New Jersey Sale and Servicing Agreement is a legally binding contract that outlines the terms and conditions between a lender or creditor and a borrower or debtor for sale and servicing of mortgage loans in the state of New Jersey. This agreement governs the relationship between the parties involved in the origination, transfer, and servicing of mortgage loans. The New Jersey Sale and Servicing Agreement defines the rights and responsibilities of both the lender and borrower regarding the sale of mortgage loans, as well as the ongoing servicing of the loans. It includes provisions related to loan origination, loan transfers, loan terms, repayment terms, interest rates, default and foreclosure procedures, and the rights and obligations of both parties involved. Keywords: New Jersey Sale and Servicing Agreement, legal contract, lender, creditor, borrower, debtor, mortgage loans, origination, transfer, servicing, rights, responsibilities, loan terms, repayment terms, interest rates, default, foreclosure procedures. There are various types of New Jersey Sale and Servicing Agreements, including: 1. Mortgage Sale and Servicing Agreement: This type of agreement is entered into between a mortgage lender or creditor and a borrower or debtor. It governs the sale and servicing of mortgage loans, including the terms and conditions related to interest rates, payment schedules, escrow accounts, prepayment penalties, and loan default procedures. 2. Commercial Loan Sale and Servicing Agreement: This agreement is specific to commercial loans and outlines the terms and conditions between a commercial lender or creditor and a borrower or debtor. It covers the sale and servicing of commercial loans, including loan terms, interest rates, payment schedules, default procedures, and collateral requirements. 3. Residential Loan Sale and Servicing Agreement: This agreement focuses on the sale and servicing of residential mortgage loans. It is entered into between a residential lender or creditor and a borrower or debtor and covers the terms and conditions related to loan origination, interest rates, repayment terms, escrow accounts, and default procedures. 4. Consumer Loan Sale and Servicing Agreement: This type of agreement pertains to the sale and servicing of consumer loans, such as personal loans, auto loans, or student loans. It governs the relationship between a lender or creditor and a borrower or debtor, specifying the loan terms, interest rates, repayment schedules, and procedures for default and loan modification. Overall, New Jersey Sale and Servicing Agreement is a crucial legal document that protects the rights and interests of both lenders and borrowers in New Jersey when it comes to the sale and servicing of various types of loans. It ensures transparency, compliance with regulations, and establishes clear guidelines for loan origination, repayment, and default procedures.

New Jersey Sale and Servicing Agreement

Description

How to fill out New Jersey Sale And Servicing Agreement?

Have you been inside a place in which you need files for both company or individual purposes virtually every day time? There are a lot of authorized papers themes available online, but getting types you can rely on is not straightforward. US Legal Forms gives a huge number of form themes, just like the New Jersey Sale and Servicing Agreement, which are created to meet state and federal demands.

When you are currently familiar with US Legal Forms web site and possess your account, simply log in. Following that, you are able to down load the New Jersey Sale and Servicing Agreement format.

If you do not provide an accounts and need to begin using US Legal Forms, follow these steps:

- Find the form you require and ensure it is for the correct town/state.

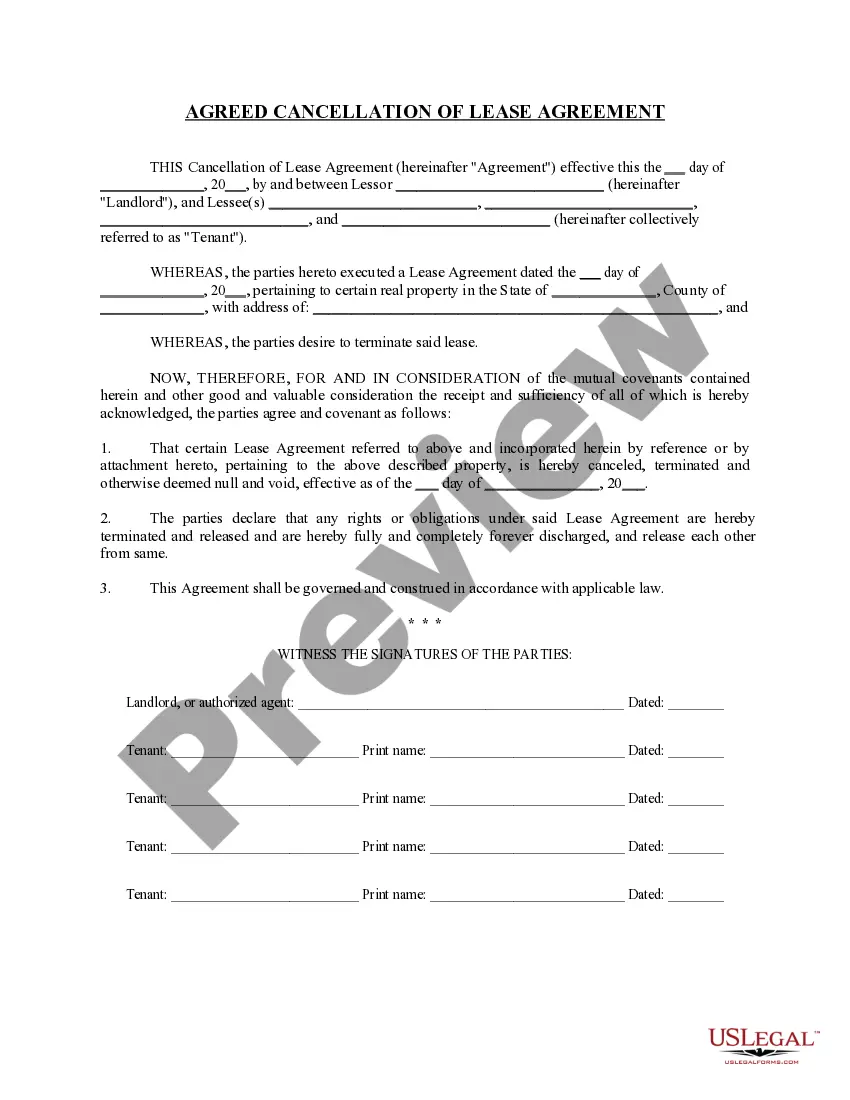

- Utilize the Preview button to check the shape.

- Read the description to actually have selected the correct form.

- If the form is not what you are trying to find, take advantage of the Lookup industry to obtain the form that meets your needs and demands.

- Once you obtain the correct form, click Get now.

- Choose the pricing strategy you need, complete the specified information and facts to produce your account, and pay money for the transaction with your PayPal or bank card.

- Select a convenient paper file format and down load your duplicate.

Find every one of the papers themes you may have purchased in the My Forms food selection. You can get a additional duplicate of New Jersey Sale and Servicing Agreement whenever, if required. Just click on the necessary form to down load or produce the papers format.

Use US Legal Forms, one of the most considerable variety of authorized types, to conserve time and prevent blunders. The service gives professionally manufactured authorized papers themes that you can use for a selection of purposes. Make your account on US Legal Forms and commence creating your lifestyle a little easier.