New Jersey Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

How to fill out Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

Are you currently in the position where you will need papers for both organization or person uses nearly every working day? There are a lot of legitimate record templates available on the Internet, but finding ones you can trust is not simple. US Legal Forms offers 1000s of kind templates, like the New Jersey Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation, that are written in order to meet federal and state demands.

In case you are currently informed about US Legal Forms site and possess a merchant account, just log in. Following that, you can obtain the New Jersey Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation web template.

If you do not come with an profile and need to begin using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for your correct city/state.

- Use the Preview key to analyze the shape.

- Look at the information to actually have chosen the proper kind.

- In the event the kind is not what you are searching for, make use of the Look for area to find the kind that meets your needs and demands.

- Whenever you get the correct kind, just click Purchase now.

- Choose the pricing plan you need, fill out the required information to produce your bank account, and purchase the order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and obtain your duplicate.

Locate all of the record templates you possess purchased in the My Forms menus. You can aquire a further duplicate of New Jersey Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation anytime, if needed. Just click the necessary kind to obtain or produce the record web template.

Use US Legal Forms, probably the most extensive selection of legitimate kinds, to save lots of time as well as prevent errors. The support offers skillfully created legitimate record templates which you can use for a variety of uses. Generate a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock. An acquisition is slightly different and often does not involve a change in management.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs.

A merger is a form of legal consolidation, where two (or more) companies form a single entity that supersedes the previously existing companies. But in an acquisition, where one company purchases another, the buyer company continues to exist.

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

If the necessary majority of the corporation's shareholders approve a merger or consolidation, it will go forward, and the shareholders will be compensated. However no shareholder who votes against the transaction is required to accept shares in the surviving or successor corporation.

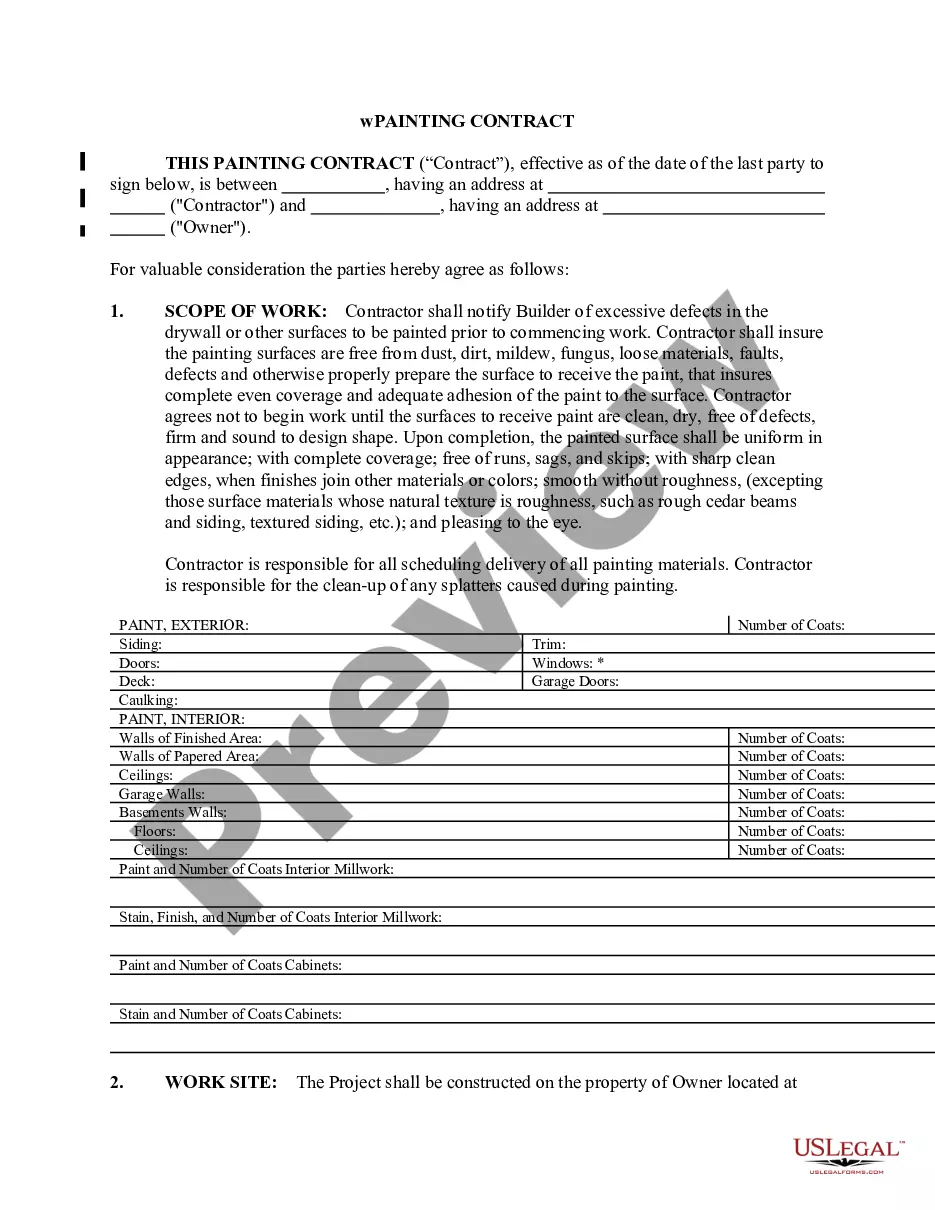

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

A merger happens when two companies combine to form a single entity. Public companies often merge with the declared goal of increasing shareholder value, by gaining market share or from entering new business segments. Unlike an acquisition, a merger can result in a brand new entity formed from the two merging firms.

Mergers and acquisitions (M&As) are the acts of consolidating companies or assets, with an eye toward stimulating growth, gaining competitive advantages, increasing market share, or influencing supply chains.