New Jersey Technical Writer Agreement - Self-Employed Independent Contractor

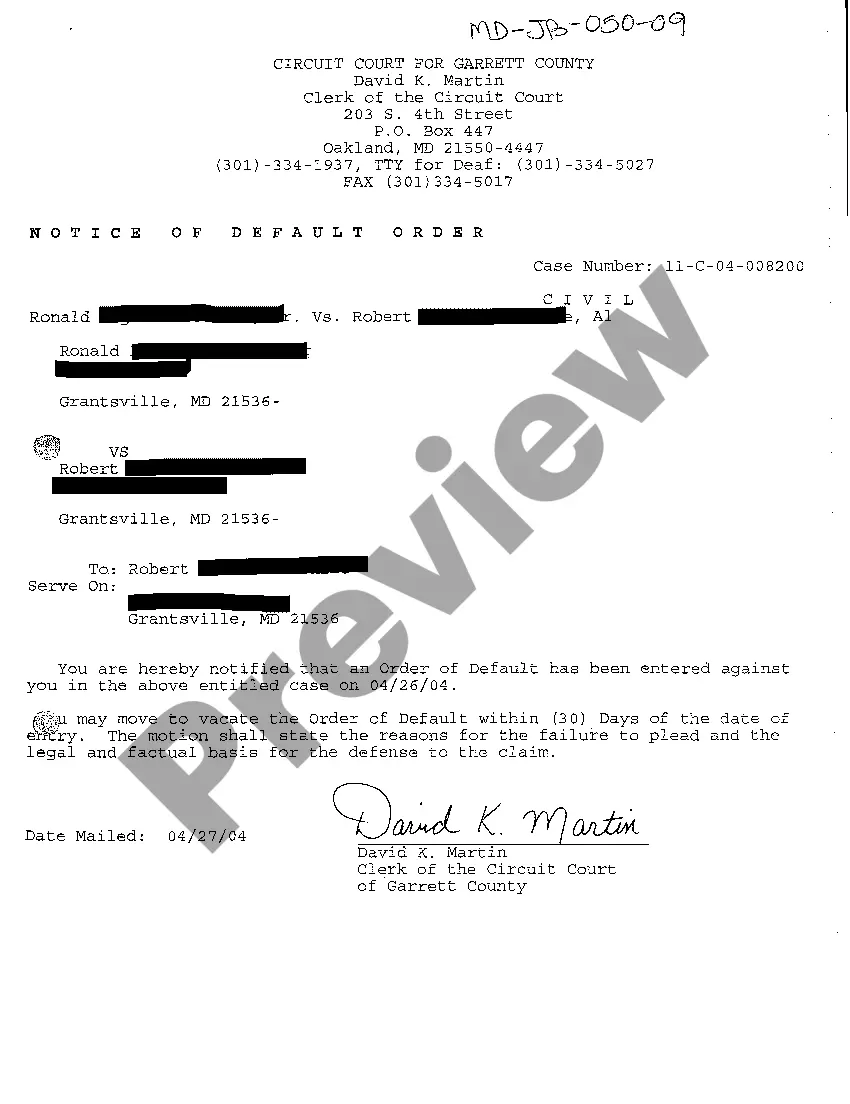

Description

How to fill out New Jersey Technical Writer Agreement - Self-Employed Independent Contractor?

If you need to comprehensive, obtain, or printing legal file templates, use US Legal Forms, the largest variety of legal kinds, which can be found on the Internet. Take advantage of the site`s simple and easy practical research to get the documents you require. Numerous templates for organization and personal purposes are categorized by categories and claims, or search phrases. Use US Legal Forms to get the New Jersey Technical Writer Agreement - Self-Employed Independent Contractor within a couple of click throughs.

If you are currently a US Legal Forms customer, log in for your profile and then click the Download button to find the New Jersey Technical Writer Agreement - Self-Employed Independent Contractor. You may also access kinds you in the past downloaded inside the My Forms tab of your respective profile.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for that right city/region.

- Step 2. Make use of the Preview solution to look through the form`s content material. Do not forget to learn the information.

- Step 3. If you are unhappy with all the type, utilize the Look for discipline towards the top of the display screen to get other variations from the legal type format.

- Step 4. Upon having identified the shape you require, click on the Get now button. Choose the pricing plan you prefer and include your qualifications to register for an profile.

- Step 5. Procedure the deal. You can use your charge card or PayPal profile to perform the deal.

- Step 6. Choose the structure from the legal type and obtain it on your gadget.

- Step 7. Comprehensive, edit and printing or signal the New Jersey Technical Writer Agreement - Self-Employed Independent Contractor.

Every legal file format you acquire is the one you have for a long time. You possess acces to every type you downloaded with your acccount. Click on the My Forms section and choose a type to printing or obtain yet again.

Be competitive and obtain, and printing the New Jersey Technical Writer Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and express-certain kinds you may use to your organization or personal requirements.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

Freelance writing is the career of a professional writer who works as a contractor as opposed to a full-time staff writer at a company. Freelancers offer their writing services to different clients and often work across a variety of genres, writing about any topic a client assigns.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.