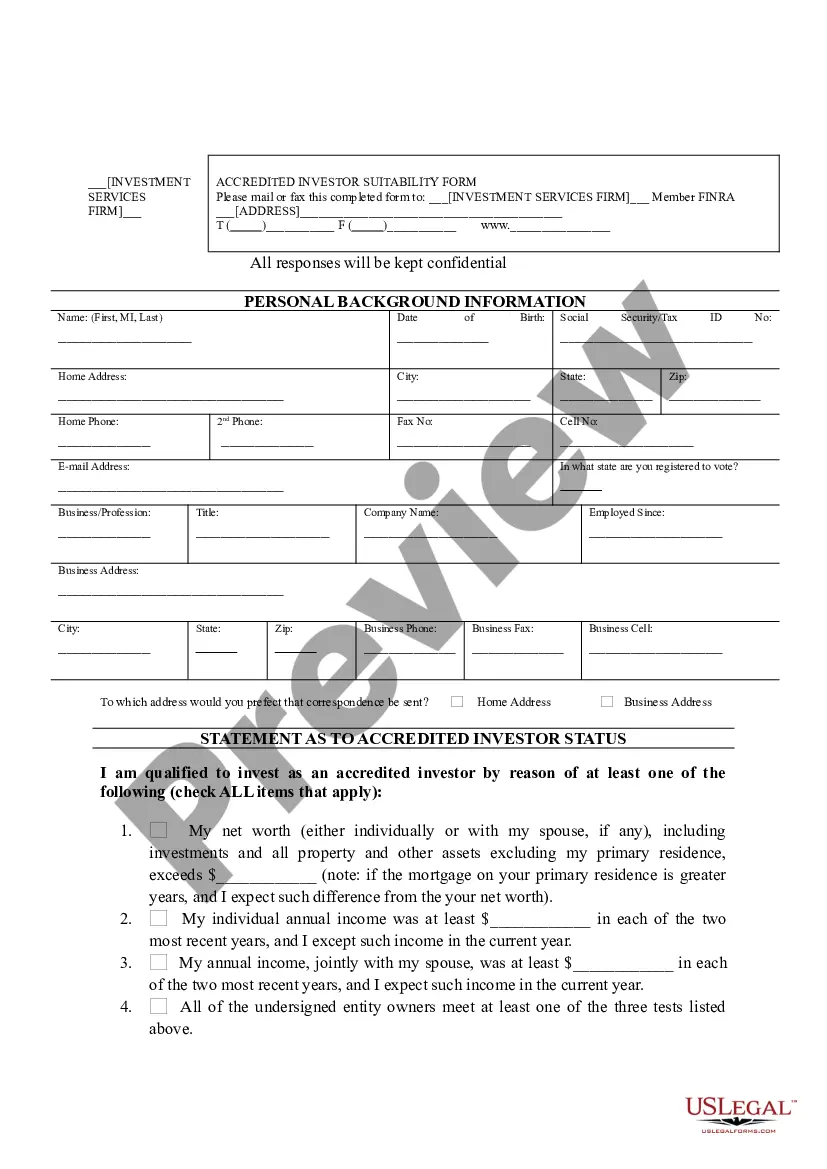

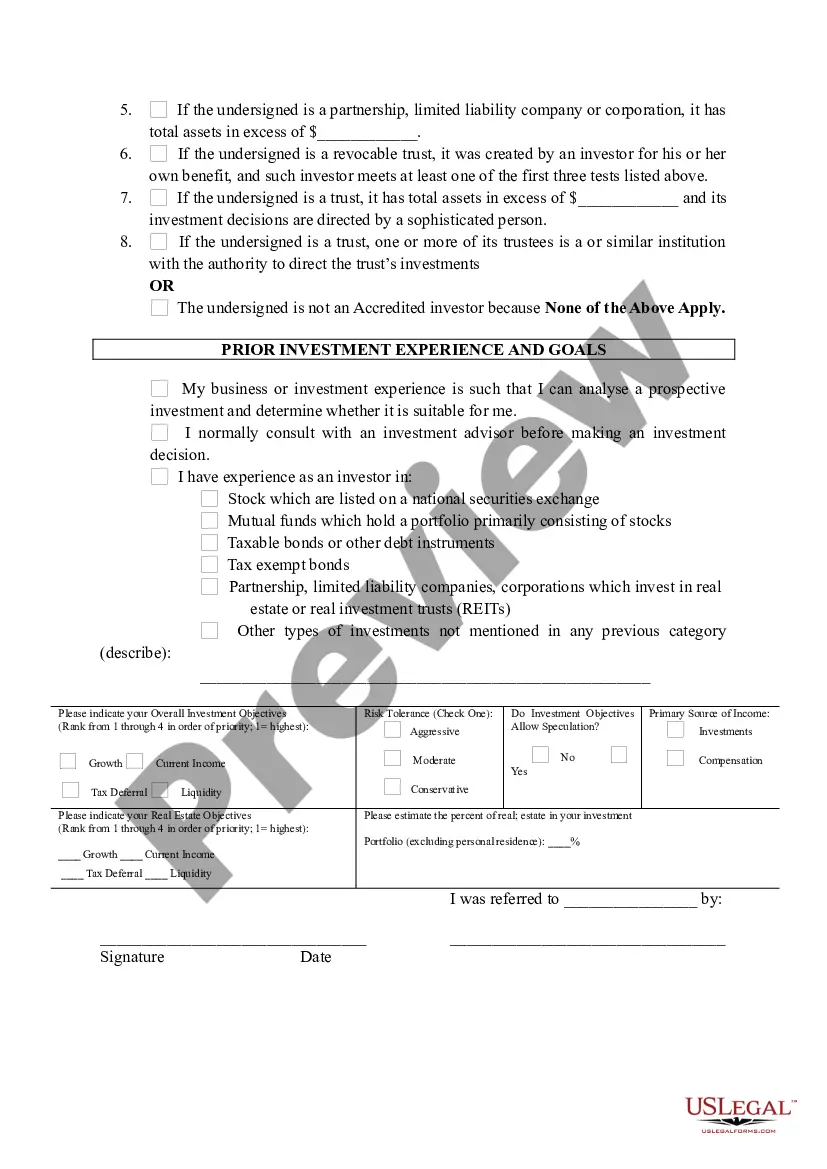

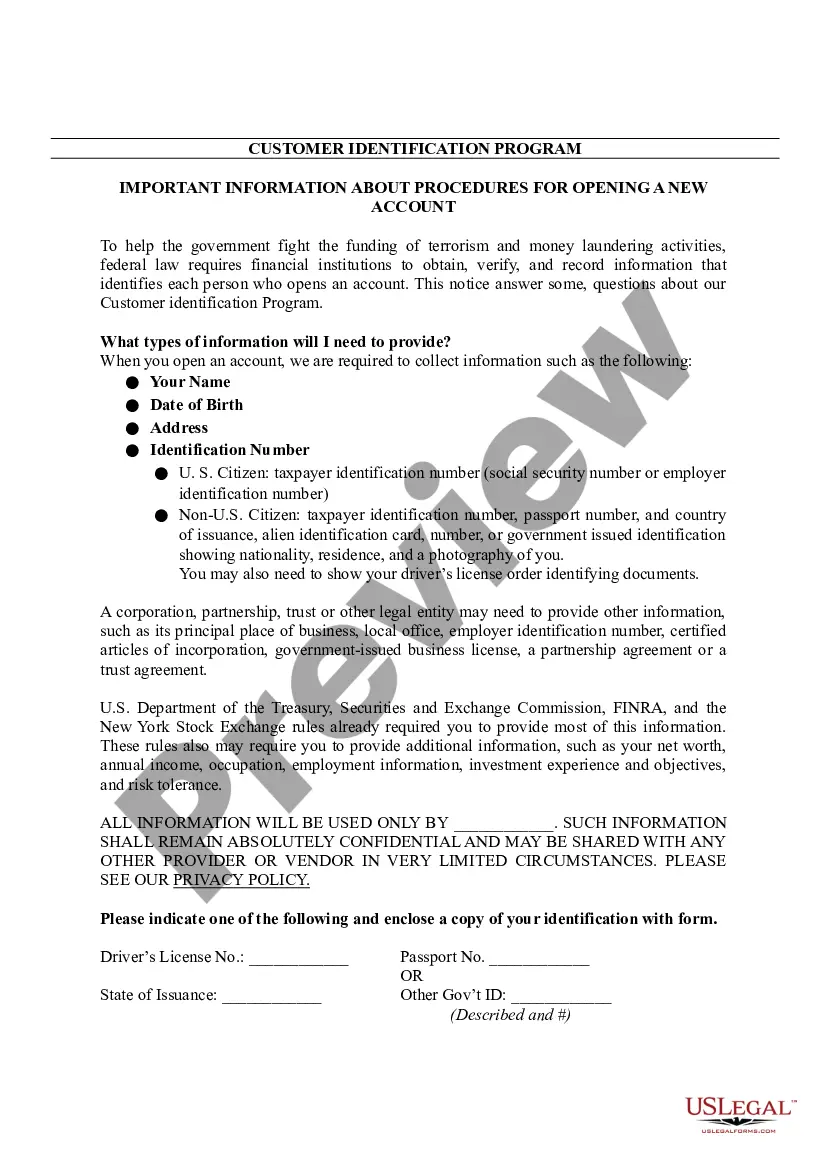

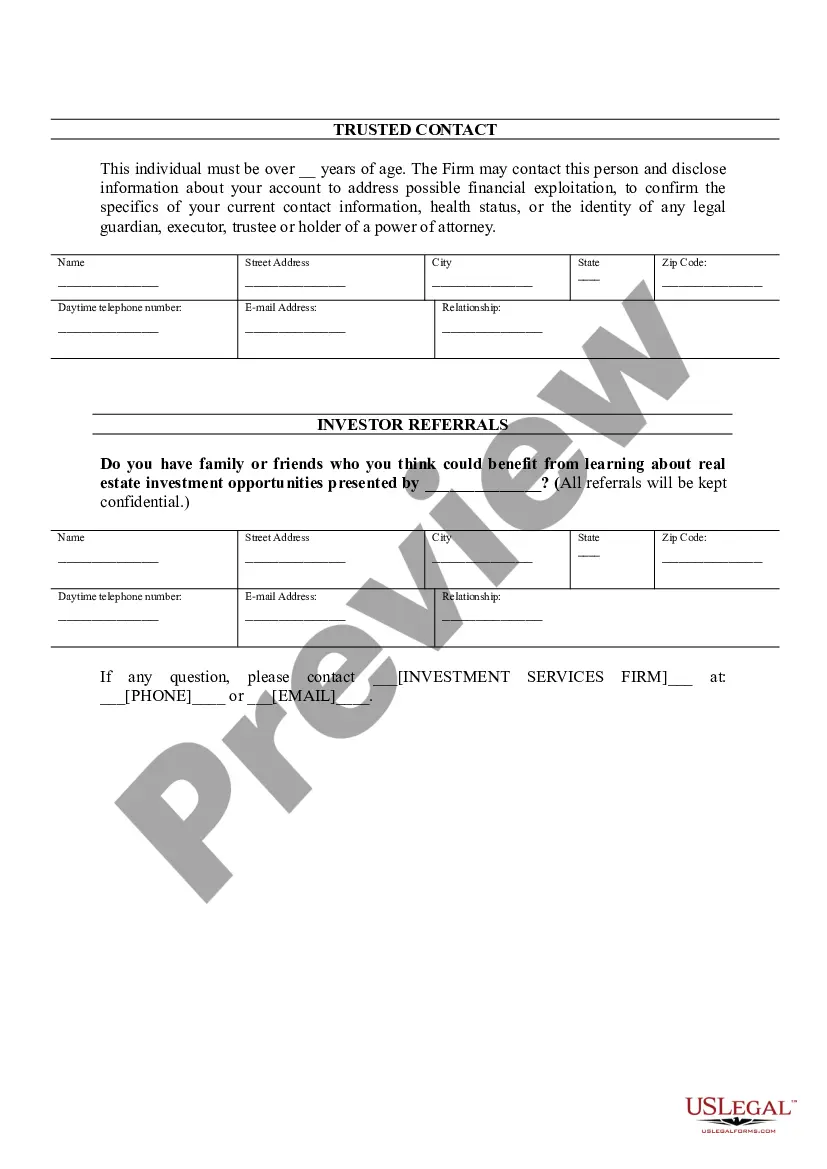

New Jersey Accredited Investor Suitability refers to the regulations and guidelines set forth by the state of New Jersey regarding the qualification and eligibility of individuals or entities to be considered as accredited investors. Accredited investors are those who meet specific income or net worth thresholds and are deemed to have the financial acumen and sophistication to participate in certain investment opportunities that may carry a higher risk. In New Jersey, like in other states, the determination of accredited investor suitability is crucial in various investment contexts, such as private placements, crowdfunding offerings, hedge funds, venture capital funds, and other investment vehicles that may be restricted to accredited investors. Adhering to these regulations helps to safeguard investors and maintain a fair and transparent investment environment. Types of New Jersey Accredited Investor Suitability: 1. Net Worth Standard: Under the New Jersey Uniform Securities Act, an individual may qualify as an accredited investor if their individual or joint net worth exceeds a specified threshold, excluding the value of their primary residence. As of 2022, the net worth requirement is set at $1 million. 2. Income Standard: An individual may be considered an accredited investor in New Jersey if their annual income exceeds a certain threshold. For example, if the individual's income surpasses $200,000 (or $300,000 in joint income with a spouse) for the past two years, and they expect the same level of income in the current year, they may meet the income standard requirement. It's important to note that meeting the accreditation suitability in New Jersey provides certain advantages to investors, including access to a broader range of investment opportunities that are otherwise restricted to non-accredited investors. However, it also implies a higher risk level due to the potential complexity and speculative nature of such investments. Investors who believe they meet the New Jersey Accredited Investor Suitability requirements should consult with a qualified attorney or financial advisor to ensure compliance with the state's regulations and to evaluate investment opportunities suitable for their specific circumstances. Additionally, it is crucial to stay updated with any changes in the New Jersey Uniform Securities Act or Securities and Exchange Commission rules pertaining to accredited investor criteria.

New Jersey Accredited Investor Suitability

Description

How to fill out New Jersey Accredited Investor Suitability?

Choosing the best lawful papers web template could be a battle. Obviously, there are plenty of layouts available on the net, but how would you obtain the lawful type you need? Utilize the US Legal Forms web site. The service provides 1000s of layouts, like the New Jersey Accredited Investor Suitability, which you can use for company and private demands. Each of the varieties are inspected by professionals and meet up with federal and state specifications.

In case you are previously listed, log in to the accounts and click on the Download key to obtain the New Jersey Accredited Investor Suitability. Utilize your accounts to check with the lawful varieties you have bought formerly. Go to the My Forms tab of your respective accounts and have an additional backup in the papers you need.

In case you are a new consumer of US Legal Forms, allow me to share easy instructions that you can comply with:

- First, ensure you have selected the appropriate type for the town/county. You can examine the shape using the Preview key and look at the shape explanation to guarantee it will be the right one for you.

- If the type fails to meet up with your needs, use the Seach industry to find the proper type.

- Once you are sure that the shape would work, click on the Get now key to obtain the type.

- Select the rates strategy you want and enter in the required details. Build your accounts and purchase an order making use of your PayPal accounts or bank card.

- Choose the data file formatting and obtain the lawful papers web template to the product.

- Total, revise and printing and signal the received New Jersey Accredited Investor Suitability.

US Legal Forms is definitely the most significant collection of lawful varieties that you can discover different papers layouts. Utilize the company to obtain professionally-made papers that comply with condition specifications.