, the state will write to you and may impose a late filing penalty that you must pay in addition to your regular annual report filing cost. The state will tell you when you must file by to avoid further action.

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee. The report is due on the last day of the month in the month in which you completed your business formation (LLC, Corporation etc).