New Jersey Letter of Agreement

Description

How to fill out Letter Of Agreement?

You can invest hours on the web attempting to find the legal papers format that meets the federal and state requirements you need. US Legal Forms supplies a large number of legal kinds which are analyzed by pros. You can actually obtain or print the New Jersey Letter of Agreement from our support.

If you already have a US Legal Forms accounts, you are able to log in and click the Obtain option. After that, you are able to comprehensive, edit, print, or indication the New Jersey Letter of Agreement. Each legal papers format you purchase is your own property for a long time. To acquire one more version for any bought form, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms site initially, stick to the straightforward guidelines listed below:

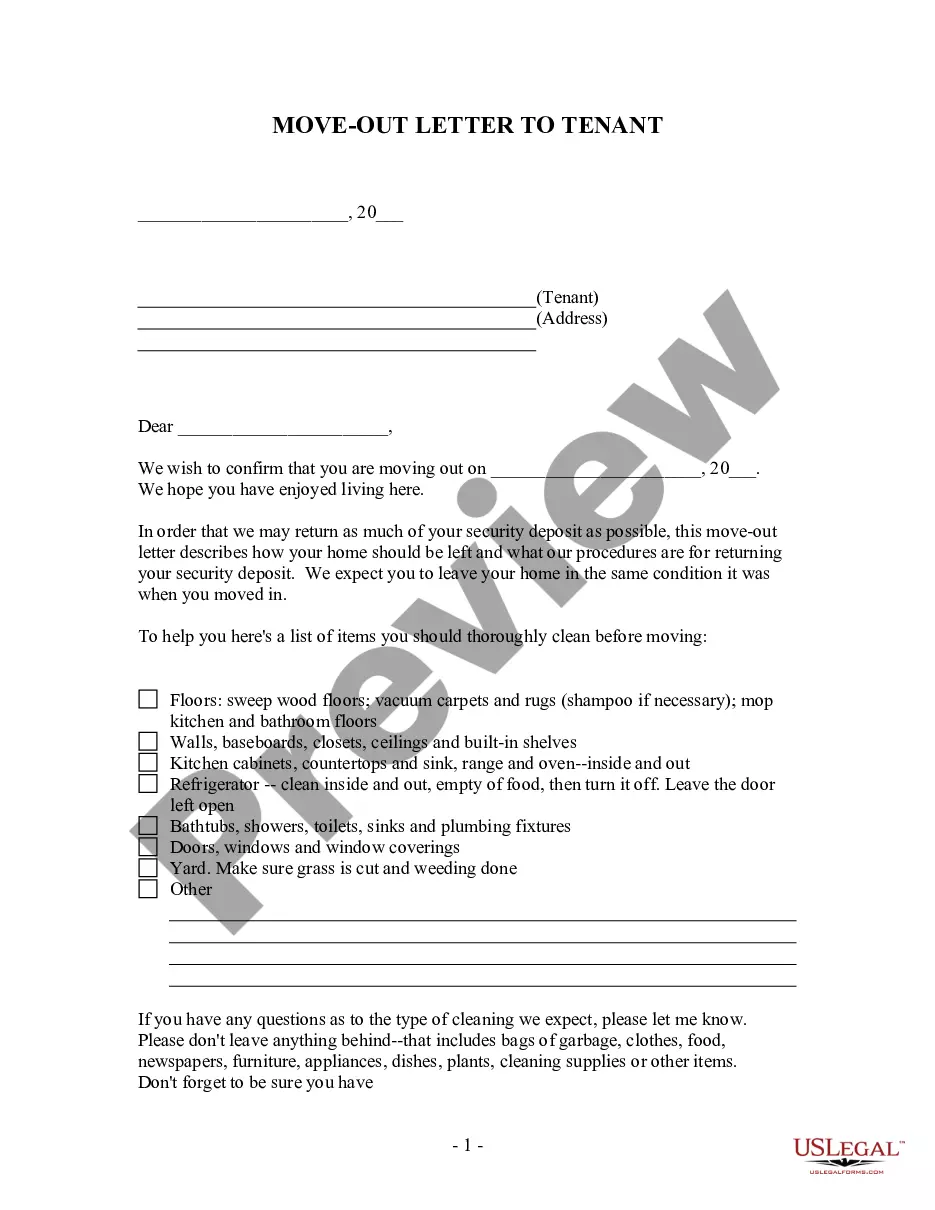

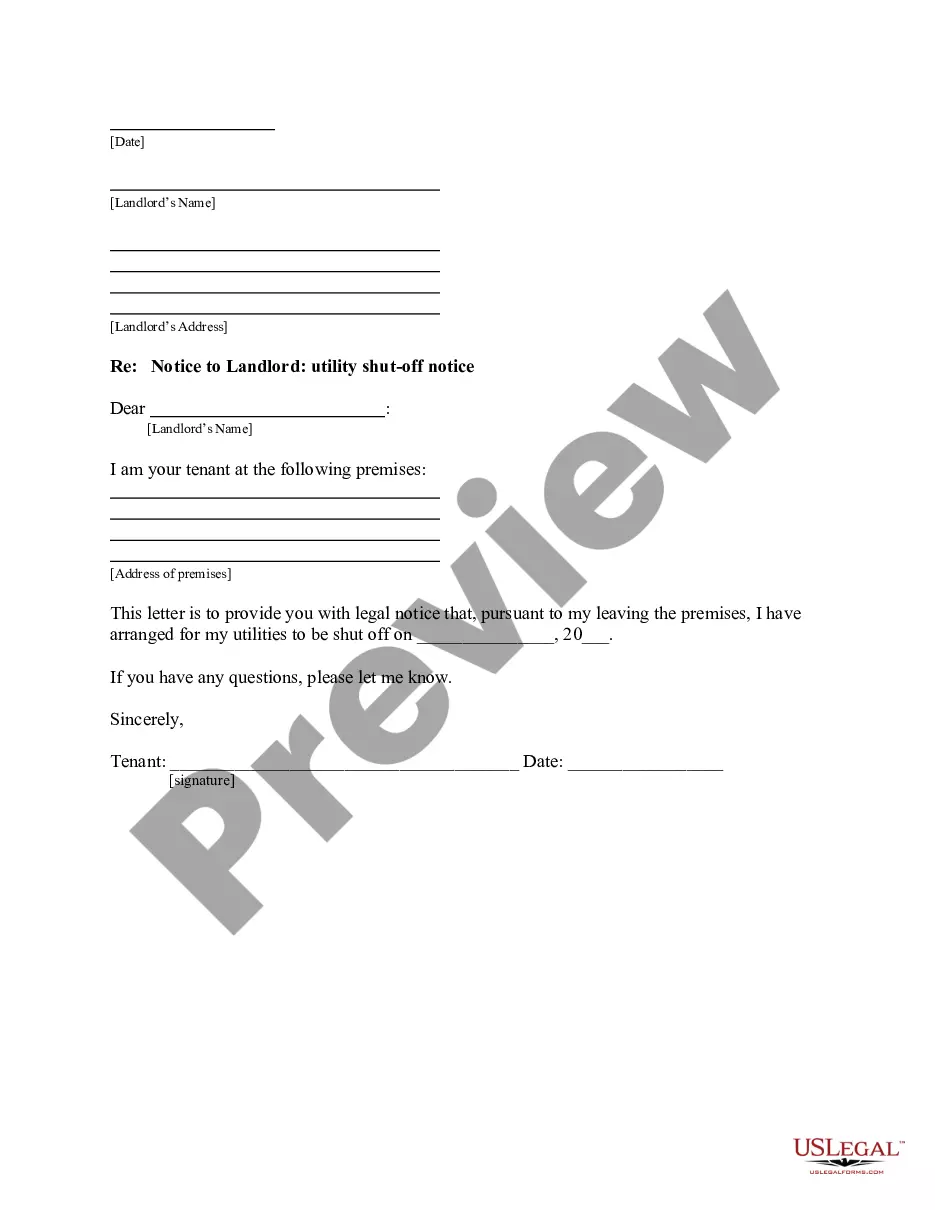

- Very first, make sure that you have chosen the best papers format for the region/city of your choosing. See the form information to ensure you have picked the appropriate form. If available, take advantage of the Review option to look from the papers format too.

- If you would like discover one more variation of the form, take advantage of the Search field to discover the format that meets your requirements and requirements.

- Once you have identified the format you need, click Get now to move forward.

- Choose the costs program you need, enter your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal accounts to cover the legal form.

- Choose the formatting of the papers and obtain it to your gadget.

- Make adjustments to your papers if necessary. You can comprehensive, edit and indication and print New Jersey Letter of Agreement.

Obtain and print a large number of papers web templates making use of the US Legal Forms Internet site, which provides the largest collection of legal kinds. Use skilled and state-distinct web templates to handle your business or personal requirements.

Form popularity

FAQ

Follow these steps to respond to a motion: Fill out the forms. You have to fill out at least 2 forms, maybe more, to file your opposition. File the forms. Turn in your completed forms by mail or efiling. Serve the other party. ... Get ready for the hearing. ... Prepare an order.

If your New Jersey taxable income is over:But not over:Your tax is:$0$20,0001.4% of your income$20,000$50,0001.75% of the excess over $20,000, minus $70.00$50,000$70,0002.45% of the excess over $50,000, minus $420.00$70,000$80,0003.5% of the excess over $70,000, minus $1,154.504 more rows

Employers not classified as weekly payers must report and remit withholding tax on a monthly or quarterly basis, using the Employer's Quarterly Report, Form NJ-927, regardless of the amount of tax due.

If I live in New York but work in another state, am I taxed twice? A person who lives in one state but works in another may have tax liability in both states, but typically will receive a tax credit in their state of residence to eliminate double taxation of that income.

Employers that are filing Form NJ-927 should enter the amount withheld for each month in the quarter. Employers that are filing Form NJ-927-W should enter the amount withheld for each week/period in this quarter. If the withholding amount is zero, enter "0."

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Employees should complete an Employee's Withholding Allowance Certificate (Form NJ-W4) and give it to their employer to declare withholding information for New Jersey purposes. New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected.