New Jersey Property Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out New Jersey Property Manager Agreement - Self-Employed Independent Contractor?

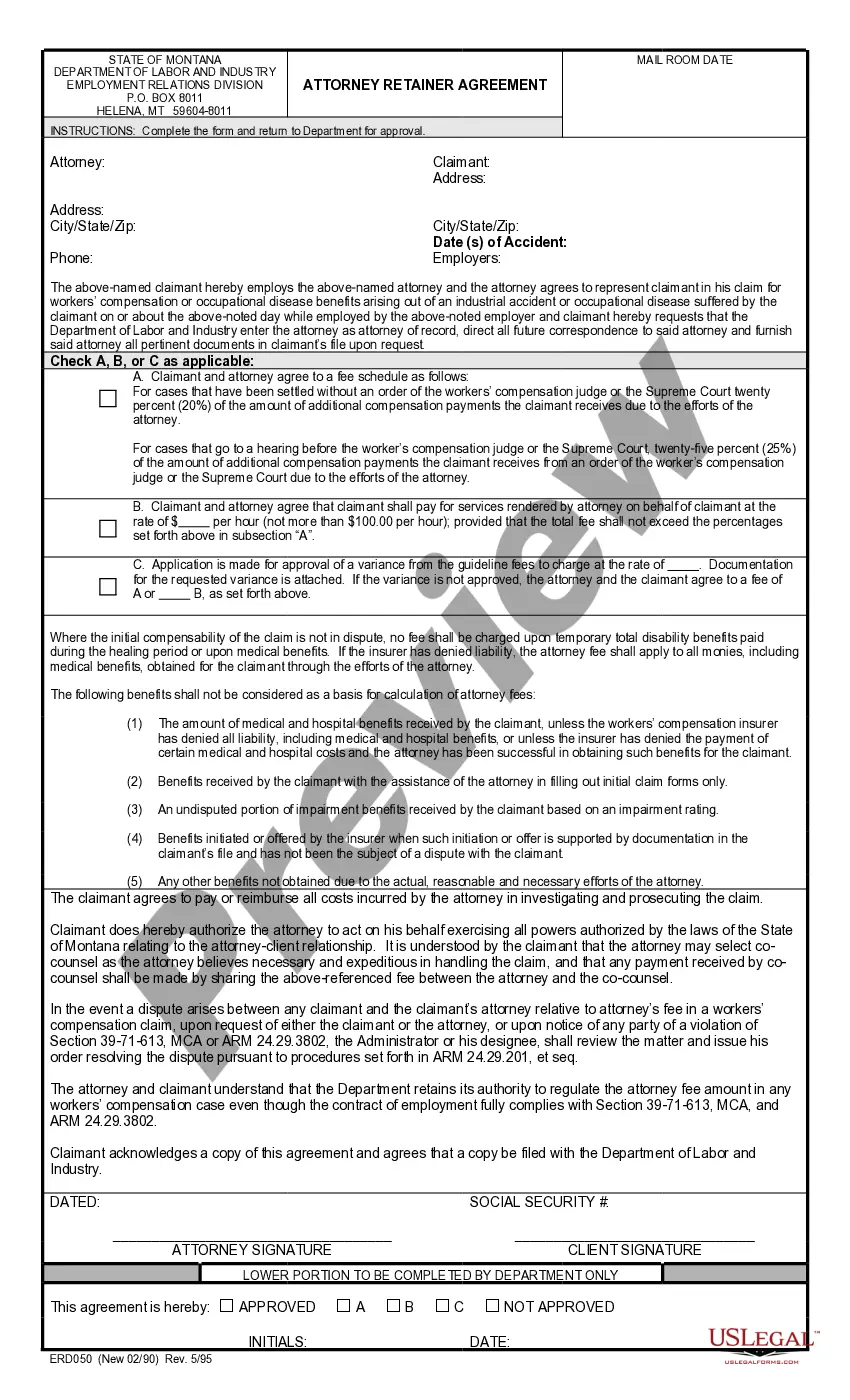

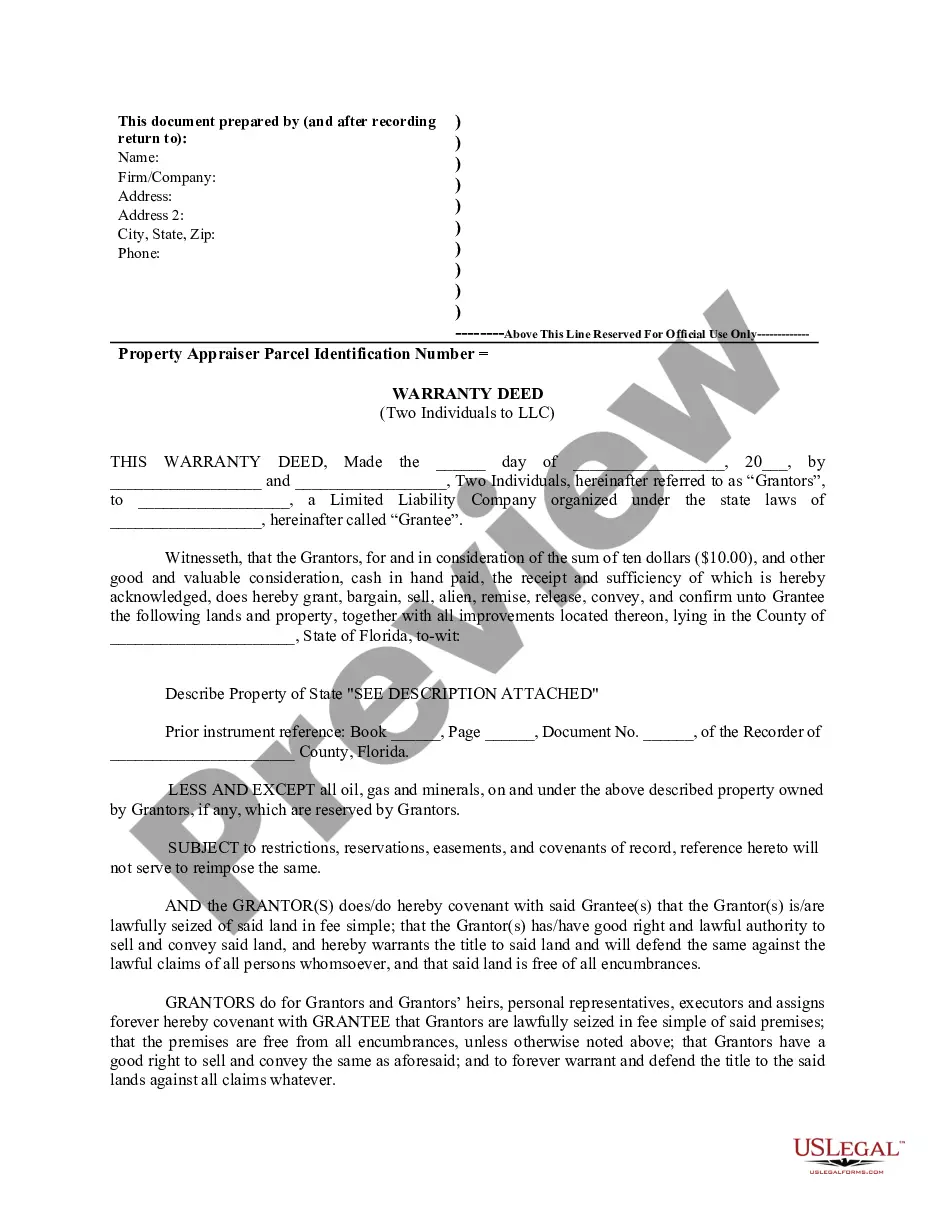

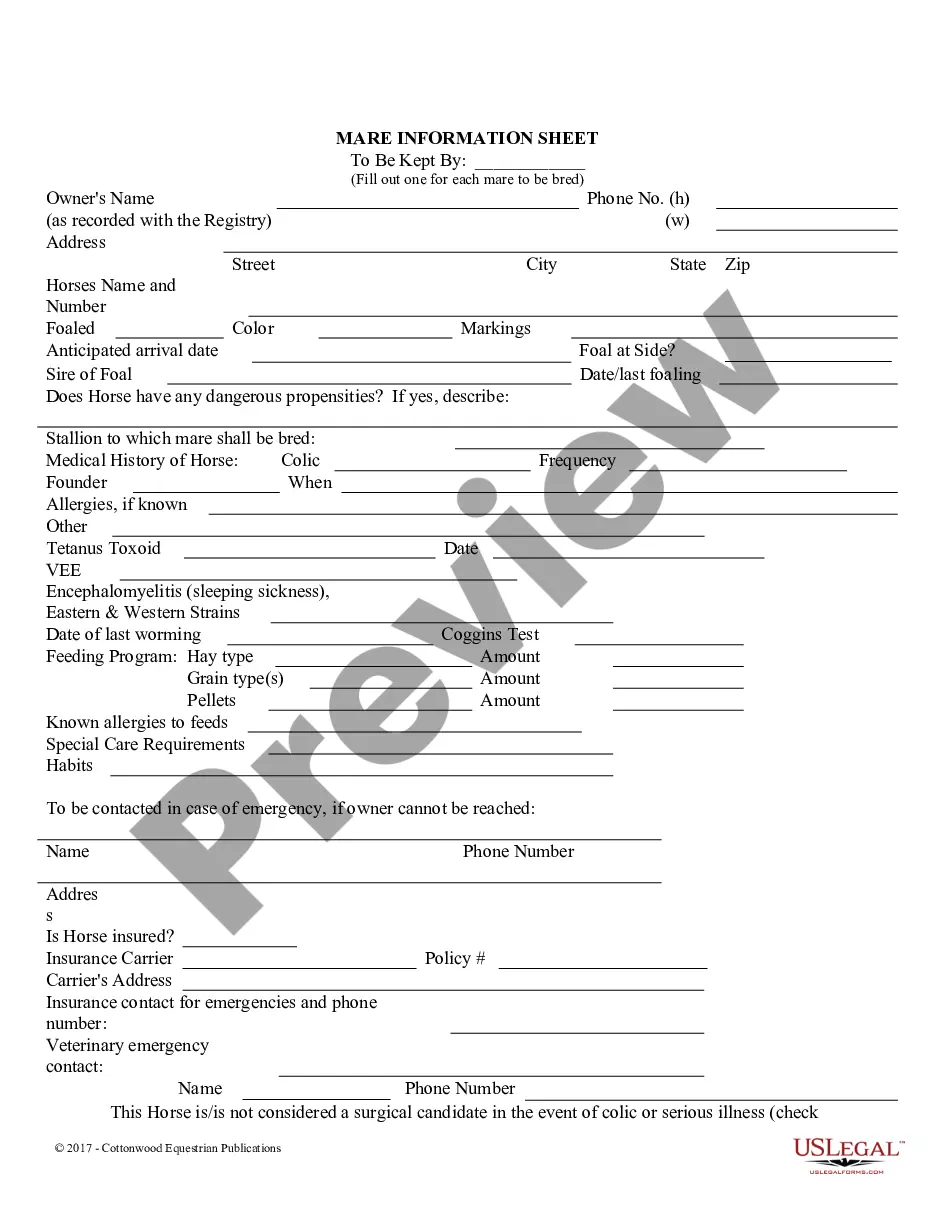

Discovering the right lawful record format could be a struggle. Of course, there are a variety of templates available on the Internet, but how do you get the lawful form you need? Take advantage of the US Legal Forms site. The assistance offers a large number of templates, including the New Jersey Property Manager Agreement - Self-Employed Independent Contractor, which can be used for company and personal demands. Each of the forms are checked out by specialists and meet up with federal and state demands.

If you are previously signed up, log in in your bank account and click the Obtain button to get the New Jersey Property Manager Agreement - Self-Employed Independent Contractor. Use your bank account to check throughout the lawful forms you have purchased previously. Go to the My Forms tab of your respective bank account and get one more backup of the record you need.

If you are a fresh consumer of US Legal Forms, listed below are easy guidelines so that you can adhere to:

- Initially, be sure you have chosen the right form for the area/area. It is possible to check out the form while using Preview button and browse the form description to guarantee this is basically the right one for you.

- When the form does not meet up with your requirements, utilize the Seach area to obtain the right form.

- Once you are certain that the form is acceptable, click on the Get now button to get the form.

- Select the prices plan you would like and enter in the essential information and facts. Make your bank account and purchase an order making use of your PayPal bank account or Visa or Mastercard.

- Select the document format and download the lawful record format in your device.

- Comprehensive, change and produce and signal the received New Jersey Property Manager Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the most significant collection of lawful forms for which you can discover a variety of record templates. Take advantage of the service to download professionally-made paperwork that adhere to condition demands.

Form popularity

FAQ

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

As an independent contractor, you are your own boss. That's the main reason why people decide to set up shop in their home office as a freelancer. If you're a contractor who works out of a client's location, you might work shoulder-to-shoulder with the employees, managers, and bosses of the company you work with.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

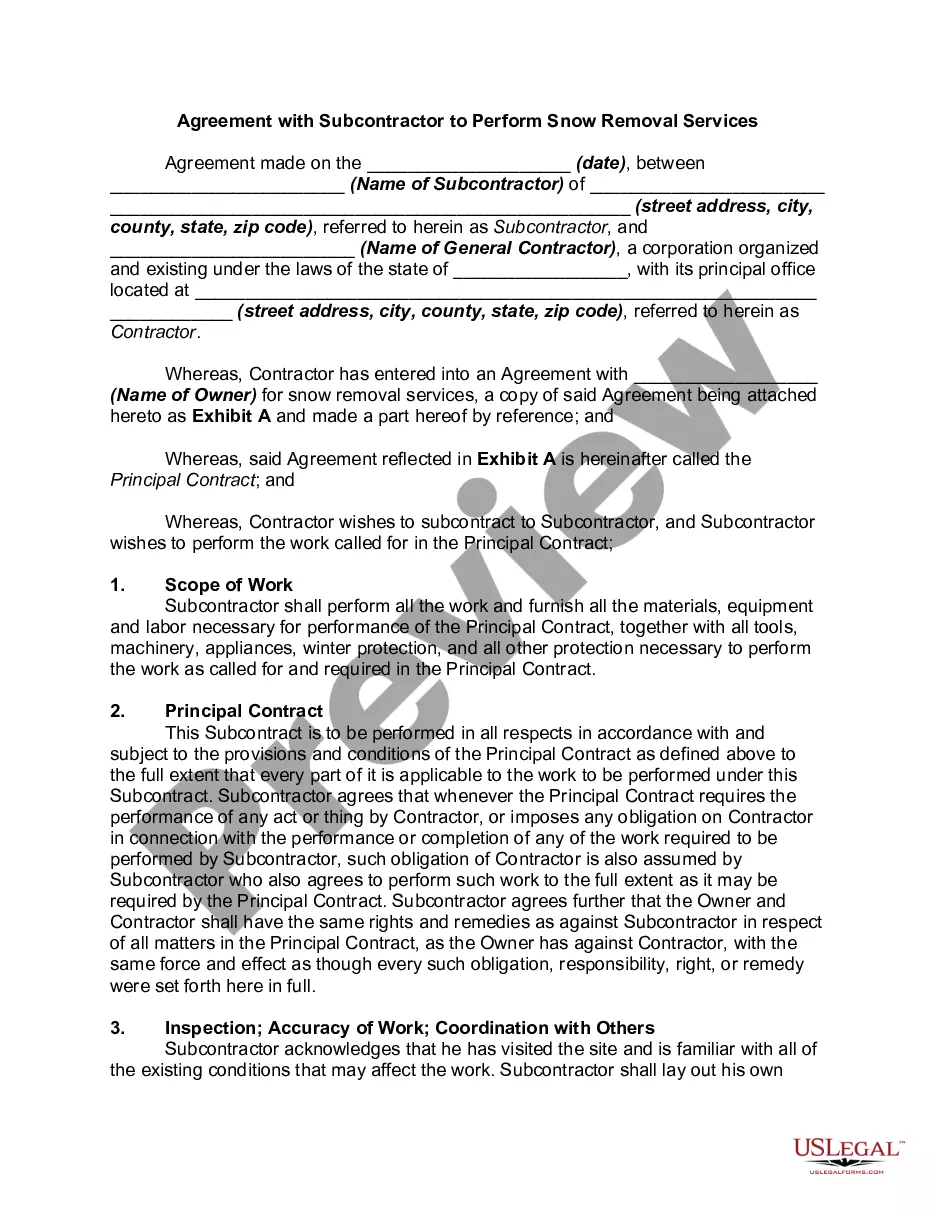

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.