Title: Exploring the New Jersey Participation Agreements between First American Ins. Portfolios, Inc., and SET Investments Distribution Co. Introduction: In this article, we delve into the details of the New Jersey Participation Agreement between First American Ins. Portfolios, Inc. and SET Investments Distribution Co. We shed light on the features, benefits, and different types of agreements, providing a comprehensive understanding of these agreements in the context of New Jersey. 1. Understanding the New Jersey Participation Agreement: The New Jersey Participation Agreement between First American Ins. Portfolios, Inc. and SET Investments Distribution Co. represents a contractual relationship that outlines the terms and conditions under which both parties collaborate and engage in specific investment activities in the state of New Jersey. 2. Features and Benefits of New Jersey Participation Agreements: — Customizable Framework: These agreements are customizable, allowing parties to set specific investment goals, risk thresholds, and involvement levels based on their individual requirements. — Risk Mitigation: Participants in these agreements enjoy the benefit of sharing investment risks with the opportunity for collective growth and profit. — Regulatory Compliance: New Jersey Participation Agreements are designed to comply with the state's legal and regulatory frameworks, ensuring a secure and transparent investment environment. — Diversification Opportunities: Participants gain access to diversified investment portfolios tailored to meet their specific financial objectives. 3. Types of New Jersey Participation Agreements: a. Active Investment Agreement: This agreement involves direct and active participation by both parties, where investment decisions are made jointly through regular collaboration, monitoring, and evaluation. b. Passive Investment Agreement: In this type, First American Ins. Portfolios, Inc. mainly takes the role of an investment manager, while SET Investments Distribution Co. acts as a passive investor. The investment decisions rely on the expertise and recommendations provided by First American Ins. Portfolios, Inc. c. Sector-Specific Agreements: These agreements focus on specific sectors, such as technology, healthcare, real estate, or renewable energy. Participants align their investments with their sector preferences, aiming to capitalize on industry-specific opportunities. d. Duration-Based Agreements: Participants can also choose different duration-based agreements, such as short-term, medium-term, or long-term, based on their investment horizon and financial goals. 4. Key Elements of the New Jersey Participation Agreement: To ensure clarity and understanding, the New Jersey Participation Agreement typically includes the following essential components: — Identification of the participating parties, specifying their roles and responsibilities. — Investment objectives, strategies, and asset allocation guidelines. — Compensation structure, including fees, commissions, and profit sharing arrangements. — Procedures for monitoring and reporting investment performance. — Terms for termination, withdrawal, or modification of the agreement. — Indemnification and dispute resolution clauses. Conclusion: With a detailed understanding of the New Jersey Participation Agreement between First American Ins. Portfolios, Inc. and SET Investments Distribution Co., prospective participants can make informed decisions about their investment strategies in New Jersey. These agreements facilitate collaborative investment opportunities while offering customized solutions tailored to individual preferences and objectives. It is important to consult with legal and financial professionals before entering into any participation agreement.

New Jersey Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.

Description

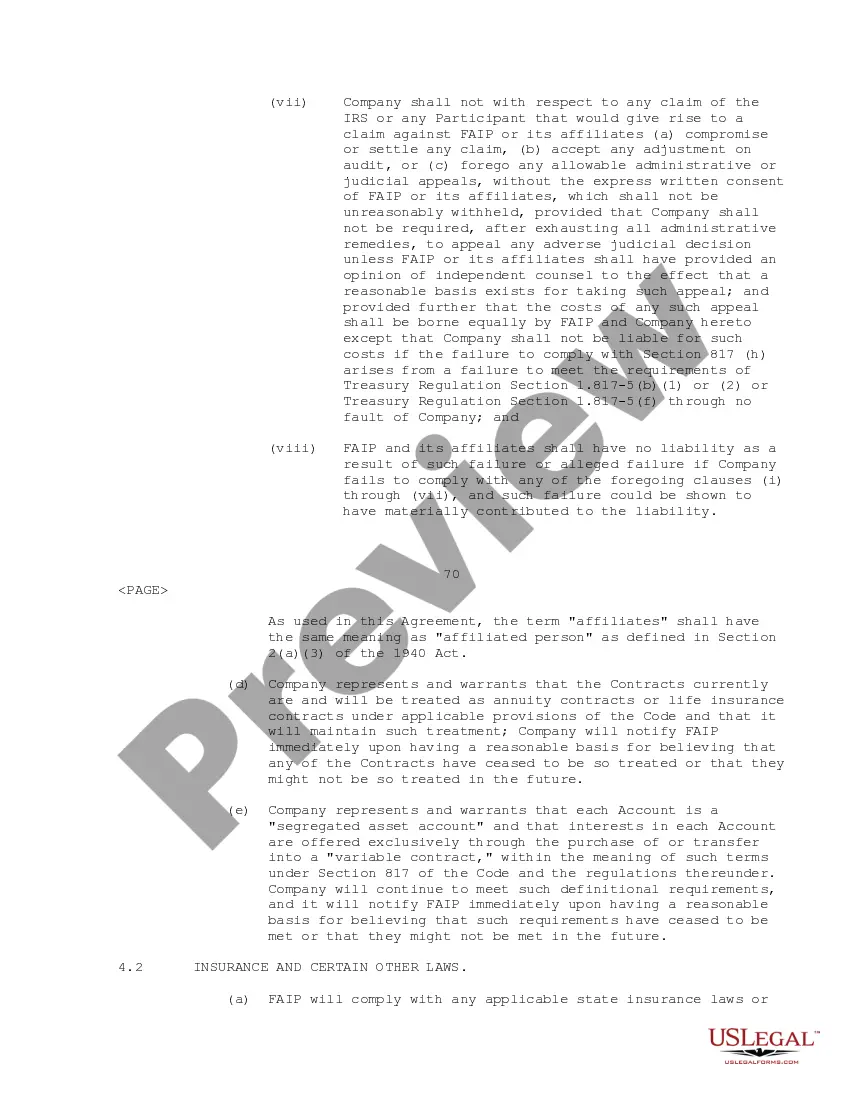

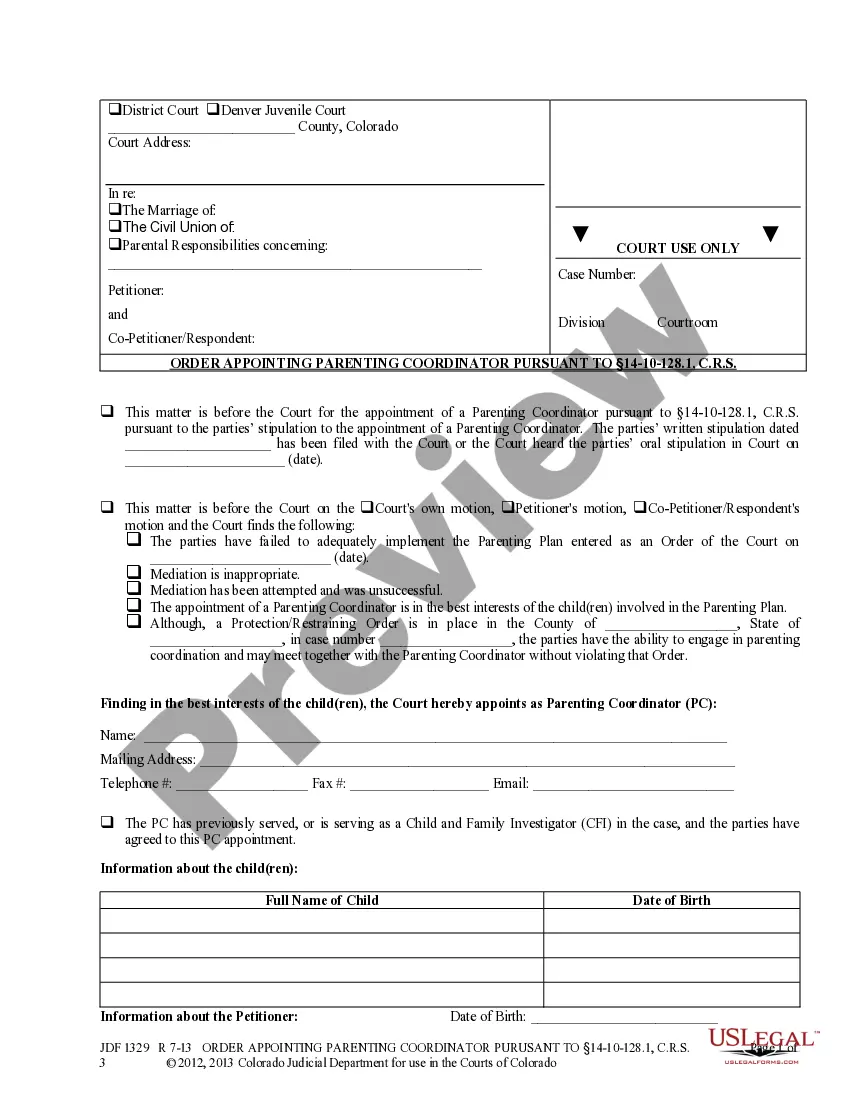

How to fill out New Jersey Participation Agreement Between First American Ins. Portfolios, Inc., SEI Investments Distribution Co.?

Have you been in the situation that you need papers for either enterprise or person purposes almost every working day? There are tons of legal file themes accessible on the Internet, but finding versions you can rely on isn`t effortless. US Legal Forms delivers a large number of type themes, just like the New Jersey Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co., that are written to satisfy federal and state specifications.

Should you be currently acquainted with US Legal Forms web site and possess your account, merely log in. Following that, you can download the New Jersey Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co. template.

If you do not have an account and need to start using US Legal Forms, follow these steps:

- Find the type you require and make sure it is for the right area/region.

- Take advantage of the Review option to check the form.

- Read the outline to ensure that you have selected the correct type.

- When the type isn`t what you`re searching for, use the Look for discipline to get the type that meets your needs and specifications.

- When you get the right type, click Purchase now.

- Pick the rates plan you need, fill in the desired info to create your money, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient paper format and download your backup.

Locate all the file themes you possess purchased in the My Forms menus. You can get a additional backup of New Jersey Participation Agreement between First American Ins. Portfolios, Inc., SEI Investments Distribution Co. whenever, if necessary. Just click on the needed type to download or print the file template.

Use US Legal Forms, probably the most substantial assortment of legal kinds, to conserve time as well as prevent blunders. The assistance delivers appropriately produced legal file themes which can be used for a selection of purposes. Generate your account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

The ownership structure of SEI Investments Company (SEIC) stock is a mix of institutional, retail and individual investors. Approximately 62.23% of the company's stock is owned by Institutional Investors, 9.04% is owned by Insiders and 28.72% is owned by Public Companies and Individual Investors. Who owns Sei Investments Company? SEIC Stock Ownership Tipranks ? stocks ? seic ? ownership Tipranks ? stocks ? seic ? ownership

Vanguard owns the most shares of Sei Investments Company (SEIC).

We deliver technology and investment solutions that help our clients power growth, make confident decisions, and protect futures.

Through its subsidiaries and partnerships in which the company has significant interests, SEI manages, advises or administers $1 trillion in hedge funds, private equity, mutual funds and pooled or separately managed assets. SEI Investments Company - Wikipedia Wikipedia ? wiki ? SEI_Investments_C... Wikipedia ? wiki ? SEI_Investments_C...

$7.86 billion SEI Investments Company has a market cap or net worth of $7.86 billion as of December 1, 2023. Its market cap has decreased by -5.71% in one year. SEI Investments Company (SEIC) Market Cap & Net Worth stockanalysis.com ? stocks ? seic ? market-cap stockanalysis.com ? stocks ? seic ? market-cap

Going Public: How it started, how it's going looks back on the decision to take SEI public in 1981, during a time of economic uncertainty.

SEI Investments Company, formerly Simulated Environments Inc, is a financial services company headquartered in Oaks, Pennsylvania, United States. The company describes itself as "a global provider of investment processing, investment management, and investment operations solutions".

1981 West Jr. discusses the decision to take SEI public in 1981, during a time of economic uncertainty. Podcast: Going public: How it started, how it's going | SEI seic.com ? podcasts ? podcast-going-public-... seic.com ? podcasts ? podcast-going-public-...