New Jersey Waiver Special Meeting of Shareholders

Description

How to fill out Waiver Special Meeting Of Shareholders?

Have you been in the situation the place you need paperwork for either enterprise or person reasons nearly every day? There are tons of lawful document web templates available on the net, but finding ones you can rely on isn`t straightforward. US Legal Forms delivers thousands of kind web templates, such as the New Jersey Waiver Special Meeting of Shareholders, that happen to be published to meet state and federal demands.

In case you are currently informed about US Legal Forms site and possess a merchant account, simply log in. Afterward, it is possible to down load the New Jersey Waiver Special Meeting of Shareholders template.

If you do not have an account and wish to start using US Legal Forms, adopt these measures:

- Find the kind you will need and make sure it is for your proper metropolis/state.

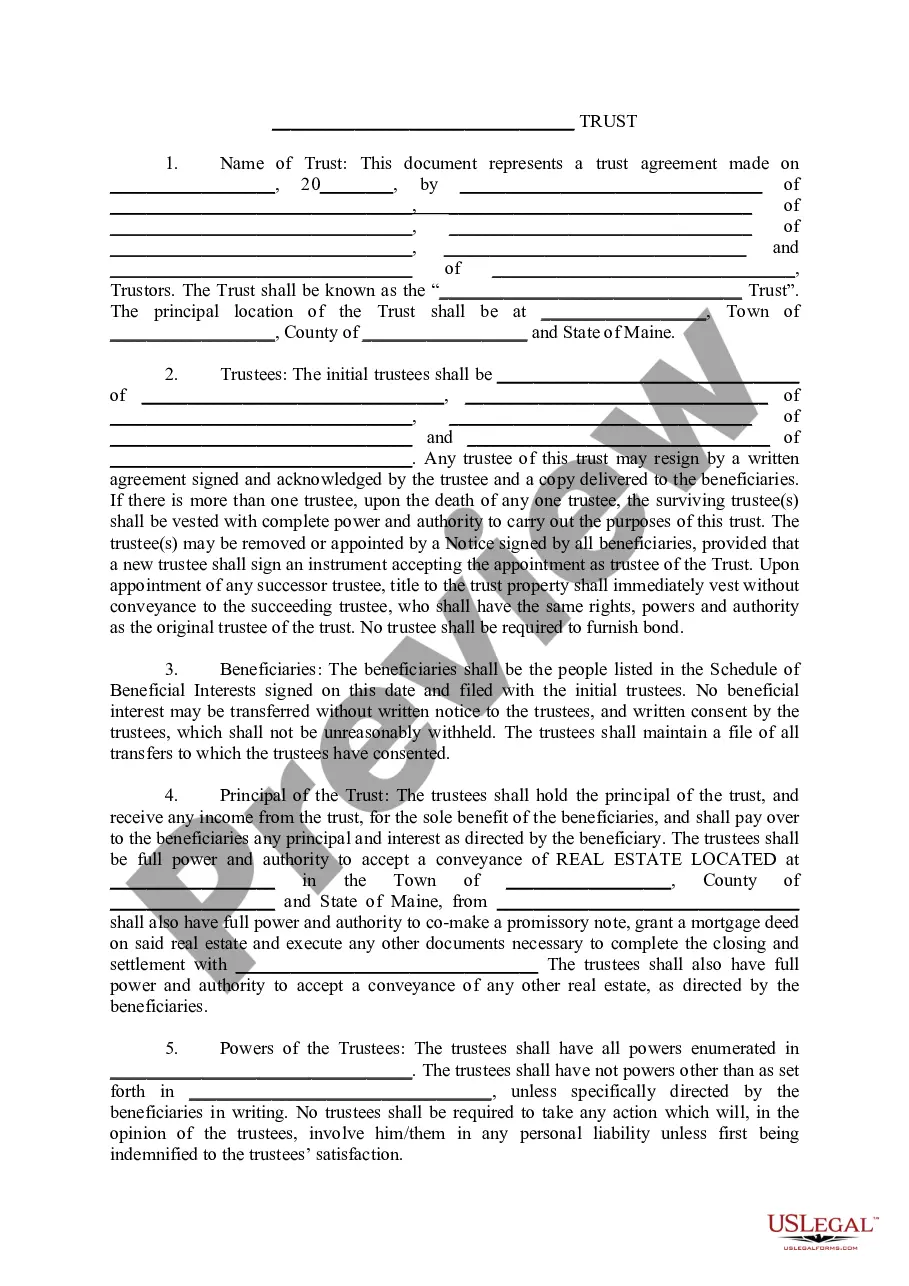

- Use the Preview option to analyze the form.

- Browse the explanation to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you are searching for, utilize the Search discipline to get the kind that suits you and demands.

- Whenever you obtain the proper kind, just click Purchase now.

- Pick the pricing prepare you desire, complete the required information and facts to create your bank account, and pay money for the order making use of your PayPal or charge card.

- Decide on a practical document file format and down load your copy.

Locate all the document web templates you might have purchased in the My Forms menus. You may get a extra copy of New Jersey Waiver Special Meeting of Shareholders any time, if required. Just click on the necessary kind to down load or print the document template.

Use US Legal Forms, probably the most considerable collection of lawful forms, to save lots of efforts and stay away from mistakes. The support delivers professionally produced lawful document web templates that you can use for a variety of reasons. Make a merchant account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

A waiver of notice is a written acknowledgment from people eligible to attend a company meeting stating that they are giving up their right to receive formal notice of the meeting.

A waiver of notice is a written acknowledgment from people eligible to attend a company meeting stating that they are giving up their right to receive formal notice of the meeting.

What should be recorded in meeting minutes? The minutes should include corporation details like the name of the corporation and the names of the chairperson and secretary of the meeting. The meeting place and time should also be found somewhere in the minutes, along with the names of the shareholders.

A General Meeting is simply a meeting of shareholders and 21 days' notice must be given to shareholders, but this can be reduced to 14 days, or increased to 28 days, in certain situations.

Even though the corporation is legally required to notify shareholders of the annual meeting, stockholders may opt out of receiving notification of the meeting by signing a waiver of notice form. Essentially, shareholders are telling the corporation that they no longer wish to be notified of future annual meetings.

The letter will typically state that a meeting is requested and the reason for the meeting. The company then sets the meeting within a set time frame, such as 30 to 90 days, and establishes a record date for eligibility to vote at the meeting.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation ...

The record date, or date of record, is the cut-off date established by a company in order to determine which shareholders are eligible to receive a dividend or distribution.

Corporations that don't consistently hold annual meetings may need to hold one without notice. The waiver of notice form is needed in order to document that all stockholders agree to the actions taken during the meeting, even though they may not have been present during it.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation ...