A New Jersey Merger Agreement refers to a legally binding contract that outlines the terms and conditions of the merger between two entities, Bay Micro Computers, Inc. and BMC Acquisition Corporation. This agreement sets forth the rights, responsibilities, and obligations of both parties involved in the merger transaction. It entails a comprehensive and detailed description of the merger process, including the exchange of shares, assets, and liabilities between the two companies. Key terms and keywords relevant to this New Jersey Merger Agreement include: 1. Merger: The act of combining two separate entities, Bay Micro Computers, Inc. and BMC Acquisition Corporation, into a single company. 2. Agreement: The legal document that outlines the terms and conditions of the merger. 3. Merger Consideration: The assets, shares, or cash that will be exchanged between the merging companies as part of the merger transaction. 4. Shareholder Approval: The requirement for both companies' shareholders to vote in favor of the merger, as specified in the agreement. 5. Effective Date: The specified date when the merger becomes legally binding and takes effect. 6. Board of Directors: The individuals responsible for managing and overseeing the operations of both Bay Micro Computers, Inc. and BMC Acquisition Corporation. 7. Articles of Merger: The formal documents filed with the State of New Jersey's Secretary of State to legally document the merger. 8. Conditions Precedent: Terms that must be fulfilled or events that must occur before the merger can be completed, such as regulatory approvals or third-party consents. 9. Representations and Warranties: Statements made by both companies to affirm the accuracy of the information provided during the merger process. 10. Termination: The provision that outlines the circumstances under which the merger agreement can be terminated, including breaches of contract or failure to satisfy specific conditions. Different types of New Jersey Merger Agreements between Bay Micro Computers, Inc. and BMC Acquisition Corporation can include: 1. Stock-for-Stock Merger: The merger agreement where the shareholders of Bay Micro Computers, Inc. receive shares of BMC Acquisition Corporation in exchange for their existing shares. 2. Asset Acquisition Merger: The merger agreement where Bay Micro Computers, Inc. transfers its assets to BMC Acquisition Corporation in exchange for cash or other assets. 3. Reverse Merger: A type of merger where BMC Acquisition Corporation, the acquiring company, merges into Bay Micro Computers, Inc., the target company. As a result, BMC Acquisition Corporation's stockholders become the majority shareholders of Bay Micro Computers, Inc. In conclusion, a New Jersey Merger Agreement serves as the legal foundation for the merger between Bay Micro Computers, Inc. and BMC Acquisition Corporation. It specifies the terms, conditions, and types of exchanges involved in the merger transaction, ultimately shaping the future of the combined entity.

New Jersey Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation

Description

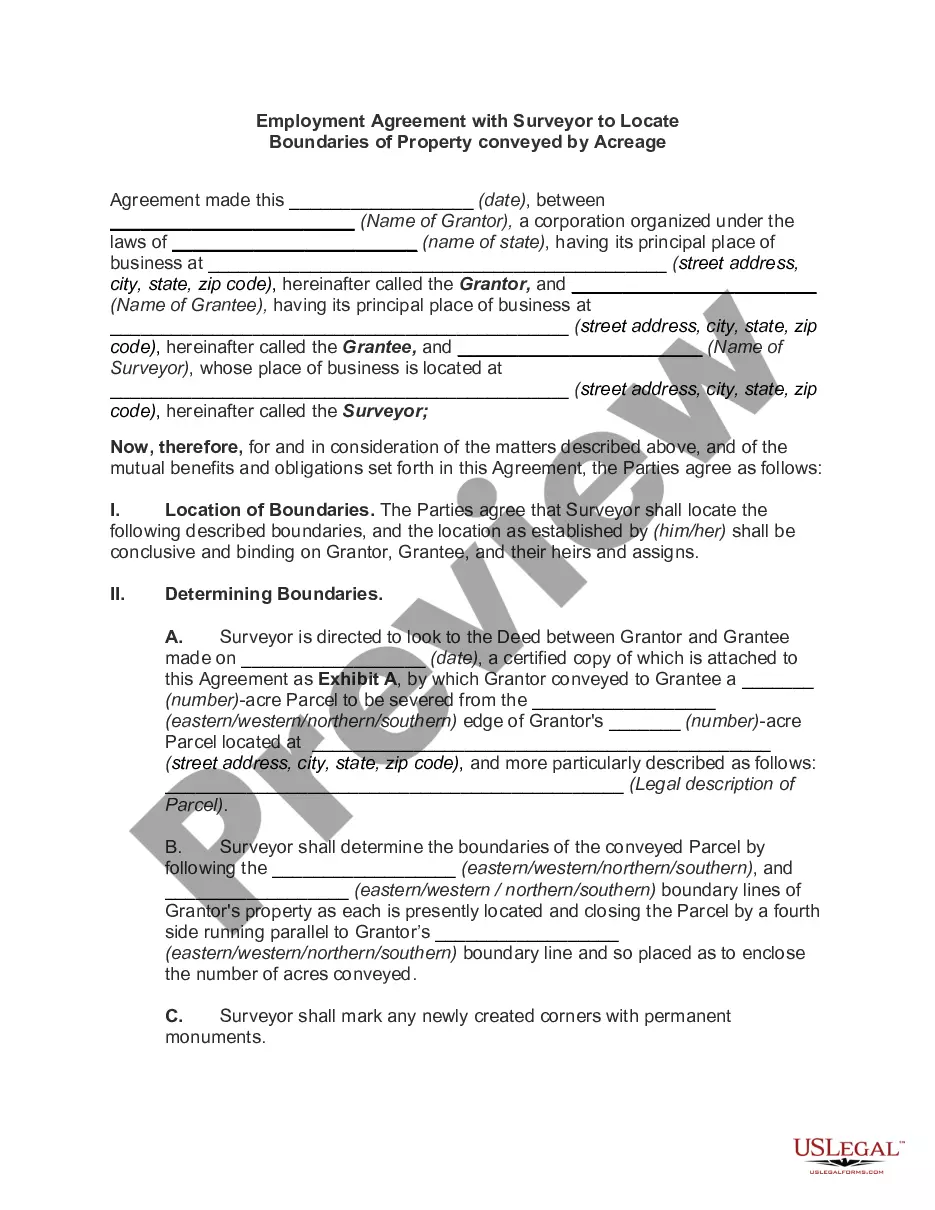

How to fill out New Jersey Merger Agreement Between Bay Micro Computers, Inc. And BMC Acquisition Corporation?

If you wish to full, download, or print out authorized file web templates, use US Legal Forms, the largest collection of authorized forms, which can be found on-line. Take advantage of the site`s basic and hassle-free research to find the files you will need. Numerous web templates for organization and individual uses are sorted by categories and states, or keywords. Use US Legal Forms to find the New Jersey Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation in a handful of mouse clicks.

In case you are presently a US Legal Forms buyer, log in for your accounts and click on the Download option to find the New Jersey Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation. Also you can entry forms you in the past acquired in the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for the appropriate town/country.

- Step 2. Use the Review option to look over the form`s articles. Do not overlook to learn the information.

- Step 3. In case you are unsatisfied together with the kind, make use of the Lookup field on top of the display screen to get other versions of your authorized kind web template.

- Step 4. After you have found the form you will need, go through the Purchase now option. Select the prices strategy you prefer and include your credentials to register on an accounts.

- Step 5. Process the transaction. You should use your credit card or PayPal accounts to finish the transaction.

- Step 6. Find the file format of your authorized kind and download it in your system.

- Step 7. Comprehensive, revise and print out or signal the New Jersey Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation.

Every authorized file web template you get is your own property permanently. You possess acces to each kind you acquired with your acccount. Go through the My Forms portion and decide on a kind to print out or download again.

Contend and download, and print out the New Jersey Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation with US Legal Forms. There are millions of skilled and state-distinct forms you can use for your personal organization or individual needs.