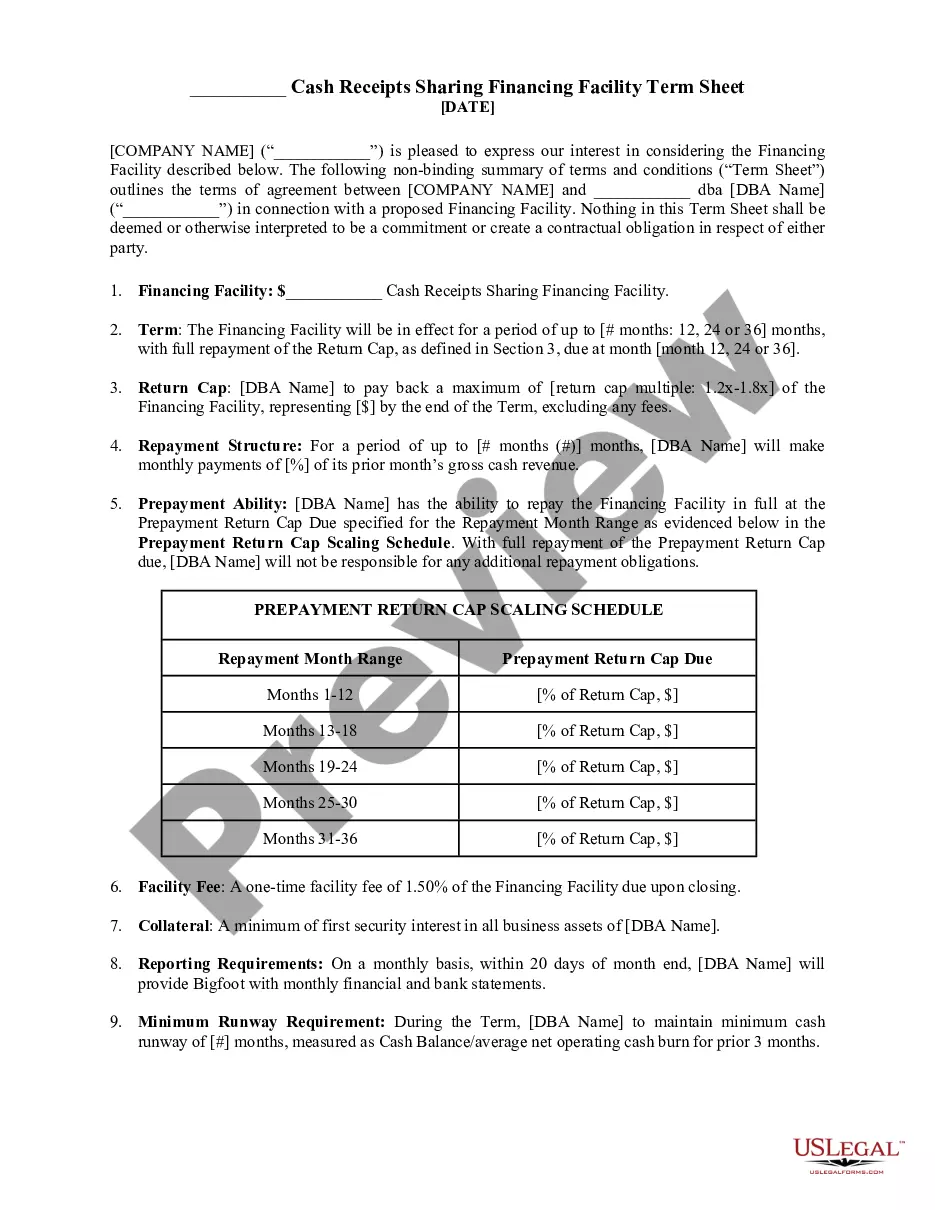

New Jersey Cash Receipts Sharing Financing Facility Term Sheet

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth."

How to fill out Cash Receipts Sharing Financing Facility Term Sheet?

Choosing the best legal record format could be a have difficulties. Needless to say, there are a lot of themes available on the Internet, but how can you obtain the legal develop you require? Use the US Legal Forms website. The assistance provides thousands of themes, including the New Jersey Cash Receipts Sharing Financing Facility Term Sheet, that can be used for enterprise and private requires. Each of the forms are inspected by professionals and meet state and federal specifications.

When you are presently authorized, log in to your profile and then click the Acquire switch to obtain the New Jersey Cash Receipts Sharing Financing Facility Term Sheet. Make use of profile to look throughout the legal forms you might have ordered formerly. Visit the My Forms tab of your respective profile and have another copy of the record you require.

When you are a fresh consumer of US Legal Forms, listed below are basic guidelines so that you can stick to:

- Initially, make certain you have chosen the right develop for the city/area. You may examine the form while using Review switch and look at the form description to guarantee it will be the best for you.

- When the develop does not meet your requirements, utilize the Seach field to find the proper develop.

- When you are certain the form is proper, click the Acquire now switch to obtain the develop.

- Pick the costs plan you need and enter in the required information and facts. Build your profile and pay money for the transaction utilizing your PayPal profile or credit card.

- Opt for the file structure and obtain the legal record format to your device.

- Total, modify and print and sign the attained New Jersey Cash Receipts Sharing Financing Facility Term Sheet.

US Legal Forms will be the largest library of legal forms that you can find a variety of record themes. Use the company to obtain appropriately-created documents that stick to status specifications.

Form popularity

FAQ

The receipt should include: The date. The dollar amount. Name of person paying for the transaction. Description of the service or product. Department name. Signature of the cash handler.

Your cash receipts journal should be recorded chronologically. Remember not to record the sales tax collected in the cash receipts journal. Instead, record this in the sales journal. Cash receipts are recorded in your sales journal as credit and your cash receipts as debit.

Are Cash Receipts Debit or Credit? As an accounting entry that records the receipt of money from a customer, a cash sales receipt is a debit.

If the receipt was in cash, then state the name of the paying party, check the ?cash?? box, and the amount paid. Once all line items have been completed, enter the grand total in the ?total receipts? field at the bottom of the form. Sign the form and state the date on which the checks and cash were received.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

Many businesses maintain cash receipts and cash payments on separate spreadsheets, but you can do them together in a cash receipts and payments journal. This journal details the cash, checks and electronic payments you took in and paid out during specifically defined time periods over the course of the year.

A cash receipts journal is used to record all cash receipts of the business. All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received. An additional posting must be made to balancing the transaction.

Examples of cash receipts could include fees collected by a lawyer, deposits made toward the purchase of a home and refundable airline tickets bought by a customer and returned after their flights are cancelled. Cash receipts can come from the sale of goods instead of services as well.