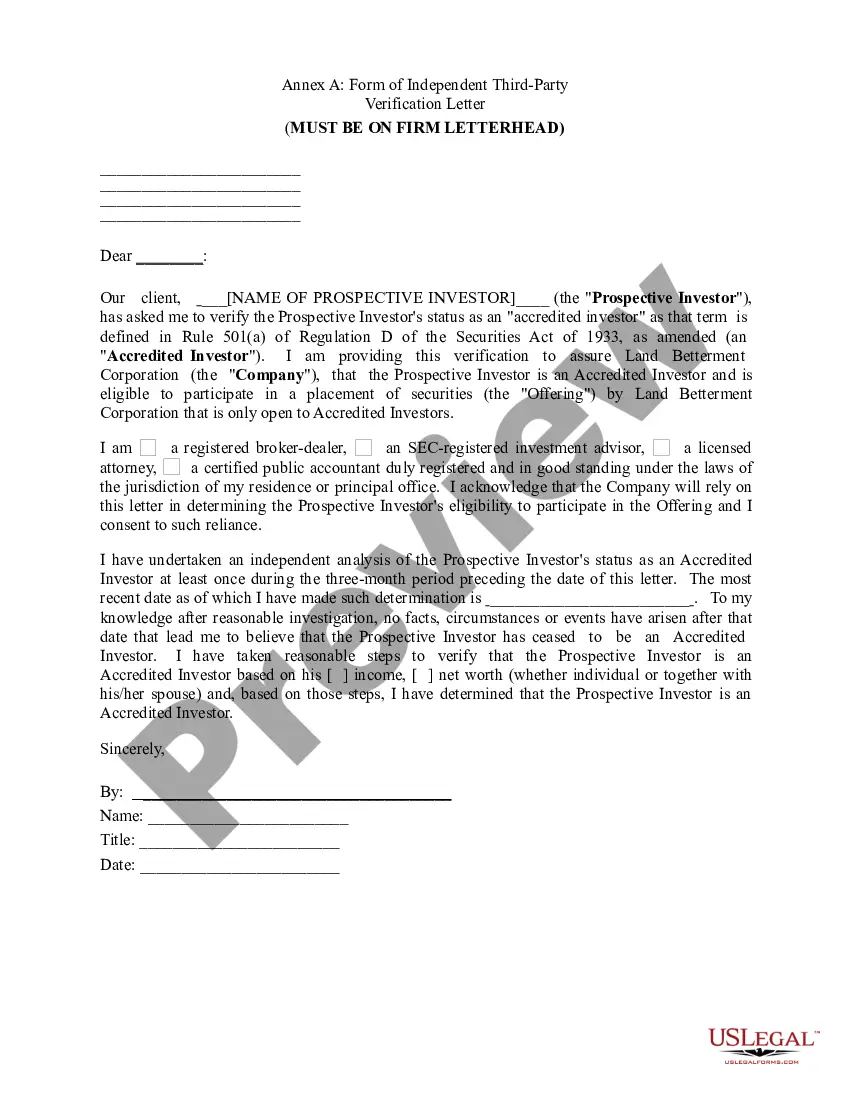

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

Title: New Jersey Accredited Investor Certification Letter: Detailed Overview and Types Description: The New Jersey Accredited Investor Certification Letter is an essential document required by the State of New Jersey to verify an individual's status as an accredited investor. This accredited investor certification serves as proof that the individual meets the strict financial requirements set by the New Jersey Bureau of Securities to participate in certain private investments or securities offerings. Keywords: New Jersey, Accredited Investor Certification Letter, accredited investor, financial requirements, private investments, securities offerings, New Jersey Bureau of Securities. Types of New Jersey Accredited Investor Certification Letter: 1. Individual Accredited Investor Certification Letter: This type of certification letter is issued to individuals who meet the specific financial thresholds outlined by the New Jersey Bureau of Securities. These thresholds include minimum income and net worth criteria. The individual must provide detailed financial documents and certifications to qualify as an accredited investor. 2. Institutional Accredited Investor Certification Letter: Institutional investors, such as banks, insurance companies, registered investment companies, and other entities with significant financial resources are required to obtain the Institutional Accredited Investor Certification Letter. This document verifies their eligibility to participate in various private offerings based on their financial standing and expertise. 3. Domestic Entity Accredited Investor Certification Letter: This type of certification letter is designed for domestic entities, including corporations, limited liability companies (LCS), or partnerships. It confirms their status as accredited investors based on their financial position and structure. Similar to individual investors, these entities must meet specific financial thresholds defined by the New Jersey Bureau of Securities. 4. Foreign Entity Accredited Investor Certification Letter: Foreign entities aiming to participate in private investments or securities offerings within the state of New Jersey must obtain the Foreign Entity Accredited Investor Certification Letter. This certification demonstrates that the entity meets the financial requirements specified by the New Jersey Bureau of Securities, despite being based outside the United States. 5. Variations and Other Accredited Investor Certifications: Apart from the mentioned types, there might be certain variations or additional certifications specific to certain investment opportunities or situations within New Jersey. These variations may cater to unique circumstances or requirements that may arise within specific industries or sectors. By understanding the different types of New Jersey Accredited Investor Certification Letters and their significance, individuals and entities can navigate the investment landscape with confidence, ensuring compliance with regulations and accessing exclusive investment opportunities available to accredited investors. Overall, obtaining the New Jersey Accredited Investor Certification Letter enables eligible individuals and entities to actively participate in private investment opportunities that generally come with higher risk but also promise higher returns.