New Jersey Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample

Description

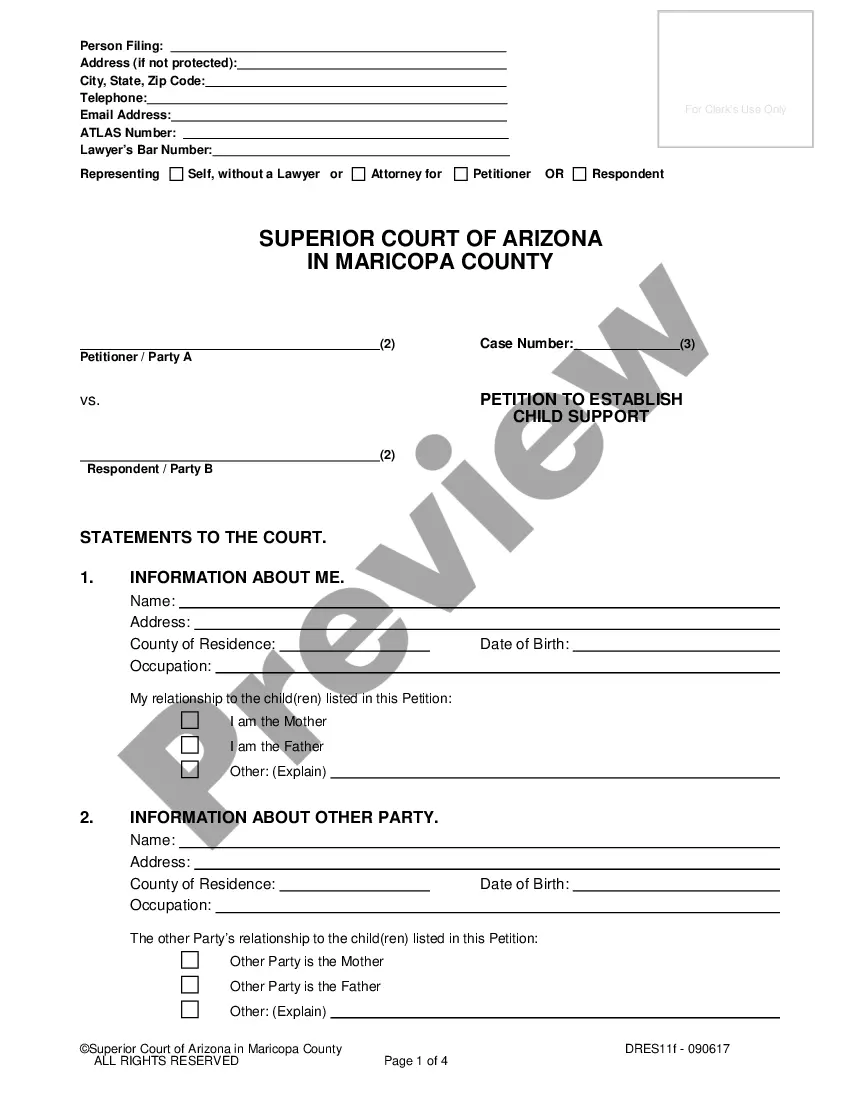

How to fill out Sample Asset Purchase Agreement Between Orth-McNeil Pharmaceutical, Inc. And Cygnus, Inc. Regarding The Sale And Purchase Of Assets Of Company - Sample?

You can invest hours on-line trying to find the lawful file format that meets the state and federal demands you will need. US Legal Forms supplies a huge number of lawful varieties which can be examined by pros. You can easily acquire or print the New Jersey Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample from the assistance.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Download option. Following that, it is possible to comprehensive, modify, print, or sign the New Jersey Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample. Each lawful file format you acquire is your own property permanently. To obtain one more duplicate associated with a obtained kind, proceed to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms website initially, keep to the straightforward instructions listed below:

- Initial, make certain you have chosen the correct file format for that region/metropolis of your liking. Look at the kind explanation to make sure you have selected the right kind. If accessible, utilize the Review option to appear from the file format too.

- If you wish to locate one more edition of the kind, utilize the Research discipline to discover the format that fits your needs and demands.

- After you have discovered the format you desire, simply click Acquire now to proceed.

- Pick the costs prepare you desire, key in your credentials, and register for your account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal accounts to purchase the lawful kind.

- Pick the format of the file and acquire it to your device.

- Make adjustments to your file if required. You can comprehensive, modify and sign and print New Jersey Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample.

Download and print a huge number of file themes while using US Legal Forms web site, that provides the greatest selection of lawful varieties. Use skilled and status-particular themes to deal with your small business or personal requires.

Form popularity

FAQ

An asset purchase agreement (often called an ?APA?) is typically used when buying or selling a business. Three of the most important provisions in an asset purchase agreement are: a material adverse change clause, a non-compete agreement, and indemnity and liability provisions. 3 of the Most Important Provisions in Asset Purchase Agreements dyeculik.com ? post ? 3-of-the-most-import... dyeculik.com ? post ? 3-of-the-most-import...

The asset purchase agreement is typically prepared by the buyer's lawyer. However, it is important to have the agreement reviewed by a business lawyer to ensure that all assets are properly transferred and that the purchase price is fair.

An asset purchase (or asset sale) is when a buyer purchases the assets owned by the selling entity. After signing the APA, the seller's business entity transfers ownership of its assets to the buyer's entity, while the seller retains legal ownership of the surviving entity.

Asset purchases include acquiring seller assets under the terms and conditions outlined in the asset purchase agreement (APA). There is a negotiation period, followed by terms drafting, and then the final signing like many contracts. Asset Purchase: Everything You Should Know Contracts Counsel ? asset-purchase Contracts Counsel ? asset-purchase

The asset purchase agreement is typically drafted by the buyer and seller of the assets. However, in some cases, it may be handled by an attorney. Asset Purchase Agreement - Carbon Collective carboncollective.co ? sustainable-investing carboncollective.co ? sustainable-investing

An Asset Purchase Agreement (APA) is a contract that spells out the terms of the sale in precise detail. It is a legally binding agreement that formalizes the price, deal structure, terms, and other aspects of the transaction. All in all, it is one of the most important legal documents during the acquisition process. Understanding Asset Purchase Agreements - Quiet Light quietlight.com ? understanding-asset-purchase-agr... quietlight.com ? understanding-asset-purchase-agr...