New Jersey Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company

Description

How to fill out Sample Stock Purchase Agreement Between The Wiser Oil And Wiser Investment Company?

US Legal Forms - one of the greatest libraries of legitimate kinds in the States - offers a wide array of legitimate document themes it is possible to acquire or print. While using internet site, you can find 1000s of kinds for company and specific reasons, categorized by groups, says, or key phrases.You can find the newest variations of kinds such as the New Jersey Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company in seconds.

If you have a membership, log in and acquire New Jersey Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company from your US Legal Forms collection. The Obtain key will show up on each kind you see. You gain access to all in the past delivered electronically kinds within the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, listed below are straightforward directions to help you started off:

- Be sure you have picked the correct kind to your area/state. Select the Review key to review the form`s articles. See the kind outline to ensure that you have selected the proper kind.

- If the kind does not suit your specifications, utilize the Lookup industry near the top of the display to obtain the one that does.

- If you are content with the shape, affirm your decision by clicking the Buy now key. Then, pick the rates prepare you favor and provide your references to sign up for an bank account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Select the structure and acquire the shape on the product.

- Make changes. Fill up, modify and print and indicator the delivered electronically New Jersey Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company.

Every web template you included with your money lacks an expiry particular date and is your own eternally. So, if you want to acquire or print another version, just go to the My Forms area and click on in the kind you want.

Gain access to the New Jersey Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company with US Legal Forms, probably the most substantial collection of legitimate document themes. Use 1000s of specialist and state-specific themes that fulfill your company or specific requires and specifications.

Form popularity

FAQ

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.

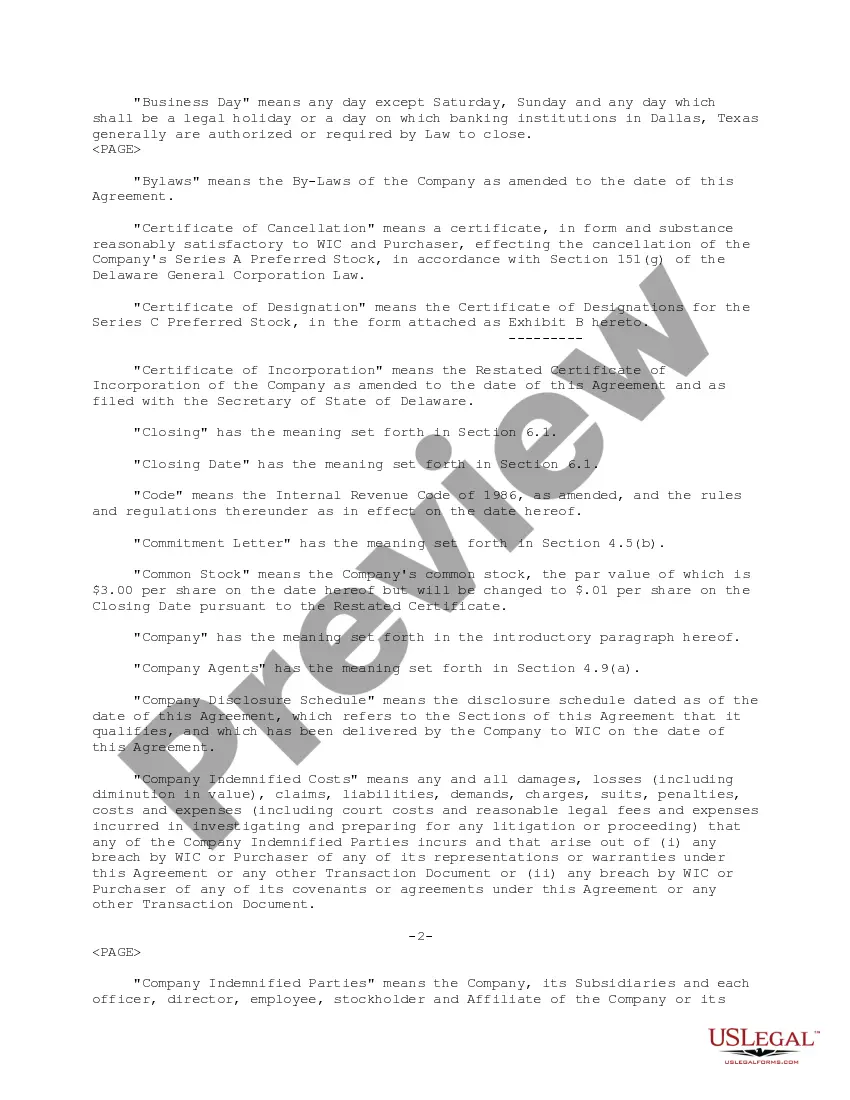

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

The Letter of Intent is a written, non- binding document which outlines an agreement in principle for the buyer to purchase the seller's business, stating the proposed price and terms. The mutually signed LOI is required before the buyer proceeds with the ?due diligence? phase of acquisition.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A letter of intent is a document between two businesses that declares a preliminary commitment to doing business. The letter of intent should outline the terms of any future agreement and can be used to record negotiations and discussions.