New Jersey Foundation Contractor Agreement - Self-Employed

Description

How to fill out New Jersey Foundation Contractor Agreement - Self-Employed?

If you need to complete, acquire, or printing lawful papers web templates, use US Legal Forms, the biggest assortment of lawful kinds, which can be found on the web. Take advantage of the site`s simple and easy convenient look for to get the documents you need. Different web templates for business and personal purposes are categorized by categories and suggests, or search phrases. Use US Legal Forms to get the New Jersey Foundation Contractor Agreement - Self-Employed within a few click throughs.

When you are currently a US Legal Forms client, log in to the accounts and click on the Obtain switch to have the New Jersey Foundation Contractor Agreement - Self-Employed. You can also access kinds you earlier saved in the My Forms tab of your accounts.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the proper area/region.

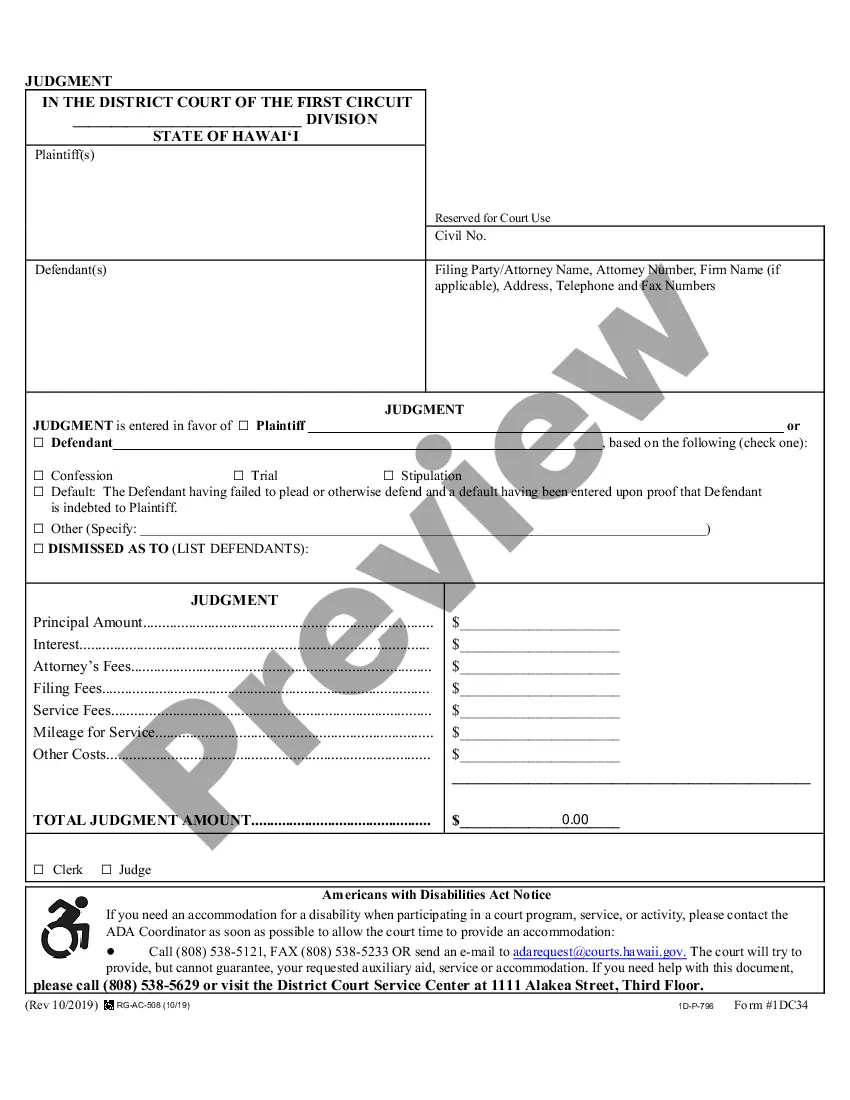

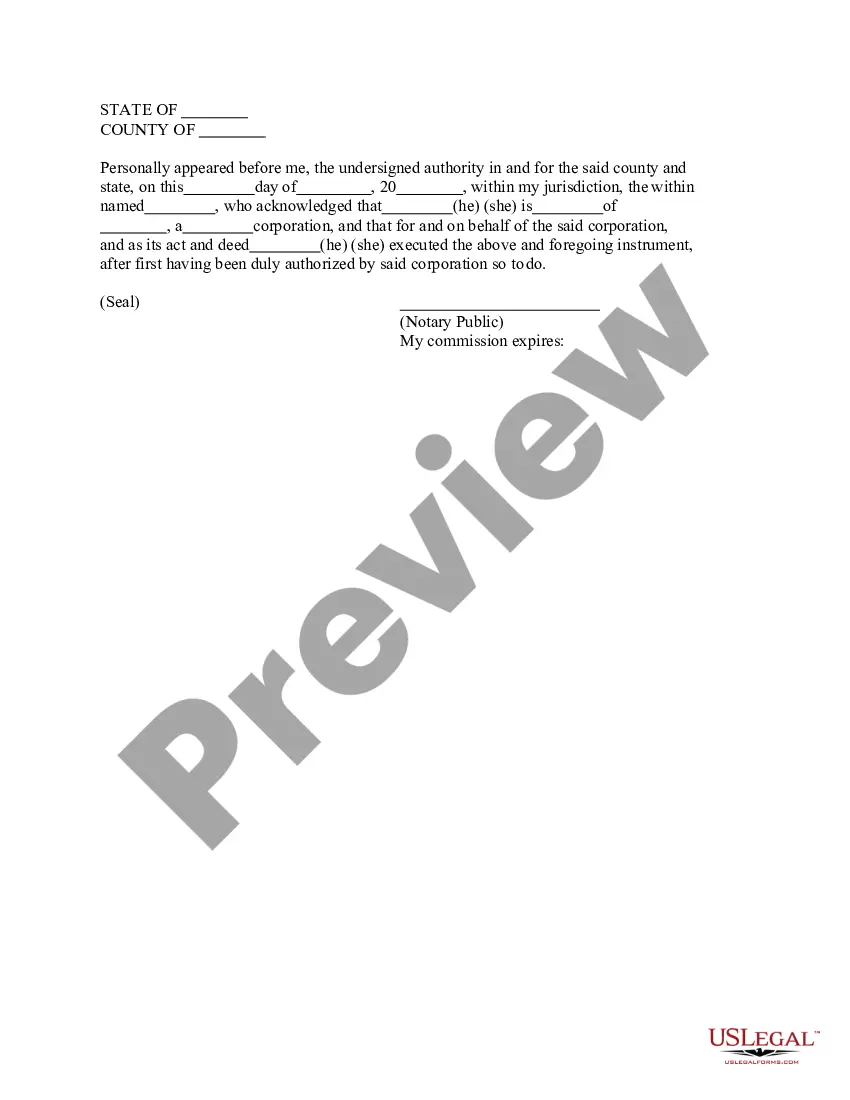

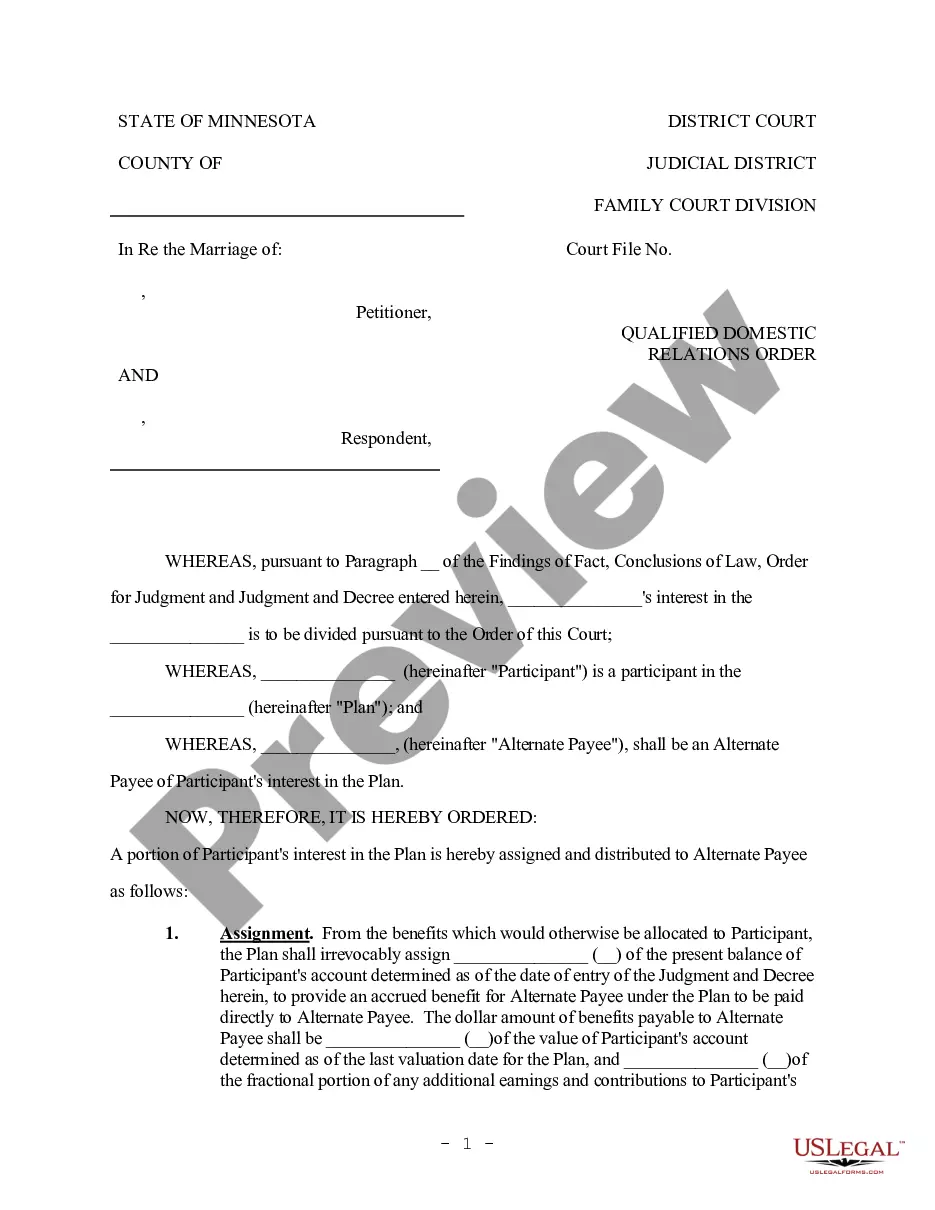

- Step 2. Use the Preview choice to examine the form`s articles. Never forget to read the information.

- Step 3. When you are not happy with the develop, make use of the Research field towards the top of the display screen to find other models of the lawful develop format.

- Step 4. Upon having located the form you need, click on the Purchase now switch. Select the rates prepare you like and add your qualifications to register for an accounts.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the structure of the lawful develop and acquire it on your own device.

- Step 7. Full, change and printing or sign the New Jersey Foundation Contractor Agreement - Self-Employed.

Every single lawful papers format you acquire is yours permanently. You have acces to each and every develop you saved in your acccount. Go through the My Forms portion and choose a develop to printing or acquire again.

Compete and acquire, and printing the New Jersey Foundation Contractor Agreement - Self-Employed with US Legal Forms. There are thousands of skilled and state-specific kinds you may use to your business or personal requires.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The 4 Different Types of Construction ContractsLump Sum Contract. A lump sum contract sets one determined price for all work done for the project.Unit Price Contract.Cost Plus Contract.Time and Materials Contract.

5 Key Elements Every Construction Contract Should Contain1) The project's scope.2) The cost and payment terms.3) The project's time frame.4) Protection against lien law.5) Dispute resolution clauses.