New Jersey Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

How to fill out Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

You can devote time on the Internet looking for the lawful document format that meets the federal and state needs you need. US Legal Forms offers a huge number of lawful kinds that happen to be evaluated by experts. It is simple to obtain or print out the New Jersey Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc from my support.

If you already possess a US Legal Forms account, you can log in and click the Down load key. Next, you can total, revise, print out, or indicator the New Jersey Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc. Each lawful document format you buy is your own property forever. To acquire yet another copy of any obtained develop, proceed to the My Forms tab and click the related key.

If you use the US Legal Forms website the first time, follow the simple instructions below:

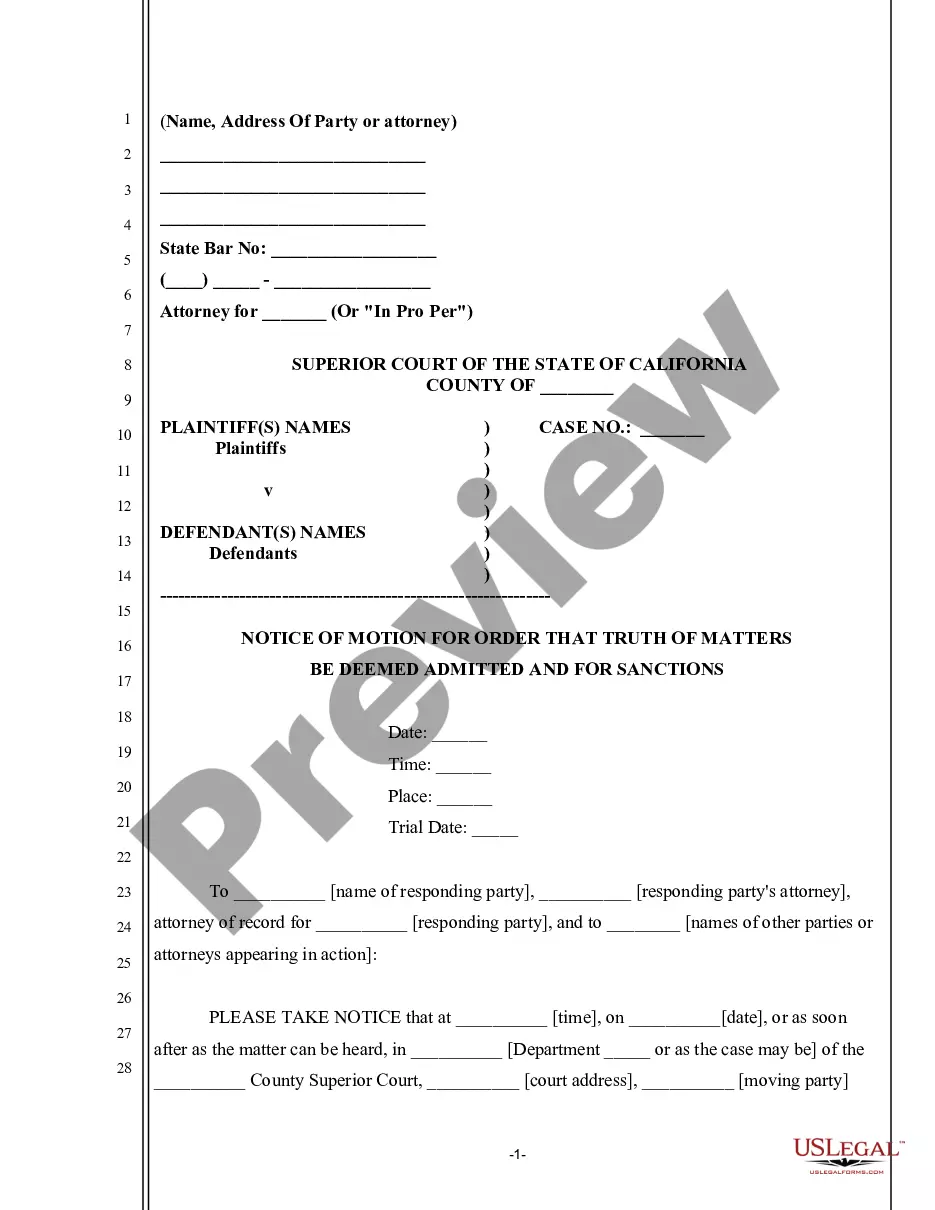

- Very first, make certain you have chosen the best document format for your county/area of your choosing. Browse the develop information to make sure you have picked the appropriate develop. If available, make use of the Preview key to search with the document format also.

- If you wish to find yet another edition from the develop, make use of the Research industry to discover the format that meets your needs and needs.

- Upon having discovered the format you want, click Buy now to continue.

- Choose the pricing plan you want, type in your accreditations, and register for a merchant account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal account to purchase the lawful develop.

- Choose the formatting from the document and obtain it for your device.

- Make adjustments for your document if possible. You can total, revise and indicator and print out New Jersey Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

Down load and print out a huge number of document themes using the US Legal Forms website, which provides the largest collection of lawful kinds. Use specialist and condition-particular themes to take on your organization or specific needs.